The following is an excerpt of an upcoming ebook From Expertise to Enterprise by Bennett Financials’ founder, Aaron Bennett.

This chapter explores the evolving role of CFOs in modern professional services firms and how strategic financial leadership can transform business performance. Drawing from real client experiences and practical insights, Aaron provides a compelling look at how the right financial partnership can dramatically impact your firm’s growth trajectory.

Chapter 1: How the CFO’s Role is Changing in Modern Professional Services Firms

“The greatest danger in times of turbulence is not the turbulence itself, but to act with yesterday’s logic.” – Peter Drucker

As a professional services firm owner, you face many challenges. Your expertise got you here. But as your business grows, you might wonder: Are you using your leadership team to its full potential? More specifically, are you getting the most out of your financial leadership?

The role of the Chief Financial Officer (CFO) is changing fast. This is especially true in professional services. The CFO is no longer just a number-cruncher. They’re not hidden away in a back office. They don’t just show up for monthly reports or to warn about overspending. Today’s CFO is becoming a key partner. They work closely with the CEO. They help drive business growth.

In this chapter, we’ll explore how this role has changed and what it means for your firm.

The Traditional CFO Role

In the past, CFOs were seen as business caretakers. They focused mainly on:

- Financial reports and following rules

- Making budgets and forecasts

- Managing cash flow

- Handling risks

- Controlling costs

These tasks are still important. They’re the foundation of good financial management. But in today’s fast-changing business world, they’re not enough. Modern professional services firms need more from their financial leaders.

How the CFO Role Has Changed

Today’s CFO is expected to be a strategic partner in the business. They combine financial know-how with a deep understanding of operations, technology, and market trends.

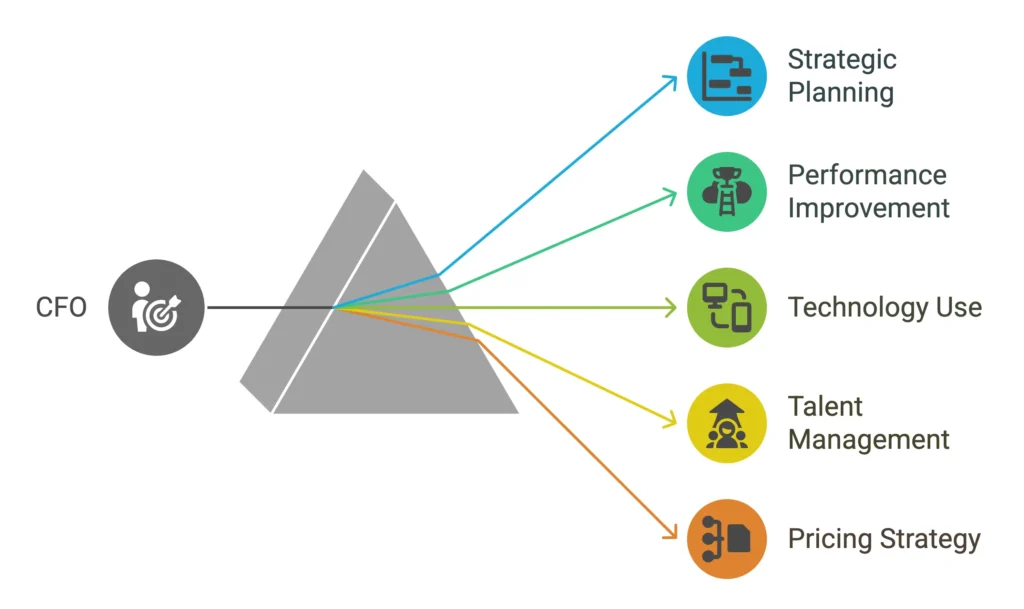

This bigger role includes:

- Strategic Planning: Working closely with the CEO to plan and carry out growth strategies.

- Performance Improvement: Finding key performance indicators (KPIs) and using data to boost business performance.

- Technology Use: Using financial technology to work more efficiently and get real-time insights.

- Talent Management: Working with HR to create pay strategies that align with company goals.

- Pricing Strategy: Teaming up with sales and marketing to set prices that maximize profit while staying competitive.

These changes are crucial in professional services firms. The nature of these changes can make financial management more complex.

The CFO as a Key Partner

Let’s look at a real example from my consulting work. It shows the impact a strategic CFO can have.

I recently worked with a struggling cybersecurity firm. They had strong technical skills. They had good clients. But they had stopped growing. The owner worked 80-hour weeks. He was always putting out fires. He felt like he was running in place – lots of work, but no real progress.

I came in as a part-time CFO. We started by looking closely at their finances. But we didn’t stop there. We looked at how financial decisions affected every part of the business. Here’s what we found:

- Pricing Problems: They were charging too little, especially for complex projects. We studied the true costs and value to clients. We set new prices. This increased profits without losing clients.

- Poor Use of Staff: High-paid tech staff were doing work that junior team members could do. We changed job roles. This freed up senior staff for more important work.

- Lack of Financial Clarity: The owner couldn’t see which clients and projects made the most money. We set up new reporting systems. These gave insights for better decision-making.

