Introduction

This guide covers the Profit First Target Allocation Percentages Table and how to use it to set your business allocations. It is designed for business owners, entrepreneurs, and CFOs who want to improve their financial health and cash flow management. Understanding Profit First TAPs is crucial for ensuring your business remains profitable, sustainable, and prepared for growth. This chapter gives you a starting point and a system to adjust as you grow.

There’s no perfect percentage. Your allocations should match your stage, your margins, and your current cash flow. In the Profit First system, these are called ‘target allocations’ or ‘Profit First percentages’—the planned percentage distributions of revenue across different accounts, such as profit, owner’s pay, taxes, and operating expenses.

It’s important to align your allocation strategy with your overall business model, ensuring that your financial decisions support your business structure and long-term goals.

Start small. Stay consistent. Let the habit compound. Using a structured financial method like Profit First can provide financial clarity from the start, helping you understand your true profitability and cash flow. Now let’s get to it:

The Most Common Question: “What Percentages Should I Use?”

Once you’ve set up your Profit First bank accounts, the next question is inevitable:

“Okay… but how much do I actually move into each one?”

There’s no one-size-fits-all answer. And that’s good news. Because your allocations should reflect your business stage, your goals, and your current cash flow reality not someone else’s blueprint.

This chapter gives you a clear starting point, but more importantly, it gives you a system to evolve your percentages over time. Before making any changes, you should first assess your current allocation percentages (CAPs) to understand how your revenue is currently distributed across different financial categories.

Many entrepreneurs freeze here, afraid of getting the numbers wrong. But the power of Profit First isn’t in precision it’s in rhythm. You can start small and improve as you go. Progress beats perfection every time. The Profit First system is designed to help you achieve guaranteed profit by prioritizing profit allocations before expenses, ensuring consistent profitability and financial stability.

How Allocation Percentages Work

On each allocation day (typically twice per month), you move a percentage of your current Income Account balance into each of the other accounts. This means you are allocating funds from your revenue account to the appropriate accounts, ensuring your business’s revenue is systematically divided for profit, taxes, owner’s pay, and operating expenses.

Profit First encourages a disciplined approach to managing every expense, which can lead to better financial health.

Example Allocation Table

Account | Percentage | Amount (from $10,000 revenue) |

|---|---|---|

Profit | 5% | $500 (calculated as Real Revenue in Profit First) |

Owner’s Pay | 50% | $5,000 |

Tax | 15% | $1,500 |

OPEX | 30% | Learn how to maximize your business valuation and potentially increase your exit proceeds beyond $3,000 by following our Business Exit Plan 2025: Maximize Valuation & Minimize Tax. |

You would be transferring money from your revenue account to each of these accounts according to the set percentages. Then that’s how your funds get divided on allocation day. Simple.

To maintain discipline, funds should be transferred from the Income account to the other accounts on the 10th and 25th of each month.

This structured approach helps you calculate profit by setting aside profit before paying expenses, supporting better cash flow management and financial health.

Setting Up Bank Accounts for Profit First

Implementing the Profit First system starts with a simple but powerful step: setting up multiple bank accounts, each with a clear, designated purpose. This structure is the backbone of effective cash flow management and ensures you’re always allocating funds where they matter most.

Understanding the Five Profit First Accounts

Each of the five Profit First accounts serves a unique and essential role in your business’s financial ecosystem. Understanding how these accounts work together is key to mastering the Profit First method and achieving true cash flow clarity.

- Income Account: This is the central hub for all incoming revenue. Every dollar your business earns is deposited here first, giving you a clear picture of your real revenue before any allocations are made.

- Profit Account: The profit account is where you allocate a set percentage of your income—your core profit—before paying any other expenses. Keeping this account separate ensures you’re prioritizing profit and building a buffer for growth, emergencies, or taking profit distributions.

- Owner’s Pay Account: This account is dedicated to your owner’s compensation. By treating your pay as a regular, predictable business expense, you reinforce healthy personal finance strategies and avoid the common trap of underpaying yourself.

- Tax Account: The tax account is your safeguard against tax season surprises. Allocating funds here with every deposit means you’re always prepared to pay taxes on time, reducing stress and avoiding penalties.

- Operating Expenses (OpEx) Account: All business expenses are paid from this account. By restricting spending to what’s available in your opex account, you enforce financial discipline and make smarter financial decisions. This separation helps you spot high overhead costs early and adjust your spending habits to protect your profit margins.

