Got a solo 401(k)?

Then the IRS is expecting a form from you. One you’ve probably never heard of.

It’s called Form 5500-EZ. It’s short, easy to overlook, and skipping it can cost you up to $150,000 in penalties.

Most business owners miss it. Their CPA doesn’t file it. Their plan provider doesn’t flag it. The IRS won’t remind you.

But when they catch it, they charge you.

If you’ve got money in a one-participant retirement plan and no one’s tracking this form, you’re exposed. Here’s what to do about it.

The Three Types of Form 5500: Know Which One You Need

Not all Form 5500 filings are the same. There are three variations, and choosing the wrong one or ignoring the one that applies to you can lead to compliance issues or steep penalties.

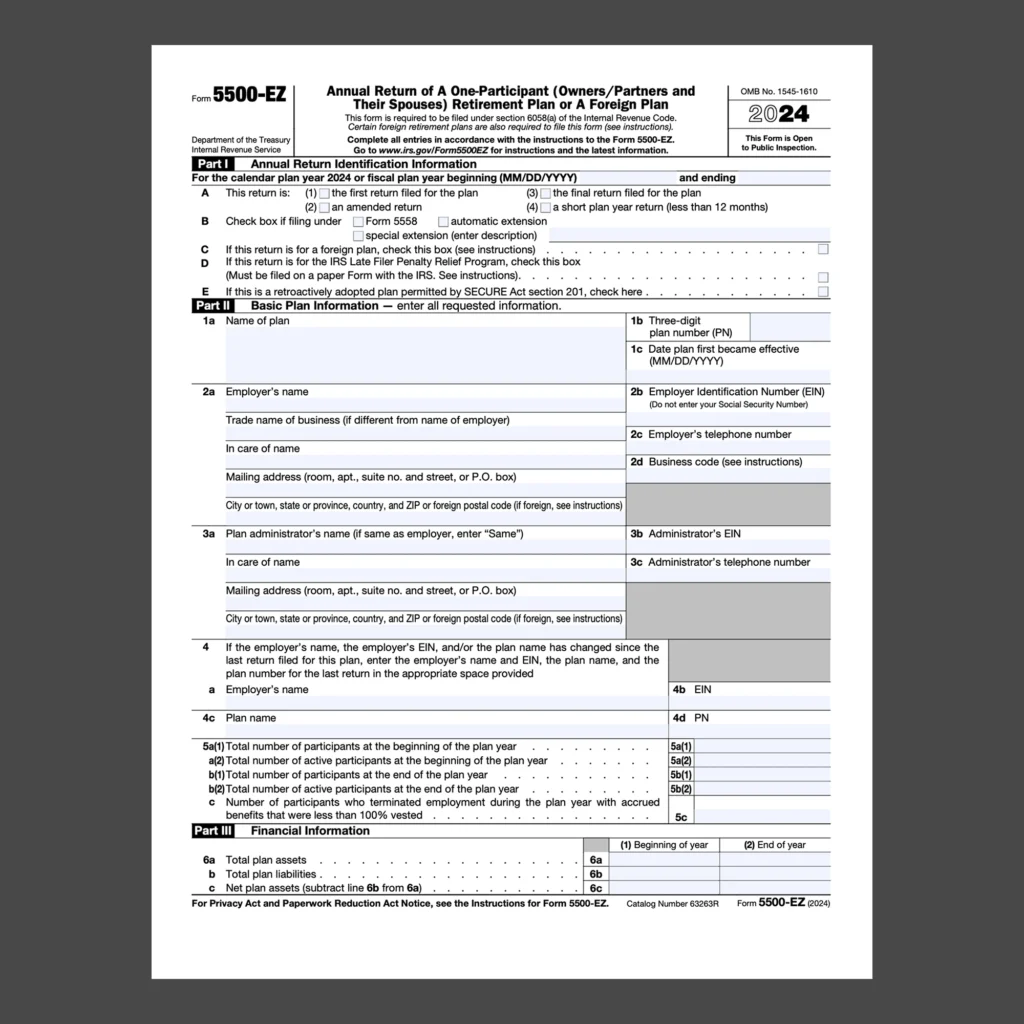

1. Form 5500-EZ

Applies to one-participant retirement plans. This typically covers solo 401(k)s or owner-only defined benefit plans. If it’s just you or you and your spouse, this is the form you need. You can file it by mail or electronically, depending on your total number of annual IRS filings.

If you’re a solo business owner, Form 5500-EZ is likely your responsibility. And if no one is tracking it, you could be sitting on a six-figure mistake.

What Is Form 5500-EZ?

2. Form 5500

Used by businesses with employee retirement plans. If you have full-time staff enrolled in a 401(k) or similar plan, this is likely your required filing. It must be submitted electronically through the Department of Labor’s EFAST2 system.

3. Form 5500-SF (Short Form)

For small businesses with fewer than 100 participants in the plan. This is still for employee plans, not solo owners, and requires electronic filing. Think of it as a streamlined version of the full 5500.

What Is Form 5500-EZ?

5500 EZ is a simple two-page document. It tells the IRS that your plan exists, how much is in it, and confirms that you’re following the rules. Nothing wild. But if you don’t file it when required, the IRS charges $250 per day, up to $150,000 per missed return. And yes, that’s per plan, per year.

When Must Form 5500-EZ Be Filed?

The moment your plan hits $250,000 in assets by the end of the plan year, you’re required to file it. Doesn’t matter how it got there—contributions, rollovers, or investment growth. If you close the plan or roll funds out, you owe a final return that says everything has been distributed.

That final return is where many owners get nailed. The account balance drops to zero. They assume they’re done. But that last filing is mandatory, and not filing it still triggers penalties.

If you have multiple solo plans and their combined balance passes $250,000, you now need to file one for each plan, even the ones under the threshold.

How to File the 5500-EZ: Electronic vs. Paper Submission

While Form 5500-EZ can be filed either electronically through the EFAST2 system or by mailing a paper copy to the IRS, electronic filing is generally recommended. Electronic submissions are processed more quickly and reduce the risk of lost or delayed mail. Additionally, if you are filing ten or more returns of any type with the IRS for the plan year, electronic filing becomes mandatory.

What To Do If You Missed The Deadline

If the IRS hasn’t sent you a penalty notice yet, there’s still a shot. You can use the IRS Late Filer Penalty Relief Program. Submit your old forms, pay $500 per year (max $1,500 per plan), and the IRS lets you off the hook.

But once they issue the penalty, that option disappears.

At that point, your only hope is something called reasonable cause relief, and the bar for that is high. Fires, illness, incapacitation, missing records, etc. “I didn’t know” won’t cut it. And if your request gets denied, you’re back in penalty land with no second chance.

What This Really Tells You About Your Financial Strategy

This isn’t a filing issue. It’s a strategy issue.

You’ve got a retirement account with real money in it. That account has rules. Those rules aren’t flagged by TurboTax or your bookkeeper. And unless someone is actively managing the structure of your plan—thresholds, timelines, rollouts, final returns—you’re betting your tax savings against the IRS’s penalty system.

There’s nothing complicated about the 5500-EZ. But what it reveals is bigger: a lack of oversight, a lack of integration, and a lack of strategy.

Most business owners are exposed, and they don’t even know it.

If your financial team isn’t tracking this, what else are they missing?

This is what we mean when we say strategy beats compliance. You don’t just need a plan. You need someone who understands what that plan touches, and what happens when it gets ignored.

Your cash should be compounding, not getting vaporized by missed forms.

Talk to our tax planning experts before a small oversight turns into a six-figure hit.