Most business owners don’t realize this: you may have tens or hundreds of thousands sitting in past tax returns. But if you wait too long, the IRS locks the door. So how far back can you go?

Here’s the practical answer—and how smart business owners are using amended returns to recover cash, reduce future exposure, and fix tax planning mistakes before they compound.

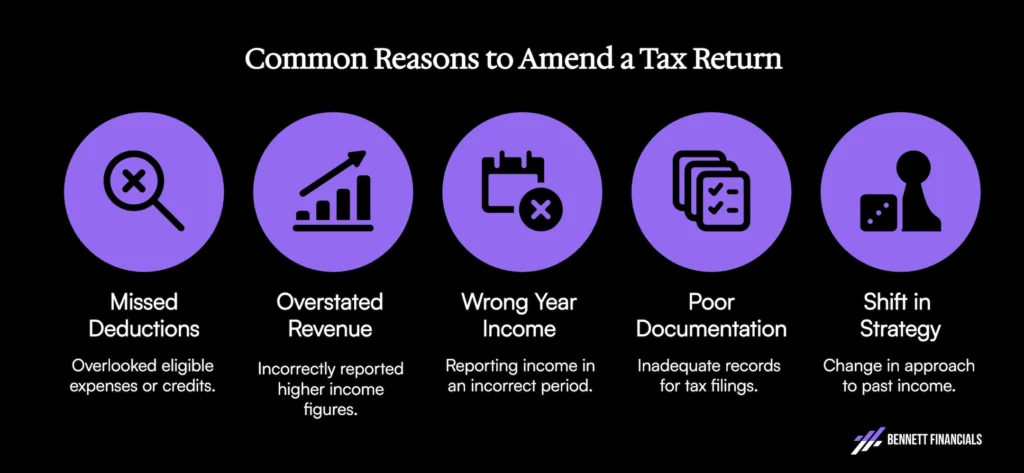

Why You Might Need to Amend a Return in the First Place

Amended returns aren’t just about fixing typos. They’re about recovering money you shouldn’t have paid in the first place—and making sure your financials actually reflect the business you’re running.

That could mean:

- Missed deductions

- Revenue that was overstated

- Writing off income in the wrong year

- Poor documentation that led to conservative filings

- A shift in tax strategy that changes how you treat past income

If you’re making $1M+ net and weren’t doing strategic planning in prior years, there’s a good chance those old returns are bleeding.

The IRS Rules: How Far Back Can I Amend a Tax Return?

There’s a statute of limitations on how far back the IRS lets you amend a return. Get this wrong and you might miss the refund window completely.

Here’s the clear rule: You can amend a return up to 3 years after the date it was filed, or 2 years after the date you paid the tax—whichever is later.

- Filed your 2021 return on April 15, 2022? You have until April 15, 2025.

- Filed late or paid late? That changes the deadline.

- Past that window? You can still file—but you can’t get money back.

Can You Really Get a Refund for Past Years? Yes—If You Catch It in Time

The IRS pays refunds on amended returns all the time. But you have to catch it before that window closes—and you need documentation to back your case.

We’ve seen business owners recover six figures:

- One client booked prepaid income all at once—overstated revenue by $400K. We amended it. IRS paid the difference.

- Another had over $220K in depreciation missed because their assets weren’t classified correctly. That’s not a math error. That’s a real cash loss.

- These aren’t outliers. They’re common once you start reviewing old filings with fresh eyes.

Beyond Compliance: When Strategic Tax Planning Uncovers Missed Money

Most old returns reflect a mindset of “file and forget.” But once you start using strategy, you’ll see just how much was left on the table.

If you’ve changed:

- Business structure (e.g. LLC to S-Corp)

- Entity stacking (adding holding companies, real estate entities)

- Compensation method (e.g. salary vs distribution mix)

- Asset classification or depreciation timelines

Then your current planning probably conflicts with your old filings—and amending them can close the gap.

Common Mistakes That Trigger Amendments (and How to Avoid Them Next Time)

The mistakes that cost the most money rarely set off alarms. They blend in—until someone goes looking for them.

These are the patterns we see most:

- Misclassifying prepayments as income before they’re earned

- Depreciating assets too slowly, or not at all

- Ignoring home office, auto, or travel deductions due to fear or bad advice

- Over-reporting revenue due to timing issues between invoicing and payment

- Incorrect entity structure, leading to over-taxation on distributions

The solution isn’t just filing an amendment. It’s fixing your system so you don’t keep repeating the same issues year after year.

Risks and Red Flags: Will Amending Your Return Get You Audited?

This is what stops most owners from amending—even when they’re owed money. But an amendment isn’t a red flag when it’s backed by clean documentation and a clear explanation.

The IRS doesn’t audit just because you file an amendment:

- Audits are triggered by suspicious activity—not honesty.

- A well-structured amendment shows clarity, not confusion.

- We always include a supporting memo outlining: what changed, why it changed, and how we calculated the revision.

- Transparency wins. It reduces audit risk—not increases it.

How Business Owners Use Amended Returns as Part of a Bigger Strategy

The most sophisticated operators don’t wait for the IRS to catch mistakes—they proactively clean things up to position for what’s next.

Amendments are used to:

- Normalize books ahead of an acquisition or capital raise

- Sync old filings with new entity structures or tax strategies

- Clean up reporting before entering new compliance environments (e.g. multi-state nexus, foreign filings)

- Fix years where previous teams didn’t understand your growth trajectory or income model

If you’re planning to sell or scale—your returns need to back up your story.

How to Amend a Return (And What Not to Do)

There’s a right way to file an amended return. It’s not just about sending in new numbers—it’s about presenting the IRS with a full, documented position.

What to do:

- Use Form 1040-X (individual) or 1120-X (corporate)

- Attach a corrected copy of the original return

- Include any new supporting docs (receipts, depreciation schedules, etc.)

- Add a clear written explanation of what’s being changed

What not to do:

- Don’t guess at numbers or send vague summaries

- Don’t file without backup

- Don’t expect a refund without justification

The Most Expensive Tax Mistake: Doing Nothing

Waiting doesn’t protect you—it just locks in the damage. Every year you wait is a year of lost leverage.

The real cost of inaction:

- You lose the refund window

- You miss the chance to fix patterns before they snowball

- Your tax strategy becomes harder to implement cleanly going forward

If something feels off, get it checked. Even if the answer is “you’re good,” that peace of mind is worth it.

Final Word: If You’re Wondering Whether to Amend—You Probably Should

Smart business owners don’t file returns and forget them. They treat every tax year like a financial snapshot, and if something’s out of focus, they fix it.

Want a second opinion on your past tax returns? Talk to our team. We’ve saved our clients an average of $360k in overpaid tax from 2024 to 2025. We’ll tell you if you’re leaving money on the table.