Using these five separate accounts transforms the way you manage business finances. It forces you to allocate revenue intentionally, prioritize profit, and maintain control over business expenses. The result? More money in the right places, less financial guesswork, and a business that’s built to last.

Profit First Target Allocation Percentages (TAPS)

What Are TAPs?

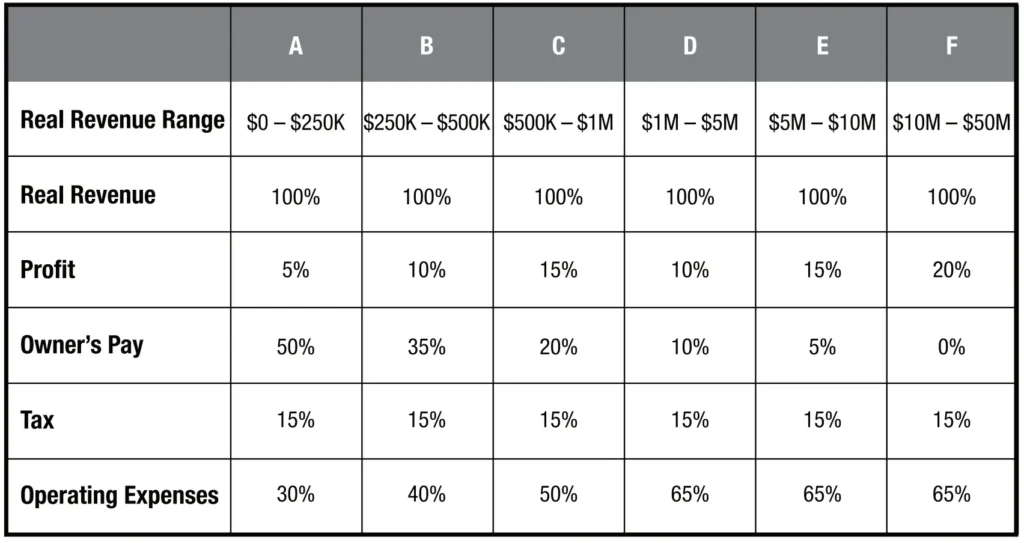

Target Allocation Percentages (TAPs) are the recommended guidelines for how much revenue to allocate to each Profit First account. TAPs define what percentage of revenue you’ll transfer to each of your Profit First accounts. TAPs are based on real revenue, which is the total amount of money your business generates annually minus the cost of materials and subcontractors.

This TAPS table lists the target allocation percentages by revenue range, and can be found in the original book, Profit First by Mike Michalowicz:

Target Allocation Percentages (TAPs) define what percentage of your business’s real revenue you’ll transfer to each of your Profit First accounts. Real revenue is your total revenue minus the cost of materials and subcontractors, ensuring your allocations are based on the true cash available to your business.

Profit First percentages and target allocations are used to customize your financial strategy, helping you set, adjust, and gradually transition to the optimal distribution for your business’s profitability and cash flow management.

Recommended TAPs for Service-Based Businesses

Recommended TAPs for many service-based businesses are:

- Profit: 5% to 10%

- Owner’s Pay: 30% to 50%

- Taxes: 15% to 25%

- Operating Expenses (OpEx): 30% to 65% (the remainder after other allocations)

These target allocations provide a framework for improving profitability and managing cash flow effectively as your business grows.

Account | Recommended Percentage Range |

|---|---|

Profit | 5% – 10% |

Owner’s Pay | 30% – 50% |

Taxes | 15% – 25% |

30% – 65% |

We’ve further tailored this for our target clientele below, and added notes relevant to service-based businesses in the $1-$20M range.

How to Use the TAPS Table

Use the TAPS table as a starting point to set your initial allocation percentages. Review your current financials, compare them to the recommended ranges, and adjust as needed based on your business’s unique needs and cash flow.

Adjusting Your TAPs Over Time

As your business grows and your financial situation changes, revisit your TAPs quarterly. Gradually shift your allocations toward the recommended targets to improve profitability and cash flow management.

Allocation Benchmarks by Business Stage

We’ve broken this into three stages based on what we’ve seen work across hundreds of service-based businesses. These are starting points, not hard rules.

For operating expenses (OPEX), expense control is critical—only spend money from your operating expenses account to maintain discipline and prevent cost overruns. You should only pay business expenses from the operating expenses account to avoid overspending and ensure profitability.