- Reactive Cash Management: The company was often surprised by cash flow issues. We set up forecasting and management techniques. This allowed for better planning.

- Misaligned Bonuses: The bonus system wasn’t linked to company profits. This led to big bonuses even when overall profits were low.

We fixed these issues. We transformed the company’s financial management. Within a year, they increased revenue by 50%. They more than doubled their profit margin. The owner worked fewer hours. He could focus on growing the business instead of daily problem-solving.

This example shows the power of a CFO as a true strategic partner. It’s not just about keeping the books. It’s about using financial insights to guide business decisions across the company.

The CFO and Leadership Team Teamwork

For the CFO to be most effective, they need to work closely with other leaders. This teamwork aligns financial strategies with overall business goals.

In professional services firms, the CFO needs strong relationships with:

- The CEO: Acting as a key partner in setting and carrying out the company’s vision.

- The Chief Revenue Officer (CRO) or Sales Director: Working together on pricing strategies, client profitability analysis, and sales pay structures.

- The Chief Operating Officer (COO): Working to use resources better and improve efficiency.

- The Chief Marketing Officer (CMO): Ensuring marketing spend brings good returns and targets the most profitable clients.

- The Chief Technology Officer (CTO): Working together on technology investments to improve financial management and overall business performance.

Here’s another example from my consulting work. It shows this teamwork in action.

I worked with a marketing agency struggling with profitability. They had strong revenue growth. But the CFO and Chief Revenue Officer weren’t on the same page. The CRO focused only on increasing revenue. The CFO worried about shrinking profit margins.

We brought everyone together. We put in place a new approach:

- We created a client profitability model for the sales team. They could use it when pitching to new clients. It helped them focus on winning the most profitable clients, not just the biggest.

- We created a new pay structure for the sales team. It included profitability goals, not just revenue targets.

- The CFO started joining key client meetings. They gave insights on how different service packages would affect both client results and agency profits.

- We set up regular meetings with the CFO, CRO, and COO. They would review performance metrics together. They made decisions as a team.

The result? A more united leadership team. They drove both revenue growth and improved profitability. Within six months, the company increased its profit margin from 8% to 18%. They kept up strong revenue growth.

This level of teamwork and strategic input sets apart a modern CFO in a professional services firm.

Challenges in Changing the CFO Role

The benefits of this new CFO role are clear. But it’s not without challenges. Common obstacles include:

- Skill Gap: Many CFOs come from traditional accounting backgrounds. They may need new skills in data analysis, strategic planning, and leadership.

- Resistance to Change: Other leaders may be used to the CFO playing a limited role. They might resist this expanded influence.

- Technology Limitations: Old financial systems can make it hard to get real-time data. CFOs need this data to play a more strategic role.

- Time Constraints: CFOs still handle traditional financial tasks. Finding time for strategic work can be challenging.

- Cultural Fit: Changing from back-office number cruncher to front-line strategic partner requires a big shift in mindset.

Overcoming these challenges often requires buy-in from the entire leadership team. They must embrace this new approach to financial leadership.

Bringing It All Together

The role of the CFO in professional services firms is changing in a big way. Let’s review the main points we’ve covered:

- CFOs now do more than just manage finances. They’re key partners in growing the business and making it perform better.

- Today’s CFOs know about finance, but they also understand how the business runs, what technology it needs, and what’s happening in the market.

- A CFO with a strategic mindset can really change a business for the better. Remember our cybersecurity firm example? The CFO helped improve pricing, use staff better, see financial details clearly, and increase profits.

- Good CFOs work closely with all the top leaders in a company. They make sure money plans match the company’s big goals.

- This new role isn’t easy. CFOs might need new skills, face resistance from others, and need better tech tools.

As we look ahead, we can see that the CFO’s job will keep changing. The most successful firms will be the ones that welcome this change. They’ll use their CFO’s knowledge to make smart choices and grow the business.

In the next chapter, we’ll look at specific numbers, called Key Performance Indicators (KPIs), that modern CFOs should watch. These numbers are important for seeing how well your business is doing and helping it make more profit and grow.

The preceding was an excerpt from the upcoming book, From Expertise to Enterprise, by Arron Bennett

In the complete book, Aaron shares the exact frameworks that transformed his own business from a side hustle in 2018 to a powerhouse that’s transforming the financial services industry and the clients they serve. These aren’t just theoretical concepts – the book includes battle-tested strategies that helped multiple US clients increase revenue while doubling profit margins, exiting at 10-25X multiples, all while the owner worked fewer hours.

Through real client stories and practical guidance, Aaron reveals how the right financial partnership doesn’t just improve your tax situation – it fundamentally transforms how you experience business ownership. It’s the difference between simply surviving and truly thriving in today’s competitive landscape.

If your CPA is stuck in the past, your financial future is already at risk. With outsourced CFO services from Bennett Financials, you get more than clean books — you get real strategy. Our fractional CFO team helps business owners cut taxes, grow cash flow, and scale smarter. Talk to us today and see what forward-looking finance actually feels like.