Most business owners glance at their P&L like it’s a receipt. A necessary evil they send to their CPA once a year.

But if you’re doing over $2 million in revenue and you’re still not managing your P&L like a tool for decision-making, you’re leaving money on the table. And not just a little—hundreds of thousands in mispriced services, bloated overhead, and missed tax strategy.

That’s not bookkeeping. That’s blindfolded leadership.

Why P&L Management Actually Matters

Your P&L isn’t just a scorecard. It’s a blueprint. It shows how your business really makes money—and where that money leaks out.

Most founders only look backward. What happened last month? What did we spend? Did we make a profit?

But a well-managed P&L is forward-facing. It answers the questions that shape your next move:

- Is your pricing sustainable?

- Are your margins tightening?

- Should you hire, hold, or cut?

Every financial strategy—compensation, taxes, reinvestment—starts here.

Common P&L Management Mistakes That Are Costing You

Here’s where most business owners go sideways:

They confuse revenue with profit. You made $300K last month? Cool. But if $280K went out the door, that’s not scale. That’s survival.

They treat timing like a technicality. Revenue booked today for work you’ll deliver over six months? That inflates your numbers and gives you false confidence.

They hand off the books and never look back. Bookkeepers are not strategic advisors. They record. You decide.

They misread signals. Your ad spend is up, revenue is flat, but no one notices because no one’s comparing inputs to outputs. No one’s asking, “Are we getting leverage here?”

These aren’t small errors. They kill growth and cloud judgment.

What to Look for In Your P&L – And What to Ignore

The goal isn’t just to look at numbers. It’s to interpret them.

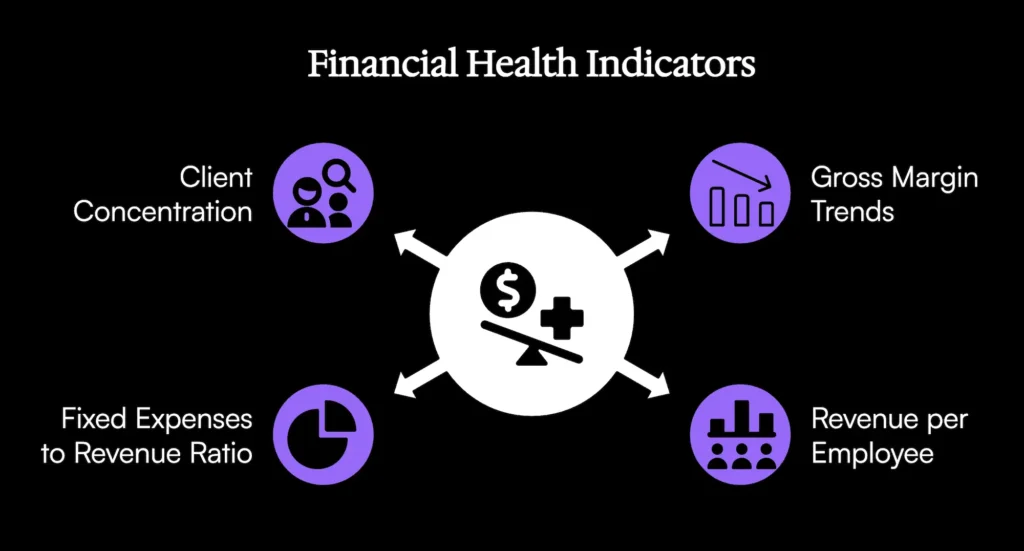

You want to track indicators that tie directly to cash and profitability. These matter:

- Gross margin trends over time

- Revenue per employee

- Ratios between fixed expenses and revenue

- Client concentration (if 40% of your income is one client, you’re fragile)

Ignore vanity metrics. Total revenue means nothing if your margins suck. The number of clients doesn’t matter if most of them are unprofitable. Focus on quality, not volume.

Best Practices to Improve P&L Management

If you want to run a real business, not just a high-income job, this is where you start.

Close your books fast. You need numbers by the 5th, not the 25th. Waiting until the end of the month—or worse, the quarter—means you’re always making decisions with outdated information.

Review monthly. Build a simple rhythm: what changed, what broke, what needs action. If you’re not reviewing it with someone who can explain the “why,” you’re wasting your time.

Tie numbers to decisions. Don’t just spot a $20K spike in software spend—decide whether it stays or goes. Don’t just note revenue is up—figure out what made it happen so you can do it again.

Report for decisions, not decoration. Most P&Ls are cluttered with data and starved of insight. Strip it down. You want a report that tells you what to fix, what to fund, and what to fire.

P&L vs. Cash Flow: Know the Difference or Bleed Money

This is the one that kills fast-growing businesses.

You look at your P&L and think you’re crushing it. But your bank account is shrinking. Why?

Because cash doesn’t care what your P&L says. If a client pays late, but your expenses hit now, you’re in the red—even if the spreadsheet says you’re up.

Here’s what this looks like in real life:

A consulting firm books a $120K contract in Q1. The revenue gets recorded immediately. But the actual delivery stretches across six months. Meanwhile, team bonuses go out in March. By April, cash is tight.

That’s not mismanagement. That’s misunderstanding. Your P&L told you a story you didn’t know how to read.

How We Used P&L Strategy to Scale Eden Data From $0 to $300K MRR

When Taylor Hersom launched Eden Data, they had no revenue. Just a vision, a laptop, and some domain expertise.

We came in before the first dollar landed and built the financial structure from scratch. Our reviews weren’t just about tracking dollars—they were about directing strategy.

We focused on a few key drivers:

- Revenue per employee: to ensure the team scaled with margin, not just volume

- Deferred revenue: to match income with delivery and avoid a false sense of profitability

- Pricing corrections: to reflect actual delivery costs and protect long-term value

- Compensation planning: to reduce tax drag and keep more money in the business

Taylor went from nothing to $300K MRR. No outside capital. No financial guesswork. Just strategic clarity, month after month.

That’s the power of P&L management when it’s done right.

Final Word: Profit Is a Choice

You can’t control the market. But you can control how you respond to it.

If you don’t know what’s happening inside your numbers—if you’re not using your P&L to steer—you’re not a business owner. You’re a passenger.

Profit is not a byproduct. It’s a decision. It starts with visibility, then discipline, then action.

You’ve worked too hard to operate in the dark.