If you’re sitting on appreciated assets like equity in a business, stock or real estate, and are thinking about the tax hit coming your way when you exit or exit, there’s a smarter way to plan your next move. A CRAT isn’t just a tool for the ultra-wealthy or philanthropists with foundations. It’s one of the most underutilized, IRS-approved strategies for turning a tax liability into long-term income and legacy planning.

This guide breaks down what a CRAT is, how it works, who it’s for, and whether it’s the right move for your next chapter.

What a CRAT Actually Does

A CRAT lets you convert an appreciated asset into income without triggering immediate capital gains tax. Here’s how it works:

- You move the asset into a CRAT.

- You get an immediate charitable tax deduction.

- The CRAT sells the asset, pays you a fixed income each year.

- When you die (or after a defined period), the remaining balance goes to a qualified charity.

This structure solves three major problems at once:

- Capital gains taxes on highly appreciated assets

- Inconsistent or uncertain retirement income

- Legacy planning (philanthropy that actually makes an impact)

You keep control over the income, avoid a massive tax bill, and get to direct funds to causes that matter to you.

You also extend the life of your money. Instead of giving a chunk of it away to taxes upfront, you keep it working for you for decades, then send the remainder to a cause that carries your name forward.

Who Should Consider a CRAT

CRATs are built for business owners, real estate investors, and professionals nearing retirement with significant appreciated assets. If you’re in the 60–75 age window, this strategy hits its sweet spot – it maximizes the deduction and income stream while meeting IRS requirements.

You don’t need to be a billionaire. You just need to be looking at a tax event in the six or seven figures.

This works extremely well for owners selling:

- Consulting or agency businesses

- Dental or medical practices

- Commercial real estate

- SaaS companies

If you’re planning to exit in the next 3–5 years, it’s smart to start modeling a CRAT now.

What is the Difference Between a Unitrust and a Charitable Remainder Trust?

A charitable remainder trust (CRT) is a broader category that includes multiple structures. The two most common are:

- Charitable Remainder Annuity Trust (CRAT)

- Charitable Remainder Unitrust (CRUT)

The difference comes down to how income is calculated and distributed.

- CRAT: Pays a fixed dollar amount each year. The amount is locked in based on the initial value of the trust assets. It doesn’t change regardless of market performance. That makes it ideal for those who want predictable income and less volatility.

- CRUT: Pays a percentage of the trust’s assets, revalued annually. This means your income can go up – or down – depending on how well the assets perform. It offers more upside but less stability.

CRAT is for security. CRUT is for growth potential. If your goal is stable retirement income, CRAT is the better play. If you’re younger and comfortable with market fluctuation, CRUT might make more sense because the annual payment adjusts based on the trust’s investment performance.

If you’re comfortable with some volatility and want potential upside, CRUTs are worth exploring. But for most business owners heading toward retirement, CRATs offer peace of mind.

CRAT vs CRUT: Know the Difference

There are two flavors of charitable remainder trusts:

CRAT (Annuity Trust)

- Fixed annual income, based on initial asset value.

- Payments never change.

- Ideal for predictable, stable income planning.

CRUT (Unitrust)

- Payments fluctuate with the value of the trust each year.

- More upside potential, more risk.

- Better if you’re younger and want exposure to market growth.

Pros and Cons of a CRAT

CRAT Pros

- Avoid Capital Gains Tax

Transfer appreciated assets into the CRAT, and the trust sells them, not you. No capital gains tax is triggered on your personal return. - Get an Immediate Deduction

You’ll qualify for a charitable income tax deduction in the year you fund the CRAT. This reduces your taxable income, sometimes dramatically. - Create Predictable Income

Your annual payout is locked in. That stability is rare and valuable, especially when you’re building around a retirement or succession plan. - Legacy with Purpose

You decide where the remainder goes. You can build a legacy on your terms, whether that’s education, faith-based initiatives, or social change. - Asset Protection

Assets inside the trust are generally protected from lawsuits and creditors. It’s a bonus most people don’t even think about until it’s too late. - Improve Cash Flow Without Triggering Tax

If you’re selling a non-cash-flowing asset (like equity or land), a CRAT lets you unlock the value and turn it into income while avoiding a massive tax bill.

CRAT Cons

- No Do-Overs

Once you fund the trust, you can’t take the assets back. The decision is final. That’s why this strategy isn’t for anyone living paycheck to paycheck. - No Inflation Adjustment

Payments are fixed, so if inflation spikes, your buying power drops. We sometimes hedge this with other investments or strategies. - You Can’t Change Beneficiaries

Pick carefully. Your income beneficiaries are locked in when you create the trust. - Complexity and Cost

CRATs aren’t DIY. You’ll need legal, tax, and financial pros to set it up and maintain it. There are upfront and ongoing costs involved. - It Reduces Your Estate

Assets moved into the CRAT don’t go to your heirs. If passing everything to family is your top goal, this might not be the best move.

Annual Filing Requirements

You’ll have to file a Form 5227 each year, and if the trust generates income, it may also require Form 1041. Your CPA will need to handle this.

The 10% Rule: Why Age Matters

The IRS requires that at least 10% of the initial value of the trust must go to charity when the trust ends. That’s non-negotiable. If you’re too young or set the payout too high, the trust might not pass the test.

That’s why CRATs make the most sense between ages 60 and 75. You’re old enough to meet the requirement but young enough to benefit from the income for years.

If you’re outside that window, you can still structure it creatively, but the math has to work. A tax attorney or strategic financial planner should model it first.

