Most founders don’t think about financial planning until something breaks.

Cash flow gets tight, payroll feels risky, or you suddenly realize your margins have been slipping for six months and no one caught it.

That’s when they start looking for reports, models, dashboards—anything that will give them a handle on what’s going on.

But at this level, you don’t just need better data. You need a decision-making system that keeps the business aligned, funded, and growing on purpose.

That’s what FP&A is for. Here’s how it actually works inside a service business—and how to tell when it’s time to bring in help.

What Is Financial Planning and Analysis?

FP&A stands for financial planning and analysis. In plain English, it means creating a clear financial plan, tracking your progress in real time, and using that data to steer the business before things go off track.

You’re not just building a budget. You’re turning your business strategy into numbers, timelines, hiring plans, and revenue targets you can actually manage to.

A real FP&A system should answer questions like:

- Can we afford to hire this person now?

- Are we tracking ahead or behind on gross margin?

- How much cash will we have in 90 days if nothing changes?

- What’s our breakeven point by department or team?

If you don’t have fast, reliable answers to those, you’re not running FP&A—you’re just looking in the rearview.

Want to see how this works in practice? Explore our FP&A consulting services to learn how we build systems that drive financial clarity and control.

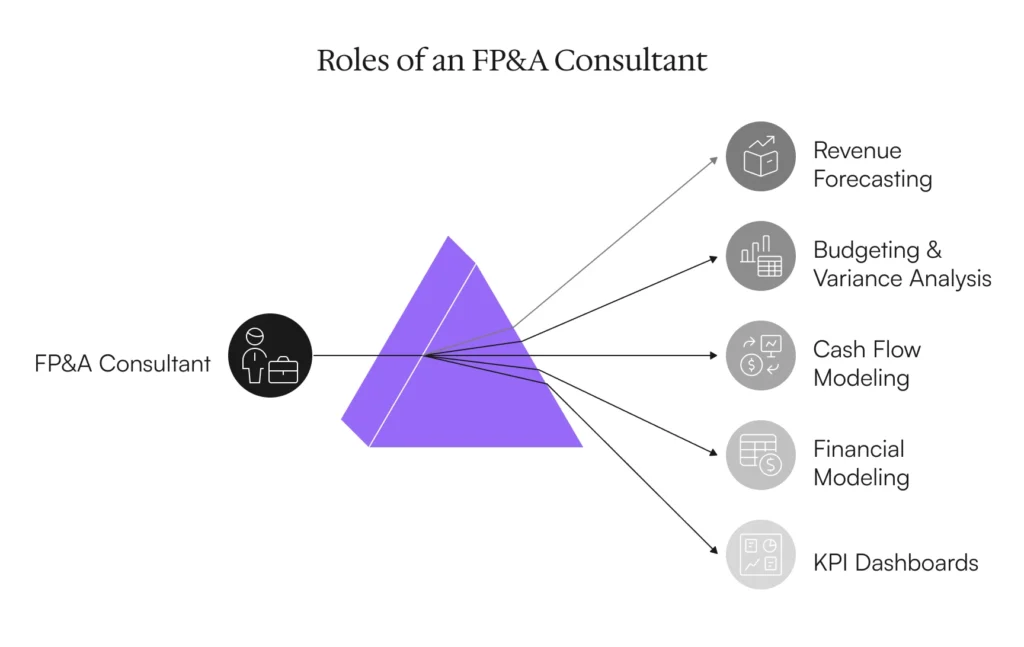

What Does an FP&A Consultant Actually Do?

An FP&A consultant builds the systems that answer those questions.

They don’t just deliver reports. They install financial tools, forecasts, and models that connect strategy to execution. That includes:

- Budgeting and forecasting

- Real-time KPI reporting

- Monthly financial analysis and variance tracking

- Cash flow modeling

- Performance dashboards by team, service line, or location

- Scenario planning for growth, hiring, or M&A

- Board and investor reporting

- Sales compensation modeling and ops support

Depending on the business, this can be a solo analyst or a full fractional CFO function. The goal is the same: financial visibility, proactive decisions, and a structure that scales.

Learn more about how we build these systems in our FP&A consulting approach.

Why Most Businesses Don’t Do This (Until It Hurts)

Most service businesses grow fast without upgrading their finance function. They lean on their CPA for taxes, a bookkeeper for clean records, and hope that’s enough.

But when revenue climbs and the team expands, things break:

- Cash doesn’t match the P&L

- You’re hiring reactively

- No one owns budget accountability

- Forecasts don’t exist or are stuck in spreadsheets

- Margin trends go unnoticed until it’s too late

That’s when you start bleeding cash, overstaffing, undercharging, or missing growth opportunities.

You don’t need more data. You need a system that turns data into action.

That’s exactly what our FP&A consulting services are designed to do.

What Happens When FP&A Works

We’ve seen this firsthand.

A cybersecurity firm came to us with no forecasting process. Hiring was erratic. Revenue looked good but cash was unpredictable. We built a dynamic model that tied revenue targets to hiring, margins, and burn rate. The result: $400K in avoided staffing mistakes, $1.2M reinvested, and higher margin stability across the board.

Same thing with a service business that kept hitting payroll stress—even though the books looked fine. We mapped out revenue-per-tech, aligned it with compensation, and built a forecast that flagged issues 60 days in advance. They added $140K to the bottom line in 4 months.

That’s the difference. FP&A isn’t just about reporting what happened. It’s about knowing what’s coming and doing something about it while there’s still time.

How to Know If You’re Ready for FP&A Support

If any of this sounds familiar, you’re ready:

- You’re growing, but cash is unpredictable

- You want to hire but don’t know the financial impact

- You can’t see department or service line profitability

- Month-end close takes too long

- Financials feel like a post-mortem, not a decision-making tool

This is where FP&A changes everything. Not just for your systems, but for your role as CEO. You move from reactive to strategic. From guessing to leading.

Ready to install a system that drives every financial decision?