It’s a fair question.

How do you maintain accounting accuracy?

Most business owners ask it when something feels off. Maybe the P&L doesn’t match the bank. Maybe they got hit with a surprise tax bill. Or maybe they’re growing, but the numbers feel disconnected from reality.

It’s not just a bookkeeping issue. It’s an operational one.

If your numbers are wrong, you don’t just misreport profit—you mismanage the entire business. You overhire. You underprice. You miss cash flow gaps until they’re a crisis.

Let’s walk through what accounting accuracy really means, what breaks it, and how to build a system that actually works.

The Real Cost of Inaccurate Books

Accuracy isn’t about compliance. It’s about decision quality.

One of our clients, Danny, was running a fast-growing business. Revenue was up. The team was slammed. But every month felt like a grind. Profit was slipping, and he had no idea why.

The books were technically “done.” His accountant filed on time. There were no red flags. But the financials didn’t break out service lines. Labor was buried inside one big category. There was no margin visibility. No departmental reporting. Just a single net income number and a gut feeling that something was wrong.

Once we restructured his chart of accounts, rebuilt the reporting, and tied revenue to delivery costs, the real issue became obvious—his pricing didn’t support the comp model. His team was overdelivering on underpriced work.

We fixed it. Within 90 days, he added $140K to the bottom line.

But here’s the part that stings: the business had been leaking cash for over a year. If the books had been accurate and actionable, he would’ve seen it earlier.

That’s the real cost of bad data. Not just tax penalties. Not just slow reports. But missed decisions that cost real money.

What Accuracy Actually Means

Here’s what accurate books look like:

- Transactions are entered in real time

- Every charge is coded to the right category

- Bank and credit cards are fully reconciled each month

- Reports are structured to show margins, not just totals

- The owner can read the reports and take action without a finance degree

Clean is not enough. You don’t need a pretty spreadsheet. You need a system that helps you run the business.

If your P&L doesn’t tell you what happened, what changed, and what needs attention, it’s just noise.

Got it. Here’s the fully cleaned-up version of the section—no em dash, no fluff, just direct and structured to answer the H2 immediately:

How Do You Maintain Accounting Accuracy?

You maintain accounting accuracy by assigning full ownership. One person or team must be responsible for making sure the numbers are correct, complete, and on time.

Not just who enters transactions, but who reviews them. Who checks for errors. Who connects the numbers to the real-world performance of the business.

Most business owners assume their CPA handles this. But CPAs focus on filing. They aren’t managing weekly categorization, reviewing your general ledger, or catching margin shifts.

A bookkeeper might handle data entry, but they’re not building the reporting system or closing the books consistently.

If no one owns the process from end to end, accuracy breaks down. Delays happen. Reports go unused. And the owner is left guessing, or managing the business based on last month’s cash balance.

Here’s what actually works:

- One person or team owns the accounting cycle from transaction to reporting

- They understand your business model

- They know your goals

- They meet with you monthly to review what changed and what to act on

That’s how accuracy becomes a decision-making tool, not just a compliance task.

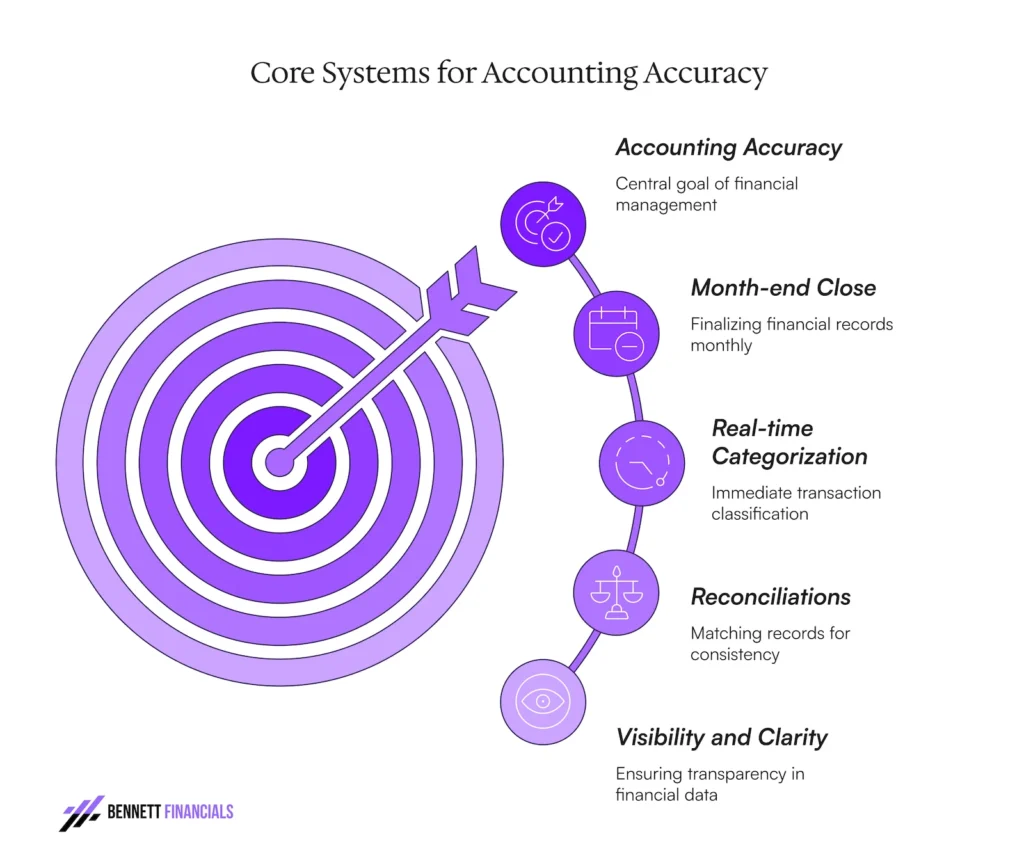

The Core Systems That Drive Accuracy

You don’t fix accounting with a better spreadsheet. You fix it with process.

