What Is Outsourced Accounting?

Outsourced accounting is when a business hires an external firm or service provider to manage its accounting tasks instead of handling them in-house. This can include bookkeeping, financial reporting, payroll processing, tax preparation, and even strategic financial planning.

Rather than building an internal team with full-time salaries and overhead, businesses tap into a specialized team that already has systems, software, and experience in place. Done right, it saves time, reduces errors, and gives you access to financial insights you might otherwise miss. It also allows business owners to focus on operations and growth instead of backend financial logistics.

Here’s the rewritten version of both sections: shorter, sharper, and more distinct in tone while preserving the educational clarity you’re aiming for.

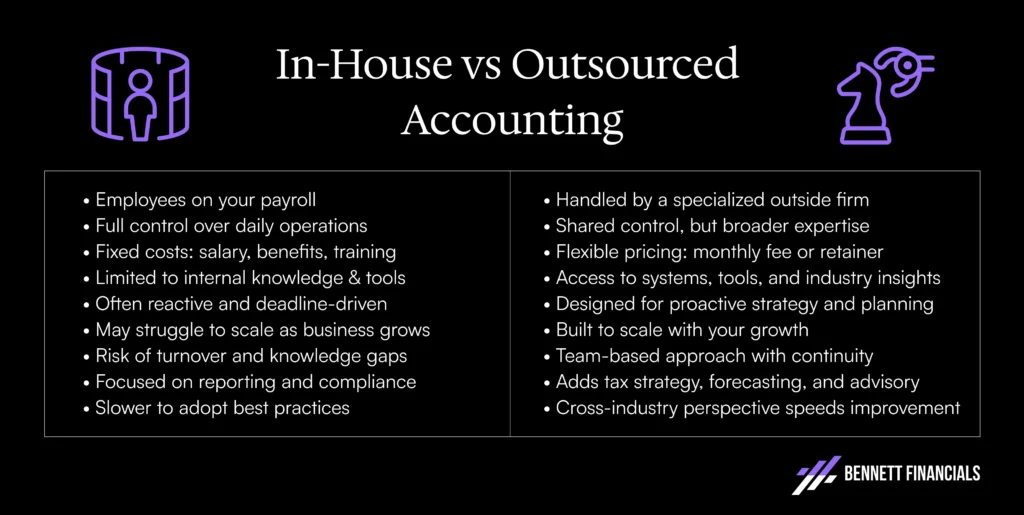

Comparing In-House vs. Outsourced Accounting

In-house accounting means hiring employees to manage your finances internally. You have direct control—but also take on the cost of salaries, benefits, training, and turnover. Most internal teams focus on day-to-day tasks like transactions, payroll, and reporting. They often lack the capacity or expertise to implement advanced strategies for tax, cash flow, or growth.

Outsourced accounting shifts those responsibilities to a specialized firm. You’re not just delegating tasks—you’re getting access to tools, systems, and experienced professionals who work across industries. The right partner will bring structure, strategy, and forward-looking insights that help you scale profitably—without expanding your payroll.

A Note on Internal vs. External Accounting

“In-house” is sometimes used interchangeably with “internal,” but they’re not exactly the same. Internal accounting refers broadly to financial operations managed by your own team. External accounting refers to those same functions being handled by an outside provider.

Internal setups offer control—but often come with limited perspective. External partners bring experience from working across dozens or even hundreds of businesses. That means faster pattern recognition, more strategic insight, and scalable systems built to support your next stage of growth.

If you’ve outgrown basic bookkeeping or you’re not getting proactive advice, it’s likely time to look outside—not just for help, but for real financial leadership. This is where strategic finance management can make a difference, providing the forward-looking financial planning that drives growth beyond basic bookkeeping.

How Do You Decide In-House or Outsourced?

It comes down to scale, complexity, and growth goals.

- If you’re doing under $500K in net income, an in-house bookkeeper may be enough.

- If you’re at $1M+ net, the cost of not having strategic oversight grows fast

Understanding what strategic finance does for a business highlights the difference that proactive financial strategy can make.

Ask yourself:

- Are you getting real-time insights on cash flow?

- Can you scale your current setup without bottlenecks?

- Is your accountant helping you reduce taxes or just filing returns?

- Do you have financial data that’s easy to act on—or do you feel like you’re flying blind?

Outsourcing makes sense when you need deeper insight, faster decision-making, and less operational drag. It also gives you the flexibility to scale without the expense and risk of hiring full-time finance staff too early.

Is Outsourcing Accounting a Good Idea for My Business?

It depends on who you hire and what you need. Outsourcing is a good idea when you need accurate books, timely reports, and proactive guidance without building a full internal finance team.

It’s especially helpful for businesses with:

- Rapid growth

- High tax exposure

- Complex entity structures

- Limited internal bandwidth

- Investors or stakeholders expecting regular reporting

It’s not always the right fit for businesses that need daily, on-site financial operations. But for most service businesses, especially in the $1M–$20M revenue range, outsourced accounting can unlock meaningful efficiencies and savings.

How Much Does It Cost to Outsource an Accountant?

