Service businesses doing $1M–$20M in revenue

Find Out Exactly Where Your Business Is Stuck — And What It's Actually Worth

A full financial diagnostic + custom tax strategy for service businesses doing $1M–$20M. Our team spends 8–10 hours analyzing your numbers. You get a 60-minute walkthrough of everything we find.

$96M in client revenue under management · We take 15 per month

THE PROBLEM

Revenue Isn't the Problem.

Your Financial Design Is.

You crossed $1M. Maybe $3M. Maybe $5M. Revenue keeps climbing — but profit doesn’t follow. The owner is still the bottleneck. Cash feels tight even when sales look strong.

The problem isn’t how hard you’re working. It’s that your margins, overhead, and growth engine aren’t engineered to scale. Most businesses don’t discover this until it’s expensive.

WHAT WE DIAGNOSE

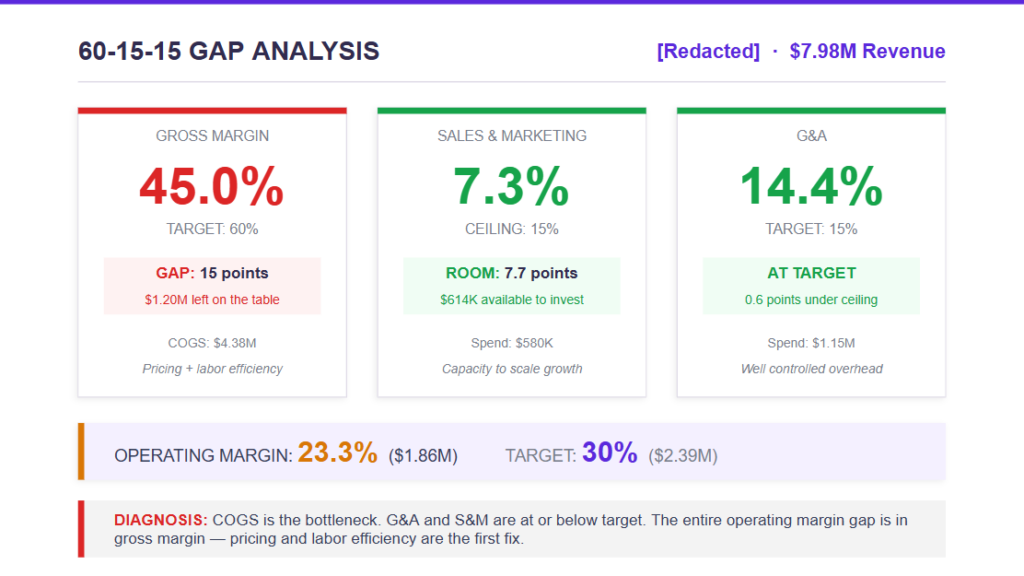

We Run Your Business Against the 60-15-15 Standard.

Gross Margin → Target: 60%

What’s left after you pay to deliver your service. If this number is off, every other dollar is under pressure. We diagnose whether the problem is pricing, labor efficiency, or delivery costs — and which one to fix first.

Sales & Marketing → Target: 15%

What you spend to get a customer in the door. We assess whether your growth engine is profitable or whether you’re buying revenue you can’t keep.

G&A → Target:

15%

Your overhead. Rent, admin, owner comp, back-office. We identify where the waste is — and what’s actually necessary infrastructure you shouldn’t cut.

30% Operating Margin

That’s the standard. Where you sit against it determines whether scaling creates wealth or just creates a bigger version of the same problem.

WHAT YOU ACTUALLY GET

This Isn't a Sales Call. It's a Full-Scale Financial Diagnostic.

Your Scale-Ready Report includes:

Your 60-15-15 Scorecard

Green, yellow, or red across every financial category. You’ll see exactly where your business sits against the operating standard — and which number is costing you the most.

