If your income’s too high for direct Roth IRA contributions, you’re not out of luck. In 2025, the cutoff is $165,000 for single filers and $246,000 for joint filers—but there’s a strategy that bypasses those limits.

It’s called the Mega Backdoor Roth IRA.

By using after-tax contributions in your 401(k), then converting them to a Roth IRA or Roth 401(k), you can save tens of thousands more each year into tax-free growth—even when the standard Roth option is off the table.

It only works if your plan supports it. And it only works if you do it right.

But if the structure is there, it’s one of the cleanest retirement tax plays available.

Why High-Earners Miss This Strategy Entirely

Most high earners think they’re capped when it comes to Roth contributions. And they are—until they know about this.

The Mega Backdoor Roth IRA opens the door for anyone with strong income and the right 401(k) setup. But many miss it for one simple reason: it’s not commonly advertised, and not every employer plan allows it.

This strategy takes coordination. It’s not something most financial advisors or HR teams are proactively walking through. But the IRS rules allow it—and if you’re earning multiple six or seven figures and want long-term tax-free growth, this is one of the few ways to make it happen.

What Is a Mega Backdoor Roth IRA?

The Mega Backdoor Roth IRA is a strategy that lets you contribute significantly more to Roth accounts than the standard limits allow—regardless of your income.

You do it by making after-tax contributions to your 401(k), then rolling those funds into a Roth IRA or Roth 401(k). It’s legal, clean, and built directly into IRS guidance.

It’s not the same as the regular backdoor Roth IRA, which is capped at $7,000 per year for those who earn too much for direct contributions. The Mega version lets you potentially contribute over $40,000 more per year, depending on your plan.

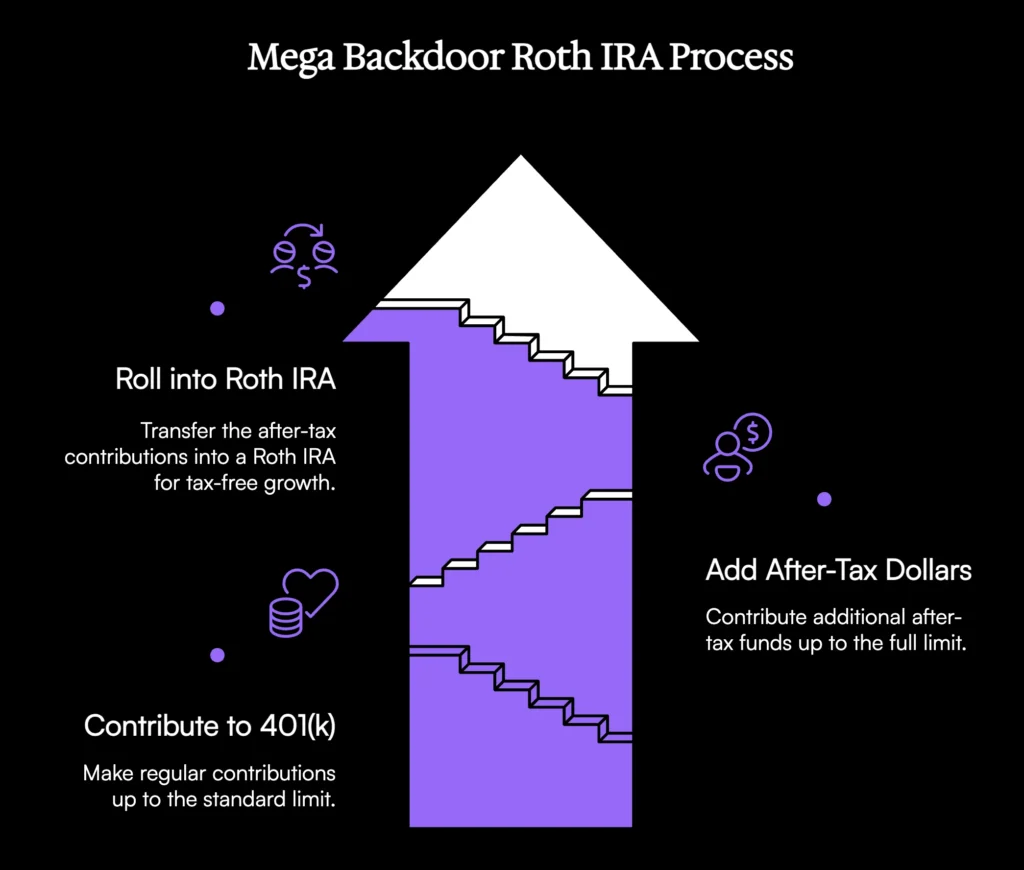

How the Mega Backdoor Roth IRA Works – Step-by-Step

Here’s the simplified version:

Step 1: You contribute to your 401(k) like normal—up to $23,000 in 2025.

Step 2: If your plan allows, you add after-tax dollars beyond that standard cap—up to the full 401(k) limit of $69,000 (or $76,500 if over 50).

Step 3: You roll those after-tax contributions into a Roth IRA or Roth 401(k), where they grow tax-free.

If you wait too long to convert, the earnings on your after-tax dollars will be taxed at ordinary income rates. But if you convert them quickly, there’s little or no tax impact—and your money grows tax-free from there.

Are You Eligible for a Mega Backdoor Roth IRA?

Eligibility has nothing to do with income or net worth. It’s about plan design.

You need a 401(k) or Solo 401(k) plan that allows:

- After-tax contributions

- In-service rollovers or in-plan Roth conversions

If either one is missing, the strategy won’t work. Many employer-sponsored 401(k)s don’t allow both. But if you’re self-employed or run your own business, you can set up a Solo 401(k) with full control.