Costs vary widely. Here’s a general breakdown:

- Basic bookkeeping only: $500–$2,000/month

- Full-service accounting (bookkeeping + monthly reports): $2,000–$5,000/month

- Strategic accounting with tax planning and CFO insight: $5,000–$15,000/month

The lowest-cost firms typically offer limited service, while premium firms embed tax and financial strategy. The key is what you get in return. Saving $100K+ in taxes annually makes the investment well worth it.

Also keep in mind: Internal hires come with overhead. Salary, benefits, payroll taxes, training—it adds up fast. Many business owners find that a flat monthly fee for an outsourced team is not just easier to budget, it delivers far more.

How Do You Outsource Your Bookkeeping?

It starts with a handoff. Here’s what a typical process looks like:

- Initial consultation: Identify needs, current pain points, and goals

- Data migration: Share past financials, current software, and access

- Clean-up: Reconcile prior records, catch errors, and reclassify transactions

- Ongoing cadence: Monthly or weekly updates, financial reviews, and reports

- Strategic inputs: Forecasts, tax planning, and owner-level decision support

You’re not just sending files and hoping for the best. A quality firm will proactively communicate, build standard operating procedures for how data is handled, and keep everything audit-ready.

What Does Outsourced Accounting Typically Include?

The scope can vary, but strategic outsourced accounting should cover:

- Day-to-day bookkeeping

- Monthly reconciliations

- Financial reporting (P&L, balance sheet, cash flow)

- Payroll support or integrations

- Tax categorization and audit-readiness

- Entity guidance (S-Corp, C-Corp, etc.)

- Forecasting and budgeting inputs

Some firms go further, integrating with your CRM, helping you track profitability by service line, and preparing reports for lenders or investors. The best partners will tailor their service to your goals—and make sure your accounting evolves as your business grows.

How Does Outsourced Accounting Work?

The best outsourced accounting is proactive, not reactive.

You get a team that:

- Reconciles accounts monthly

- Classifies transactions for tax efficiency

- Prepares reports for decision-making

- Flags issues before they snowball

- Helps position your financials for funding, selling, or scaling

You should expect regular communication—not just a monthly email with your P&L attached. Great firms help interpret the numbers, not just report them. Beyond interpretation, effective business financial strategies ensure those insights translate into actionable plans aligned with your growth goals.

Think of it like having a financial operations department on-call—without the cost of building it yourself.

A strategic partner goes beyond that:

- Reduces your tax liability legally

- Builds financial systems that scale

- Structures your business for better exits or equity raises

CPAs look backward. Strategic firms help you plan forward.

And when you’re looking to scale, exit, or raise capital, forward-looking financials make the difference between stalling—or closing the deal.

How Bennett Financials Is Different

Most outsourced accounting firms offer basic reporting, compliance support, and maybe tax prep. That’s not how we operate.

At Bennett Financials, we combine outsourced accounting with strategic finance. That means we don’t just deliver reports—we use your numbers to help you:

- Save on taxes using legal, advanced strategies

- Improve margins by identifying where money is leaking

- Forecast future growth with clean, usable data

- Structure for scale, acquisitions, or high-multiple exits

What sets us apart:

- We’ve saved clients over $65 million in taxes to date

- Our average client saves $360,000 or more

- We offer a money-back guarantee if we can’t save at least $50,000

We don’t treat accounting as a task—we treat it as a lever. And we’re not just accountants. We’re financial partners helping 7- and 8-figure business owners make smarter, more profitable decisions.

Case Study: Eden Data — From Start-Up to Scalable Growth

Eden Data came to us in the early days of their business. They had no revenue and were looking for more than just compliance—they needed strategic financial direction from day one.

We took over their accounting, built a chart of accounts that mapped to their service model, and handled all tax structuring and forecasting from the ground up. Rather than just plugging numbers into software, we became an extension of their leadership team.

We helped them optimize their S-Corp compensation, layered in legitimate tax-saving strategies like the Augusta Rule, and mapped out a long-term roadmap that balanced aggressive growth with legal tax positioning.

The result? They scaled from $0 to over $300,000 in monthly recurring revenue. All while staying lean, protected, and strategic with every financial move.

More importantly, Eden Data’s founder now has the confidence to make big financial decisions because the back office is built to support them. Their financials are clean, strategic, and built to scale. That’s what true outsourced accounting should do.

Wondering if Outsourced Accounting is Right for Your Business?

Most outsourced accounting firms offer basic reporting, compliance support, and maybe tax prep. That’s not how we operate.

At Bennett Financials, we combine outsourced accounting with strategic finance. That means we don’t just deliver reports—we use your numbers to help you:

- Save on taxes using legal, advanced strategies

- Improve margins by identifying where money is leaking

- Forecast future growth with clean, usable data

- Structure for scale, acquisitions, or high-multiple exits

We don’t treat accounting as a task—we treat it as a lever. And we’re not just accountants. We’re financial partners helping 7- and 8-figure business owners make smarter, more profitable decisions.

If your business is growing but your financial infrastructure hasn’t caught up, we can help.

Schedule a free consultation to learn how we work and whether we’re the right fit.