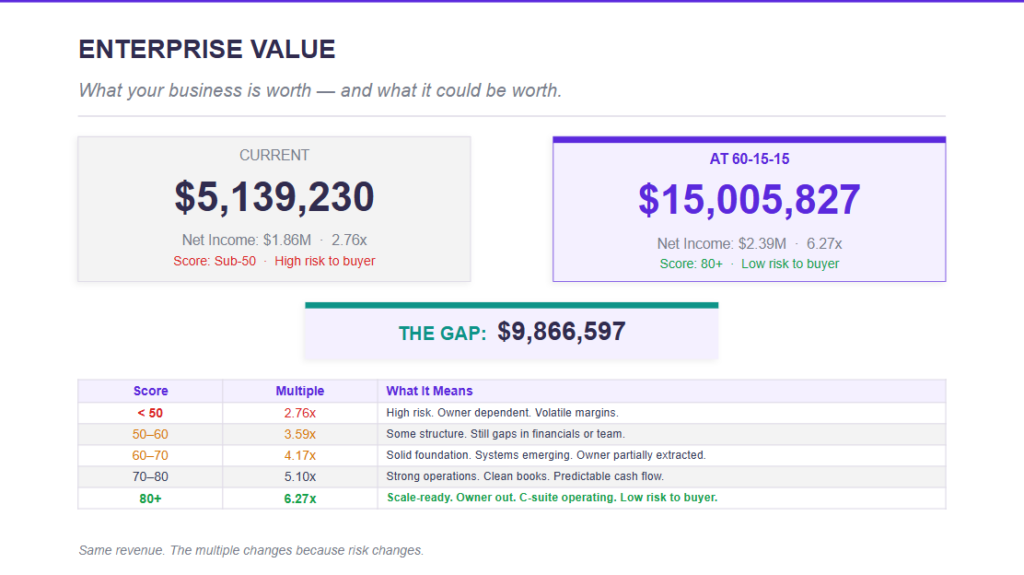

Your Enterprise Value Gap

Most founders have no idea what their business is actually worth — or what it could be worth at 30% operating margin. We show you both numbers. The gap between them is usually the most important number in the entire assessment.

A Custom Tax Strategy

Entity structure optimization, strategies your CPA likely isn’t using, and a clear implementation path. Most firms charge $10–30K for this plan alone. It’s included — not an upsell.

A Prioritized Roadmap

What to fix first, what to fix next, and what the timeline looks like. Not a generic playbook — a sequenced plan built on your actual numbers.

HOW IT WORKS

Three Meetings.

One Complete Picture.

Meeting 1: Fit Call (30 minutes)

We learn about your business — revenue, team, industry, what you’re trying to solve. We make sure this is the right fit for both sides. If it is, we move forward. If not, we’ll tell you directly and point you in the right direction.

Meeting 2: The Deep Dive (60 minutes)

We go through 60+ questions across your financials, operations, and tax position. This is where we get the real picture — not the version your P&L shows, but what’s actually happening in the business. You’ll send us your financials, tax returns, and operational data ahead of this meeting.

Meeting 3: Your Scale-Ready Report (90 minutes)

60 minutes walking through everything we found — your scorecard, your enterprise value, your tax strategy, and the prioritized roadmap. Then 30 minutes to discuss what comes next and whether we’re the right team to help you execute.

$96M in client revenue under management · We take 15 per month

WHAT WE DIAGNOSE

Built for Service Business Owners Who Want the Truth.

This assessment is designed for:

We work with marketing agencies, legal firms, medical practices, property management companies, cybersecurity firms, financial advisors, and other professional service businesses.

“Bennett Financials has been a huge part of Eden Data’s growth. We started in early 2021 with no revenue, and with Arron acting as our CFO, we scaled to about $300K MRR. He’s helped with taxes, forecasting, and countless decisions that put us on the map. It doesn’t feel like ‘fractional’—it feels like having a true finance leader on the team.”

Taylor Hersom

Eden Data, Chairman

Frequently Asked Questions

Is this really free?

Yes. We use the assessment to identify whether we can help. If there’s a fit, we’ll discuss what an ongoing engagement looks like. If not, you keep the full assessment, the scorecard, and the tax plan. No strings.

What do I need to prepare?

A recent P&L, basic revenue data, and your last two years of tax returns. We’ll send you a simple prep list after you book — it takes about 10 minutes to pull together.

How long until I get results?

Your full assessment and 60-minute walkthrough are delivered within two weeks of your initial call.

What if I already have a CPA?

Good — this complements their work. Most CPAs focus on compliance and tax returns. We focus on forward-looking strategy, margin engineering, and tax optimization they typically don’t cover. We identified $156K in savings for one client that their existing CPA had been missing.

What's the 60-15-15 framework?

It’s the operating standard we use across every business in our portfolio. 60% gross margin, 15% sales & marketing, 15% G&A = 30% operating margin. Your assessment shows you exactly where you sit against this standard and what’s pulling you off target.

Your P&L Is Hiding Growth.

Let Us Find It.

We take 15 assessments per month. If you’re a service business doing $1M–$20M and

you want to know exactly where your numbers sit — book below.

$96M in client revenue under management · We take 15 per month