When it comes to owner’s pay, treat owner’s pay as a genuine business expense and use a dedicated owner’s pay account for owner’s compensation. This separation helps ensure consistent owner compensation and supports sound financial management.

If you’re not sure which stage you’re in, default to the one where cash flow currently feels tightest. Start conservatively, and adjust quarterly.

Stage 1: Survival Mode ($0 – $500K Revenue)

Suggested Allocations

Account | Suggested Percentage |

|---|---|

1–2% | |

Owner’s Pay | 30–50% |

Tax | 10–15% |

Opportunity Account | 3% |

OPEX (Remainder) | Remainder |

The goal here is stability. You’re likely still underpaying yourself, unsure about taxes, and trying to get out of debt or inconsistency. To ensure consistent compensation, set up your own account specifically for Owner’s Pay, so you can pay yourself regularly and maintain clear boundaries between business and personal finances. The Profit First method requires setting up five separate accounts: Income, Profit, Owner’s Compensation, Taxes, and Operating Expenses. Using separate bank accounts and designated accounts for each allocation is essential for financial organization, discipline, and clarity.

Start with tiny Profit allocations. Build the habit, then increase.

You might feel selfish prioritizing your own pay, especially if team members or vendors are depending on you. But when the business owner isn’t stable, the business isn’t either.

Stage 2: Growth Mode ($500K – $2M Revenue)

Suggested Allocations

Account | Suggested Percentage (See our Best Fractional CFO Services 2026: Comparison, Pricing & Growth Strategy for guidance on choosing top strategic financial partners.) |

|---|---|

Profit | 5–10% |

Owner’s Pay | 25–35% |

Tax | 15% |

Opportunity Account | 5% |

For a detailed overview of financial due diligence requirements—including how OPEX (Remainder) factors into lender evaluations—see our Financial Due Diligence Checklist for Loan Applications (2025). | Remainder |

You’ve moved past survival. The business is growing but your systems might not have caught up. The focus now is sustainability and cash discipline.

To maintain clarity and control, allocate funds to different accounts—such as Profit, Owner’s Pay, Tax, and Opportunity—on a regular schedule, like bi-weekly or monthly. Using the appropriate account for each type of expense or allocation ensures that cash flow is managed systematically and each financial goal is properly funded.

This is where you start getting more aggressive with margin. The Opportunity Account also becomes more useful for hiring, marketing, or weathering slower months.

Review these allocations quarterly. Each 90-day window should show progress even if it’s small.

Stage 3: Scaling Mode ($2M – $5M+ Revenue)

Suggested Goal Allocations

Account | Suggested Percentage |

|---|---|

Profit | 10–15% |

Owner’s Pay | 15–20% |

15–20% | |

5–10% | |

OPEX (Remainder) | Remainder |

Your focus is now on margin, team leverage, and operational efficiency. You’re likely building a leadership team, scaling delivery, and preparing for major moves.

This is where Profit First becomes a strategic finance engine, not just a survival tool. Every allocation supports a larger vision growth, acquisition, or reinvestment.

At this level, most of your decisions are about team, risk, and opportunity cost. Having structured, pre-allocated capital removes guesswork and emotional friction. Using business checking accounts and multiple accounts for each allocation makes it easier to manage and track funds for specific purposes. Online banking platforms, especially those that allow you to open multiple checking and savings accounts without fees, streamline cash flow management and enable seamless transfers between accounts. The best banks for implementing Profit First should offer the flexibility to create numerous accounts and move funds easily; many traditional banks limit the number of accounts or charge fees, making it harder to save for specific needs and categories. Opening dedicated savings accounts for long-term reserves or surplus funds further supports disciplined cash management and profitability.

Tax Payments and Accounting

Tax Accounts

Tax payments are one of the most critical—and often stressful—aspects of business financial management. The Profit First method takes the anxiety out of tax season by making tax planning a routine part of your cash flow process.

By maintaining a dedicated tax account, you ensure that a portion of every deposit from your income account is set aside specifically for tax obligations. Using your target allocation percentages, you’ll transfer funds into the tax account regularly, so you’re always prepared for federal, state, and self-employment taxes.

Tax Obligations

Staying on top of your tax obligations means understanding your business’s tax brackets, allowable deductions, and the timing of required payments. Most business owners need to pay estimated taxes quarterly, so having funds ready in your tax account eliminates last-minute scrambles and cash flow crunches.

