Most business owners think they’re “covered” because they have a CPA.

But here’s the truth: CPAs don’t help you pay less tax. They help you file what you owe, after it’s too late to change the outcome.

That’s compliance.

What you actually need is strategy. A forward-looking financial plan that legally reduces your tax bill, frees up cash flow, and helps you build something scalable.

This post breaks down the difference between compliance and strategy and shows you exactly what your accountant isn’t doing (and why they can’t).

Now let’s get into it.

Compliance vs. Strategy

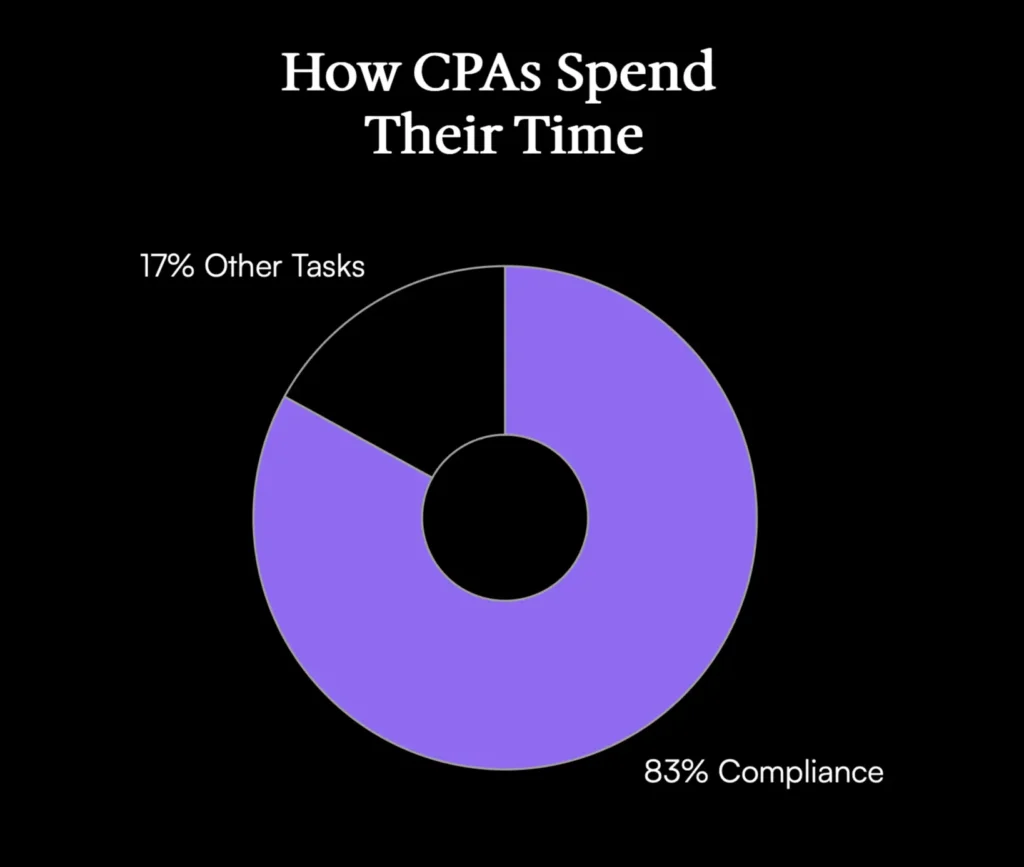

CPAs spend at least 83% of their time filing taxes. That’s it. Their focus is compliance.

Tax planners are focused on one thing: helping you owe less.

Some CPAs try to dabble in tax planning, but it’s surface-level. They’re stuck in the basics – 401(k)s, IRAs, maybe a few deductions. That’s it.

They don’t have the time, team, or technical range to pull off real strategy. Not the kind that saves six or seven figures. And definitely not at scale.

They don’t have the time, team, or depth of knowledge to dig into real strategy. Not at scale.

Why Most CPAs Can’t Strategize

When you’re filing thousands of returns a year, there’s no time to be strategic. And when you need them the most – at tax time – they’re overloaded and barely keeping their own heads above water. How can they possibly serve you at your most critical times?

Tax planning done right requires deep research, technical understanding, and diligence.

It’s the same level of complexity it takes to deliver real CFO services. You need a vetted network of experts – advanced tax strategists, lawyers, estate planners, entity structuring pros. You need to know how these strategies interact. You need to offer tools that you legally can’t even advertise unless you’re licensed.

Many of the strategies we deploy are SEC-compliant Reg D offerings. I’m not a wealth manage, but I’ve partnered with one so our clients can get access.

The Real Problem: Volume

A CPA running a multimillion-dollar tax firm? They’re doing 4,000 returns or more.

That’s a machine. That’s a tax mill.

They’re sprinting from January to October 15th. Nonstop. No time to strategize. No time to educate. Just slapping forms together so clients stay in the IRS’s good graces.

You know this feeling—like when you get a surprise $200,000 bill with no warning. I had a client tell me their CPA dropped a $250,000 estimated payment on them. On Christmas Day.

That’s not planning. That’s negligence dressed up as tradition.

Compliance Training Produces Compliance Officers

Most CPAs are trained under other CPAs. Go back to the ’80s and ’90s.

What were CPAs? Compliance officers.

So what happens when you train under that? You become a form-filler. Not a strategist.

When we hire CPAs or EAs or even tax attorneys, they all say the same thing:

“I’ve never seen it done this way.”

Of course they haven’t. They’re taught to churn out returns as fast as possible. To get through the day, not to build long-term wealth for clients.

Our Model: Education and Time

We flipped that model.

We spend more time with the client. We educate. We walk through their entire financial landscape and build strategies that actually move the needle.

We’re not offering gimmicks. We’re giving away the same strategies CPAs say you can’t access unless you’re ultra-wealthy.

And we’ll show you how to do them.

The Foundational Tax Strategies

We’re going to break down the foundational tax strategies most CPAs never take the time to explain:

- How to hire your kids (legally and efficiently)

- How to structure an owner’s retreat

- How to use the Augusta tax strategy

- How to wrap a weekend for deductions

- How to leverage an HSA for long-term savings

- When oil and gas investments make sense

- How to use captive insurance – what works, what doesn’t

- Cash balance plans – pros and cons

Every single one of these is doable. The IRS tax code is built for those who understand it. But you have to know how to apply it the right way.

Real Savings, Not Shell Games

This isn’t about kicking the can or deferring taxes into some bucket you’ll eventually pay later.

We’re talking real, cash-in-pocket savings that compound over time and scale with your business.

This is how you protect your wealth. This is how you build real freedom.

Think you’ve outgrown your CPA?

We’ll give you the map, the tools, and the strategy – so you’re not just amazed by what’s possible. You can actually go out and do it. Book a free consultation to learn what hundreds of companies have already done – hiring strategic help to go beyond traditional accounting.