Professional service businesses operate differently and they should be accounted for differently. Law firms, digital agencies, consultancies, and private medical practices don’t have inventory, but traditional accounting was built around that framework.

Your revenue isn’t tied to inventory. It’s tied to time, outcomes, or staged delivery. That creates complexity around income recognition, cash flow planning, and long-term growth that traditional accounting often overlooks.

This guide breaks down the financial principles service businesses need to understand. Not to become an accountant, but to lead with confidence, ask the right questions, and to hire the right experts to allocate capital intelligently and avoid avoidable tax and cash flow problems.

Why Professional Services Require a Different Approach

In service businesses, revenue isn’t always earned the moment cash hits your account. Work is often delivered across multiple phases. Payments may be upfront, milestone-based, or subscription-driven. The value you create and the money you collect aren’t always happening at the same time.

You can’t rely on simple transaction-based accounting.

Instead, you need to understand:

- Work-in-progress (WIP): Value delivered but not yet invoiced.

- Deferred revenue: Cash collected before services are delivered.

- Percent-complete revenue recognition: Aligning income with effort, not payment.

If you don’t track these, your income is overstated, your cash flow forecasting is off, and your taxes can hit harder than they should.

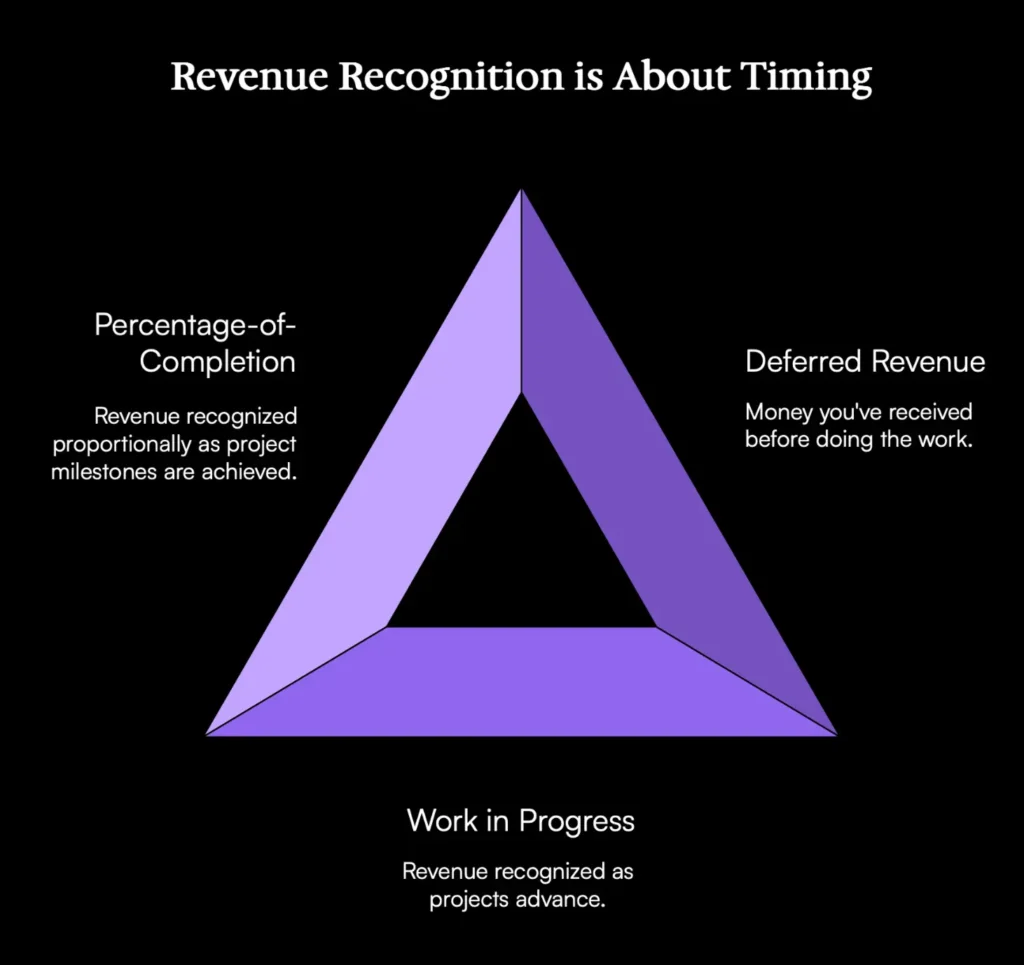

Revenue Recognition: Match Work with Income

Revenue recognition is about timing. When do you actually earn the money you’re being paid for?