Accounting for Taxes

Good financial management means regularly reviewing your tax account to confirm you have enough set aside for upcoming payments. It also involves tracking deductible business expenses to minimize your tax liability and maximize your profit allocation. By keeping your tax account separate and sacred, you avoid the temptation to dip into these funds for other expenses, ensuring your business remains compliant and financially healthy.

Prioritizing tax payments through the Profit First method not only protects your cash flow but also gives you peace of mind. With a clear system for allocating revenue and meeting tax obligations, you can focus on growing your business—knowing you’re always prepared when tax time rolls around.

Profit First Troubleshooter

OPEX Account Running Short

Problem: “My OPEX account is always running short.”

Solution:

- Your business might be over-leveraged. Review recurring expenses.

- Temporarily reduce Profit/Opportunity allocations and rebuild them gradually.

- Are you allocating based on the cash that has actually landed in your Income account or on the invoices you’ve sent out? Only allocate based on collected revenue. Invoiced money isn’t real until it clears.

- Effective money management and implementing profit allocations with discipline are key to ensuring your OPEX account remains healthy and sustainable.

Allocating to Profit When Cash is Tight

Problem: “I’m scared to start allocating to Profit when cash is tight.”

Solution:

- Start with 1%. Build the habit before the volume.

- Remember: Profit is a muscle. If you don’t train it now, it won’t be there when you need it.

- Even allocating $10 builds discipline and identity as a profitable operator.

- The Profit First method encourages a disciplined approach to managing every expense, leading to better financial health.

Unpredictable Taxes

Problem: “My taxes still feel unpredictable.”

Solution:

- Ensure you’re allocating 10–20% of all collected revenue not just profit.

- Don’t use the Tax account for emergencies. It’s sacred.

- Speak with a tax advisor quarterly and adjust if needed.

- When setting up multiple accounts for tax allocations, be aware of potential bank fees and monthly fees. Look for banks or fintech platforms that minimize these costs to optimize your cash flow.

Note: The Profit First method may not be suitable for startups that focus on rapid growth without immediate profitability.

Preview: Strategic Finance Layer

Once you’ve stabilized your allocations, the next level is turning this into an insight system. In later chapters, we’ll show you how to:

- Pair Profit First with forecasting and cash flow dashboards. Putting profit first and maintaining expense control are key to achieving financial clarity, as they ensure profitability is prioritized and operating costs are managed efficiently.

- Review allocations alongside KPIs (Cost per Lead, CAC, payroll efficiency)

- Use the Opportunity Account to fund strategic growth instead of dipping into OPEX or taking loans

The Profit First method can also lead to improved cash flow clarity by separating money into distinct accounts for specific purposes, making it easier to understand your true profitability and make informed financial decisions.

Your First Step

Pick your stage. Set your percentages. Use small, simple numbers.

If all you do this week is set 1% to Profit, 1% to Tax, and 1% to Owner’s Pay you’ve started. You’re now leading with intention. For small business owners, using different bank accounts to allocate funds for profit, taxes, owner’s compensation, and operational expenses can make managing cash flow much easier and reinforce financial discipline. The Profit First method is especially helpful for small business owners and solopreneurs who lack formal financial controls, providing a simple structure to ensure consistent profit and owner compensation. For tailored advice and optimal results, consider working with a certified Profit First professional who can help you implement the system effectively for your unique business needs.

Ready to set up Profit First the right way?

We’ll walk you through the accounts, get your allocations dialed in, and make sure your cash flow stays predictable from day one. Banking solutions like Relay, North One, and Brex make implementing the Profit First method even easier. Relay allows small business owners to open 20 no-fee business checking accounts, North One enables entrepreneurs to open envelopes for Income, Owners Compensation, Operating Expenses, Profit, and Tax accounts, and Brex allows up to 240 accounts for a single business entity—perfect for setting up designated accounts for each allocation. Relay’s platform also supports percentage-based transfers, so transferring money and allocating all the money to the right designated accounts is seamless. Talk to a Profit First Professional to get started.

This was a chapter from the upcoming ebook Profit First, Unofficial: A CFO’s Playbook for Owners. In the next chapter, learn about Profit First and the changes needed to apply it to S Corps.

The previous chapter covered How to Set Up Your Profit First Bank Accounts Without Screwing It Up.