These are the core systems we install in every client’s business:

Month-end close

Books need to close on a set schedule—ideally within 5 to 10 days. If you’re reviewing the prior month halfway through the current one, you’re already behind.

Real-time categorization

Waiting until the end of the month is a mistake. Categorize weekly. That’s how you catch errors, avoid coding backlogs, and keep the reports usable.

Bank and credit card reconciliations

Everything should match. No exceptions. If it doesn’t, the books aren’t trustworthy.

AR and AP visibility

You should know who owes you money, who you owe, and when everything is due. That’s how you manage cash flow and avoid surprises.

Payroll accuracy

Misclassifications here trigger penalties and create confusion around labor costs. You need to tie payroll directly to margin reporting and cash planning.

Accrual vs cash basis clarity

If you’re scaling, accrual accounting gives a more accurate view of profitability. Cash basis works for taxes, but it lies to you operationally.

Accuracy depends on this infrastructure. Without it, the numbers are guesses.

What Breaks Accuracy (And How to Fix It)

Accuracy breaks down for a few simple reasons:

- Your bookkeeper is entering transactions, but no one is reviewing them

- Your chart of accounts is bloated, inconsistent, or unclear

- Expenses aren’t labeled properly—no memo, no receipt, just a dollar amount and a guess

- The books are only touched monthly—or worse, quarterly

- You’re relying on your CPA to double-check things they never even see

None of this gets fixed by new software.

QuickBooks doesn’t know that your contractor should’ve been a W2. Xero won’t tell you your team is overstaffed. Your tax preparer isn’t going to restructure your P&L so you can see service-line margins.

You need oversight. And a financial rhythm.

Weekly categorization. Monthly review. Quarterly planning. That’s the cadence that keeps the numbers right, and usable.

Why Most CPAs Don’t Help You Stay Accurate

Here’s the truth most people don’t want to hear.

CPAs are trained to file taxes. That’s it. Most talk to you once a year and are in a mad rush to finish with your account so they can move onto the next business, and the next.

They’re not looking at your margins. They’re not checking your comp model. They’re not adjusting your chart of accounts so you can actually run the business better.

Their job is to stay compliant with the IRS. Not to help you grow. Not to help you scale. Not to fix your cash flow.

When Taylor came to us, he had a good CPA. But every decision felt like a guess. The firm was growing fast, but he had no system for tying financials to strategy. He couldn’t see what was driving results, and he was still stuck in the day-to-day.

We built out a real reporting system. Tied every number to ROI. Created forecasts, cash flow maps, and a decision-making framework.

That clarity helped him scale from $20K to $2M per month while keeping 30% profit margins. And when he got a 25x acquisition offer, he turned it down—because the business was finally running how he wanted.

How We Maintain Accounting Accuracy as a Fractional CFO Team

We don’t just clean the books. We rebuild the system that keeps them accurate.

Here’s how:

- We categorize expenses weekly. No backlogs.

- We close the books monthly and meet to review what changed.

- We track cash flow every week, not just at tax time.

- We help you read the numbers. Understand them. Act on them.

- We connect your financial data to your margin, growth, tax, and wealth goals.

And when we find a problem, we fix it. Fast.

That’s what accuracy looks like in practice.

How AI Affects Accounting and Bookkeeping

Let’s get this part straight.

AI helps with:

- Receipt scanning

- Transaction matching

- Categorization suggestions

- Faster reconciliation

But AI doesn’t know your strategy. It can’t tell if a charge is CapEx or OpEx. It won’t flag margin compression. It won’t redesign your chart of accounts.

If your system is broken, AI just breaks it faster.

We use AI tools where they make sense. But the accuracy still depends on human oversight, context, and strategy. That’s the part software can’t replace.

DIY vs Bookkeeper vs Controller vs CFO

Here’s how the models compare:

- DIY: You’re entering things yourself, or ignoring the books entirely. High risk, low clarity.

- Bookkeeper: You get entries and maybe reconciliations. But no reporting strategy, no analysis, no real review.

- Controller: You get consistent closes, clean reports, and some oversight. But not tied to strategy, taxes, or cash flow planning.

- CFO: You get a full financial system. Books tied to goals. Strategy backed by numbers. Real-time clarity and decision support.

The difference isn’t the software. It’s the thinking.

Final word: Accuracy isn’t optional

You can’t grow on bad data.

You can’t reduce your tax bill with delayed reports.

You can’t fix margin, forecast cash, or hire correctly unless the books are right.

So if you’re asking, how do you maintain accounting accuracy?

You build a system.

You put the right person in charge.

And you stop treating the books like a formality and start treating them like the most valuable tool in your business.

Want us to help you set that up?

Talk to us. We’ll walk you through it.