Three key concepts of revenue recognition:

1. Deferred Revenue

Deferred revenue is money you’ve received before delivering the work.

Let’s say a client pays you $60,000 upfront for a 6-month consulting package. Even though the cash is in your bank, you haven’t earned it all yet. You’re obligated to deliver value over the next six months.

Under accrual accounting, you’d only recognize $10,000 of revenue per month as you perform the work. The rest sits on your books as a liability, something you still owe in services.

Why this matters:

- You’re not taxed on the full $60,000 upfront.

- You avoid inflated revenue that doesn’t match delivery.

- It keeps your financials clean and honest—especially for forecasting.

This protects your cash flow, smooths your income over time, and avoids the trap of thinking you’ve got “extra” profit when you still owe work.

2. WIP (Work in Progress)

Now flip the situation: you’ve completed $20,000 worth of work, but the invoice hasn’t gone out yet.

That’s earned revenue sitting in limbo. If your system doesn’t track WIP, you’re underreporting income and missing critical insights into project-level profitability.

WIP helps you:

- Measure earned value accurately

- Allocate labor costs to the right period

- Project future billing and cash flow with precision

3. Percentage-of-Completion Accounting

For long or multi-phase engagements, recognize income based on completion milestones. This method is more precise than cash-based or evenly spread accrual methods.

Example: if you’ve completed 40% of the work on a $100,000 contract, your books should show $40,000 in recognized revenue, not $100,000 (cash) or $0 (if you haven’t invoiced yet).

This model supports better:

- Project forecasting

- Financial reporting

- Tax planning

Why the Old Way Doesn’t Work Anymore

Traditional accounting works fine for businesses with inventory, point-of-sale transactions, or predictable billing cycles. But in professional services, it leads to major blind spots:

- Cash gets overcounted as income

- Projects that lose money aren’t caught early enough

- Taxes are overpaid on revenue not yet earned

A strategic financial model gives you clarity:

- Which clients are profitable?

- Which service lines generate the highest margin?

- Are you collecting too early? Or too late?

- Are you reinvesting based on real income or inflated numbers?

Your Accountant Should Be Able to Answer These Questions

A service business doing over $1M/year needs more than clean books. You need answers:

- How much revenue have we earned this month, even if we haven’t invoiced it?

- How much future revenue have we already collected?

- Which projects or client segments are driving real margin?

- What’s our monthly breakeven, including all delivery costs?

- What’s the tax exposure on work we’ve already delivered versus what’s still deferred?

If you can’t get these answers from your current system, it’s time to rethink your setup.

Key Financial Practices for Modern Service Businesses

Here’s what a high-functioning accounting system looks like:

- Revenue recognition policy aligned with your engagement model

- Deferred revenue ledger that releases income as services are rendered

- WIP schedule that tracks earned value across all active clients or projects

- Project-based or client-segment P&Ls to isolate margin by line of service

- Labor mapping that matches effort to income timing

- Rolling forecasts that incorporate project timelines and collections

These aren’t accounting gimmicks. They’re operational tools.

If you want to:

- Reduce taxes

- Improve cash flow stability

- Price more accurately

- Evaluate new hires or investments with real data

…this is where you start.

Missteps That Kill Margin in Service Firms

- Recognizing all income upfront on long-term projects

- Failing to track WIP and missing revenue you’ve already earned

- Booking prepaid packages as revenue before delivery

- Ignoring project-level financials and assuming all clients are profitable

- Not tying labor to margin – especially as headcount grows

These add up to bad decisions: hiring too soon, overpaying in taxes, or thinking you have more cash than you actually do.