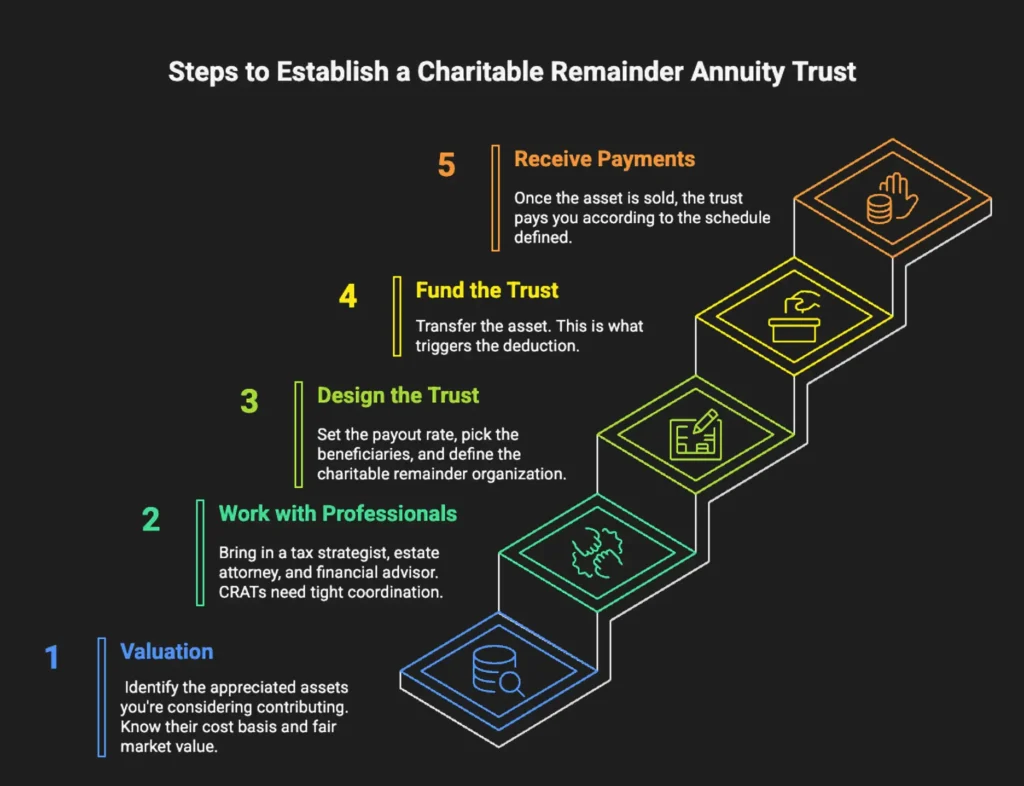

How to Establish a Charitable Remainder Annuity Trust

- Start with a Valuation – Identify the appreciated assets you’re considering contributing. Know their cost basis and fair market value.

- Work with Professionals – Bring in a tax strategist, estate attorney, and financial advisor. CRATs need tight coordination.

- Design the Trust – Set the payout rate, pick the beneficiaries, and define the charitable remainder organization.

- Fund the Trust – Transfer the asset. This is what triggers the deduction.

- Start Receiving Payments – Once the asset is sold, the trust pays you according to the schedule defined.

Once in place, your only job is to make sure the annual filings happen and the trust assets are being properly managed.

What Assets May Be Donated to a CRT?

Not all assets are created equal when funding a charitable remainder trust. The ideal asset is one with substantial unrealized capital gains.

Common asset types include:

- Appreciated publicly traded stock

- Privately held business interests (with planning)

- Real estate

- Cryptocurrency (with valuation and compliance support)

- C-corp or S-corp shares (though this requires specialized structuring)

- Interests in partnerships or LLCs

Assets with low liquidity or hard to value (like collectibles or intellectual property) can be donated, but they’ll need appraisals and may not be suitable for most.

The key is this: You want to contribute an asset that would trigger a big tax bill if sold outright. That’s where the CRAT provides maximum leverage – by avoiding capital gains and converting the asset into income.

What About a Charitable Gift Annuity?

Here’s the basics on how a Charitable Gift Annuity functions compared to a CRAT:

- Charitable Gift Annuity: You donate assets directly to a charity in exchange for fixed income payments. The charity invests the assets and manages the risk. These are simple but often come with lower payouts and limited flexibility.

- CRAT: Set up a dedicated trust with your legal and tax team. You have control over how the trust is structured, how the assets are invested, and who benefits. A CRAT is a better fit for larger donations and more complex estate or tax situations.

If you want higher income potential and customization, CRATs provide more control and long-term benefit.

Other CRAT Alternatives Worth Considering

- Donor-Advised Fund: Lower complexity, no income payments, full control over grant recommendations.

- Private Foundation: High cost, high control. Best for legacy-driven families.

- Charitable Lead Trust: Reverses the structure. The charity gets paid first, and your heirs receive what’s left.

Each has trade-offs. A CRAT fits when your priority is income now, tax efficiency, and charitable impact later.

Is a Charitable Remainder Trust Right for Me?

Here’s the checklist:

- Are you selling or planning to sell an appreciated asset worth $1M or more?

- Do you want a way to reduce or defer capital gains tax?

- Do you want consistent income for the next 10–30 years?

- Do you have a charitable goal or cause you believe in?

- Are you comfortable with irrevocably giving up some control?

If you answered yes to most of these, a CRAT or CRUT could be a smart strategic move.

Final Takeaway

It’s not about giving money away. It’s about using charitable planning to fix a tax problem while creating income and impact.

But this isn’t a plug-and-play solution. It has to be part of a bigger strategy designed around where you’re going, not just where you’ve been.

Want to know if this fits into your plan? Schedule a strategy call with us.