Check with your plan administrator or review the plan document. Look for those two features—after-tax contributions and the ability to roll them into a Roth account while still employed.

2025 Mega Backdoor Roth IRA Annual Contribution Limits

In 2025, the total 401(k) contribution cap—including employee, employer, and after-tax contributions—is $69,000. If you’re over 50, the cap is $76,500.

Here’s how the numbers stack up:

- Employee deferral limit: $23,000

- Employer contributions: varies

- After-tax contributions: fills the gap up to $69,000

So if you contribute the full $23,000 and your employer adds $10,000, you could contribute up to $36,000 more after-tax—and then roll that into a Roth.

The more employer contributions you receive, the less room you have for after-tax dollars. But even partial use of this strategy can add serious tax-free growth potential.

Is the Mega Backdoor Roth a Loophole?

Not at all.

This strategy is fully documented in IRS guidance. It’s not a workaround or some hack buried in a gray area. It’s just rarely explained clearly—so most people don’t use it.

It only feels like a loophole because of how powerful it is. You’re putting after-tax money into a Roth environment, avoiding future tax on growth and distributions. For high earners, that’s rare.

But this isn’t a “trick”—it’s law. You just have to follow the steps precisely.

Is a Mega Backdoor Roth IRA Taxed Twice?

Short answer: no. But timing matters.

The dollars you contribute after-tax were already taxed when you earned them. So when you roll them into a Roth, you don’t pay tax again on those contributions.

The problem is the earnings. If you wait too long between making the contribution and doing the rollover, those earnings can build up. When you convert, those earnings get taxed as ordinary income.

That’s why speed is critical. Some plans offer automatic conversions to avoid this. If yours doesn’t, you need to manage it manually—and do it quickly.

What Is the 5-Year Rule for Mega Backdoor Roth Conversions?

Every Roth conversion starts a 5-year clock.

You can’t withdraw converted funds penalty-free until five tax years have passed. This rule applies even if you’re over age 59½.

Each conversion has its own timer. If you do one every year, you’ll have multiple clocks running. That’s not a problem if you’re investing for long-term retirement. But if you might need access to the funds soon, this rule matters.

Plan your withdrawals accordingly—or avoid converting funds you may need short-term.

What Companies Offer the Mega Backdoor Roth Option?

Some plans support it, most don’t. Here are a few that typically do:

- Fidelity

- Vanguard

- Empower

But even if your plan is with one of those providers, it doesn’t mean your employer has enabled after-tax contributions or in-service rollovers.

If you run your own business or are self-employed, the easiest path is setting up a Solo 401(k) with those features baked in. That gives you full control and maximum flexibility.

When This Strategy Backfires (and How to Avoid It)

This is not a set-it-and-forget-it move. Common issues include:

- Plan doesn’t allow after-tax contributions

- No in-service rollover allowed

- Conversion gets delayed, triggering tax on earnings

- Contributions and conversions aren’t documented properly

Any of these mistakes can reduce or eliminate the benefit.

This isn’t something to guess on. You need clarity from your plan administrator, and you need to follow the IRS reporting rules exactly. If you’re not confident in those details, bring in someone who is.

Who Should Use It—and Who Shouldn’t

Use this strategy if:

- You max out your 401(k) every year

- You have high income and want more Roth exposure

- Your plan supports after-tax and in-service rollovers

- You’re investing long-term and don’t need access in the next 5 years

Skip it if:

- Your plan doesn’t support the features

- You need the liquidity short term

- Your business is in early growth mode and cash is tight

This is a long-term compounding strategy. If you’re constantly pulling cash for business reinvestment, this might not be your best move this year.

How a CFO Looks at This Strategy

On paper, this is a tax win. But strategy isn’t just about the math.

A CFO will ask:

- Can the business afford to shift this cash into a locked-up retirement vehicle?

- Are we optimizing for post-tax net worth or near-term investment returns?

- Will this reduce tax now, later, or both?

They’ll model this against cash flow, tax exposure, reinvestment opportunities, and your broader exit plan.

Sometimes the best move isn’t maxing out retirement. Sometimes it’s fixing margin leaks or redirecting capital toward growth. The right call depends on your situation—not a generic rule.

Should You Do a Mega Backdoor Roth Every Year?

If you can afford it and your plan supports it, yes.

This is a consistency play. A one-time contribution helps, but the real power is in doing it every year. That’s how you build real tax-free wealth.

If cash flow is tight one year, skip it. No harm done. Just make sure you’re making the decision strategically—not by default.

Alternatives If You Can’t Use It

If your plan won’t support this strategy, here are a few other ways to reduce tax or build retirement wealth:

- Backdoor Roth IRA: smaller limit, same concept

- SEP IRA: good for self-employed with lower payroll

- Cash balance plan: ideal for high earners over 45

- Real estate with depreciation

- Oil & gas, conservation easements, other niche strategies

Each comes with tradeoffs. None are as clean as the Mega Backdoor Roth—but there’s no shortage of tools if tax strategy is the goal.

Final Takeaways: Use the Tax Code, Don’t Let It Use You

The Mega Backdoor Roth IRA is one of the few tools that lets high earners stack more wealth into tax-free accounts, year after year.

It takes planning. It takes execution. And not every plan is built to support it.

But when it fits, it’s a strategy worth using—especially if you’re playing the long game with your wealth.

Most people never hear about it. Now you have. What you do next is what counts.

Ready to Maximize Your After-Tax Wealth?

Retirement strategies like this are just one layer. Want a full picture that ties together cash flow, tax strategy, and growth planning?

Talk to our team and we’ll walk you through exactly where this fits.