Best Practices for Accounting in Service-Based Businesses

A strategic accounting function for service businesses should include the following best practices:

Here’s the updated Best Practices section, fully flushed out with each item as its own H3:

Best Practices for Accounting in Service-Based Businesses

Recognize Revenue Only When It’s Earned

Adopt accrual accounting principles. Income should be recorded as you deliver work—not when the money hits your account. This ensures your financials reflect reality, protects you from inflated income, and aligns taxes with actual performance.

Track Deferred Income Monthly

Set up a deferred revenue ledger. Anytime you receive payment in advance, log it as a liability. Then, systematically release it into revenue as the related services are completed. This keeps your books clean and avoids premature tax exposure.

Implement a WIP Tracker

Use software or spreadsheets to track work in progress. This includes services delivered but not yet invoiced. A WIP schedule gives you real-time insight into earned but unbilled revenue—crucial for accurate forecasting and margin tracking.

Tie Costs to Revenue

Match labor costs to the projects or time periods in which revenue is earned. If your team works on a retainer project in June, allocate their hours and wages to June’s P&L—even if payment happens later. This uncovers your true margin.

Build Service-Line P&Ls

Break out your reporting by service type, offer, or delivery model. Don’t lump all income and expenses together. Segmenting your financials helps you see which parts of your business are performing and which are dragging.

Use Milestone Billing on Longer Projects

For engagements that span months, don’t wait until the end to invoice or recognize income. Set clear billing milestones tied to delivery—then record revenue accordingly. This improves cash flow and aligns revenue timing with work completed.

Forecast from Delivery Capacity, Not Just Sales

Don’t rely solely on your pipeline. Forecast based on how much work your team can actually deliver. This helps prevent overcommitting, underpricing, or taking on work that strains delivery bandwidth.

Review Cash vs. Accrual Statements Monthly

Both matter. Cash tells you what’s in the bank. Accrual tells you what’s earned. Comparing the two reveals timing issues, future cash crunches, and tax implications. It’s one of the most important disciplines to build.

Keep GAAP-Compliant Records if Selling or Raising

If you’re planning to exit, raise capital, or attract serious buyers, they’ll want GAAP-compliant financials. That means consistent revenue recognition, accurate WIP and deferred revenue tracking, and standardized reporting formats.

Automate Wherever Possible

Don’t try to manage all this manually. Use cloud-based accounting software (like QuickBooks Online or Xero), time-tracking tools, and project management platforms. Automation reduces error, saves time, and makes scaling possible.

Getting these in place isn’t about more complexity. It’s about reducing uncertainty and gaining clarity where it matters most—on the money your business actually keeps.

Why This Matters Now More Than Ever

As your business scales, the lag between payment and delivery creates real risk:

- You look profitable on paper but you’re tight on cash

- You overpay taxes by recognizing revenue early

- You can’t forecast accurately, so you overhire or underprice

This creates a ceiling. You can’t grow beyond it until your numbers are telling the truth.

Fixing this means:

- Fewer surprises

- Smoother decision making

- More flexibility in reinvesting

And if you ever want to sell, bring in a partner, or raise capital, these numbers will be scrutinized. Service businesses that know their real margins get better multiples.

Final Takeaways

- Revenue isn’t revenue until it’s earned.

- Deferred income and WIP are the guardrails to accurate forecasting.

- Good accounting makes service businesses easier to run, scale, and sell.

You don’t need more reports. You need smarter structure. One that reflects how your business actually works.

Next Steps

If your current system doesn’t track revenue recognition, WIP, and deferred income, or if you’re unsure how to map financials to service delivery, those are the first things to fix.

This is the foundation for:

- Improving profitability per client or project

- Smoothing cash flow across uneven delivery cycles

- Avoiding unnecessary tax exposure

- Building a business that can scale or sell

Need help putting the right structure in place?

You don’t need to overpay. You don’t need to guess. You just need to align the numbers with reality.

Book a consult and let’s get your accounting system working the way your business actually operates.