This post is part of our upcoming video course on strategic tax planning and finance for small business owners by our CEO, Aaron Bennett. The course breaks down real-world financial strategies you can implement immediately to lower taxes, increase take-home income, and build long-term wealth. We’re starting with one of the biggest levers: how to pay yourself properly in an S Corp.

How to Pay Yourself as an S Corp

If you’ve elected to be taxed as an S Corporation or you’re thinking about it, this will show you exactly how to pay yourself the right way so you stay compliant and legally save thousands in taxes.

I’ll walk you through how to structure your S Corp salary, what the IRS expects, how to split your income between payroll and distributions, and how to avoid costly mistakes. By the end, you’ll know exactly how to pay yourself and keep more of what you earn.

Here’s what we’ll cover:

- How S Corp owners get paid: W-2 versus distributions

- What the IRS means by reasonable compensation

- How to split your income and save on self-employment taxes

- Tax forms and deadlines to know

- Common mistakes and how to avoid IRS audits

S Corp Income Types

If your business is earning consistent profit—typically $80,000 to $100,000 or more annually—electing S Corp status can help you legally reduce self-employment taxes. But you need to pay yourself properly or risk IRS penalties.

If you’re new to the channel, my name is Arron Bennett, founder of Bennett Financials. We help businesses become more profitable and efficient by optimizing taxes and building better systems so that they can grow and eventually sell for higher multiples when the time is right.

How S Corp Owners Get Paid

There are two income types: one is a W-2 salary, and the other is owner distributions. Owner distributions are when you transfer money from the business bank account to your personal bank account.

You are not taxed on the money that is moving from the business to your personal account. You are taxed on the net income of the business. If you have $100,000 in profit and you move $20,000 to yourself, you’re still taxed on the full $100,000.

A W-2 salary, though, is an expense to the business. So if you have $100,000 net and then you run a $50,000 salary, you’re reducing your net income by $50,000. You’d only be taxed on $50,000.

Tax Brackets and Self-Employment Taxes

So let’s say we have a $50,000 salary. You’d get taxed at your bracket—let’s use 22% for ease of use. That’s $11,000.

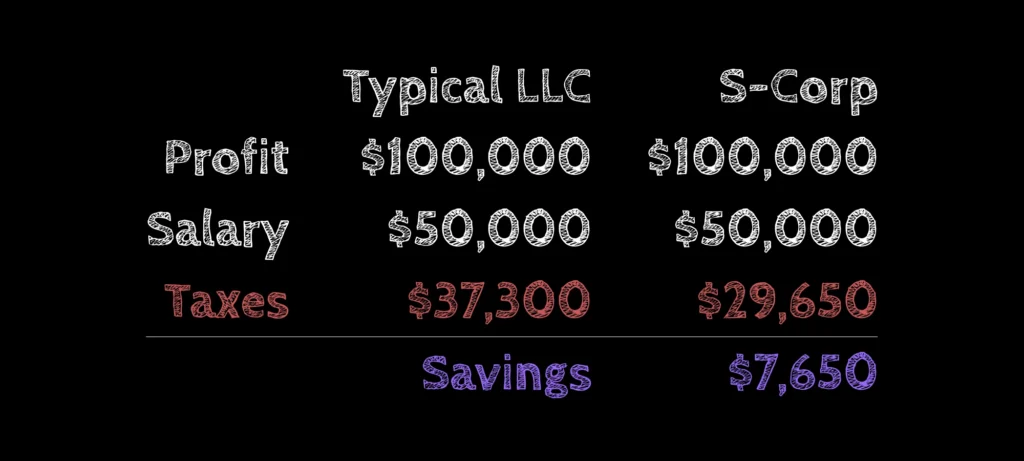

Now, if you were not an S Corp and simply an LLC, on your $100,000 in profit, you’d pay 15.3% in self-employment taxes—$15,300—and then 22% on top of that, for a total of $37,300.

But with an S Corp, you’re only paying 15.3% on your salary—so $7,650 instead of $15,300. Add in the 22% on the full $100,000 ($22,000), and your total is $29,650.

So, you’ve reduced your overall tax and kept an additional $7,650 in your pocket.

Self-Employment Tax Caps and Partnerships

You have to understand: it goes up to $178,000. Once you get past that, self-employment taxes go away.

If you have two partners, you’re both going to get taxed at that rate—15.3% up to $178,000 each. But if you have salaries in other entities, that may lower your total self-employment taxes.

Reasonable Compensation Rules

You can’t only take distributions. You have to have a reasonable compensation. I cannot stress this enough.

Reasonable compensation is generally determined by industry, role, profits, and competency. If you’re a CEO and you’re out of the day-to-day, that’s different from someone who wears many hats.

The “many hats” approach helps determine reasonable compensation. A time study is the best way to do it. Or use Salary.com—look up what you do in the business, find the median rate in your area.

If you’re doing cybersecurity, admin, and service delivery, and your primary role is cybersecurity professional at an average level, salary.com will give you that benchmark.

As you move into management, look up manager rates. As you step into a full CEO role, check CEO salaries. There’s usually overlap, but the tool helps you justify your numbers.

Screenshot that page and save it. The IRS uses your NAICS code to benchmark salaries. If you’re way under, it’s a red flag. But if you’re average—or have proof—you’re good.

Salary + Distribution Example

Let’s say you want to take $100,000 total. You could take $50,000 in salary and $50,000 in profit. That setup lowers your self-employment tax while keeping you compliant.

You still have to pay taxes, but this structure gives you real savings.

Payroll Setup and Tax Forms

This is very simple. You no longer have to use CPA firms to run payroll.

Use a modern payroll provider like Gusto, ADP, or Paychex. Gusto is a cheap option for small businesses. It handles the paperwork, W-2s, and 1099s. You can set it on autopilot and take distributions as usual.

When you’re an S Corp, you file an 1120S—this is an informational return. The profits then flow through to your 1040. If there are multiple owners, each gets a K-1 that shows their share of the profits.

Gusto and other tools will also file and pay your quarterly payroll taxes. It’s done for you. You get your W-2, take your distributions, and stay compliant—while saving money.

Common Mistakes to Avoid

- Not paying yourself any salary – easiest way to get audited. If you can’t back it up, the IRS will reclass distributions and hit you with self-employment tax on all profits.

- Paying too much salary – you won’t get penalized, but you’re giving the IRS free money.

- Missing payroll tax deadlines – penalties and interest add up fast. Use automation.

Pro Tips

Work with a CPA to set your salary annually. We use software that lets you run a time study and benchmarking in about 20 minutes. You can often bring your salary down legally and save more.

If you’re doing admin, cyber, AP/AR, and other tasks, your effective salary can drop by weighting those lower-level roles.

As your company grows, reassess your salary quarterly—especially if you’re stepping out of the day-to-day.

Use payroll software to automate payments and filings. It’s the easiest way to stay compliant and reduce your tax bill.

Closing Thoughts

If you’re running an S Corp, this is how you keep more of what you earn without taking risks that get you flagged by the IRS.

Paying yourself the right way isn’t complicated, but it does need to be done right.

If you’re not sure your setup makes sense, or want a second look, reach out.