If you’re a business owner making over $1M, you’ve probably outgrown your bookkeeper. You may even feel like your CPA is just keeping you compliant, not actually helping you grow. That nagging feeling? You’re not wrong.

You don’t need another spreadsheet audit or “tax tips” pulled off a checklist. You need someone who understands how money moves through your business, and how to restructure it to keep more of it. That’s where the right kind of financial help matters.

So let’s clear this up: what exactly is accounting consulting, what do accounting consultants really do, and where do they fall short when you’re trying to build a lean, cash-rich, scalable business?

What is Accounting Consulting?

Accounting consulting is supposed to provide guidance on how to better manage your financial systems. Think internal controls, budgeting, cleanup projects, and setting up repeatable processes.

It’s often project-based. A consultant might be brought in to:

- Clean up your chart of accounts

- Help transition to new accounting software

- Build custom reports for management

- Advise on GAAP compliance or audit readiness

If your books are a mess, or your in-house team is green, a good consultant can be a lifeline. They’ll build systems that help you see where the money’s going.

But here’s the problem: none of that fixes cashflow. It organizes your history. It doesn’t build your future.

What Accounting Consultants Really Do

Most accounting consultants operate like advanced controllers. Their job is to keep things accurate and organized. Some will help you “analyze” your financials, but it usually stops at surface-level commentary:

- “Your margins are lower this quarter.”

- “You’re spending a lot on contractors.”

- “Here’s a dashboard.”

What they don’t do is help you understand which drivers to change or what financial strategies to use to impact profit, cash reserves, or valuation.

And that’s where the disconnect starts.

If you’re trying to double cash flow, grow your valuation, or prepare for an exit, most accounting consultants aren’t equipped for that level of work.

They’ll keep the engine clean. But they won’t help you go faster.

What Skills and Experience Do Accounting Consultants Have?

Accounting consultants usually come from controller or CPA backgrounds. They’re technically strong. They understand:

- GAAP

- Financial statement preparation

- Accounting software setups

- Internal controls and audit support

Some are former auditors. Some have deep experience with SaaS metrics or manufacturing cost accounting.

Here’s the catch: very few are trained in strategic decision-making.

They weren’t taught how to:

- Forecast and model aggressive growth

- Reposition cash flow to unlock reinvestment

- Layer tax strategies with entity structuring

- Optimize for exit multiples or EBITDA arbitrage

If you ask them how to go from $2M to $10M without blowing up your margins, they’ll probably give you a budget template. Not a plan.

How Are Accounting Consultants Different Than a CPA or Regular Accountant?

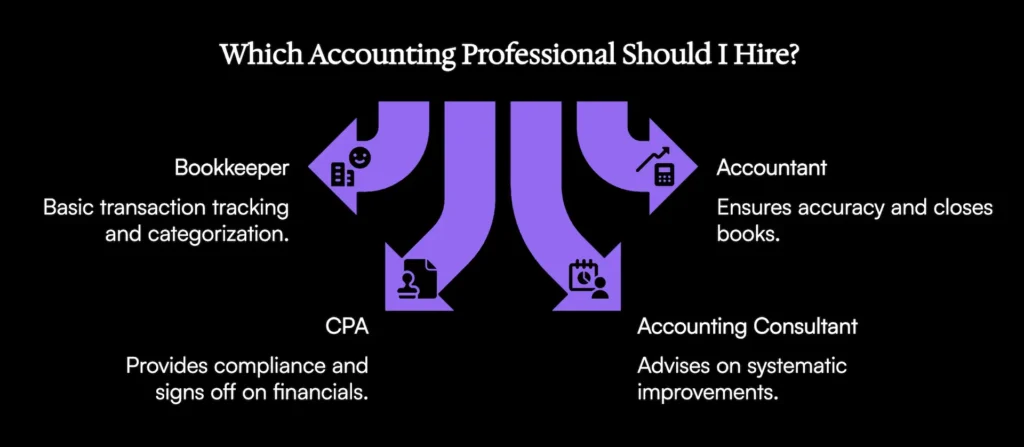

Let’s break it down:

- Bookkeepers track and categorize transactions.

- Accountants make sure the numbers are accurate and close out the books.

- CPAs sign off on tax filings and financials for compliance.

- Accounting consultants advise on how to improve your accounting systems.

But none of them are trained to help you build wealth inside your business. That’s not their fault. It’s just not what they do.

Most CPAs are glorified tax preparers. They focus on filing forms correctly and avoiding red flags. If you’re lucky, they’ll remind you to max out your 401(k).

Most accounting consultants stay in the world of operations and process improvement. They’re the ones who’ll help you implement NetSuite. Helpful? Sure. Strategic? Not even close.

What’s the Difference Between an Accounting Consultant and a Fractional CFO?

This one’s simple: consultants fix systems. CFOs build strategy.

A consultant might help you:

- Organize your reporting

- Build accounting workflows

- Support your controller or accounting team

But a CFO or Fractional CFO goes beyond that. They’re focused on:

- Forecasting future growth

- Restructuring operations to improve cash flow

- Designing tax strategies that support reinvestment

- Preparing your company for a sale, capital raise, or ownership transition

CFOs think like owners. Consultants think like technicians. The team at Bennett handles both.

What Actually Moves the Needle: Forecasting, Cash Control, and Valuation Strategy

If you want to grow your business, sell your business, or extract cash without getting killed on taxes, you need a different lens.

You need:

- Cash Flow Forecasting: Not just budgeting. Strategic modeling that shows how decisions today hit your P&L and bank balance six months from now.

- Revenue per Employee: One of the most underutilized metrics. Tells you instantly if you’re scaling profitably.

- Profit Engineering: Where are you leaking margin? What happens if you raise prices by 15% and drop bottom-funnel ad spend?

- Tax Strategy That Fuels Growth: Timing. Entity structure. Accelerated deductions. You can’t reinvest cash you’ve already sent to the IRS.

- Exit Planning: Even if you’re not selling yet, knowing what increases your multiple (and what destroys it) should guide how you run today.

That’s not accounting consulting. That’s strategic finance. And that’s what actually moves the needle.

Where Accounting Consultants Still Play a Role

This isn’t a hit piece. There are plenty of places where a sharp accounting consultant can add serious value:

- Cleanups: If your books are wrecked from years of bad categorization, you need someone who can sort through the mess and rebuild.

- System Transitions: Moving from QuickBooks to NetSuite or Xero to Sage Intacct? A consultant who’s done it before is worth their weight in gold.

- Process Documentation: SOPs, accounting playbooks, month-end close checklists—all great for companies trying to scale cleanly.

- Controller Oversight: If you’ve got a bookkeeper and a tax pro but no one managing them, a fractional controller-level consultant can close that gap.

But again—none of this is strategy. It’s operational support. Necessary? Sometimes. But not sufficient if your goal is to scale.

What to Actually Look For in a Financial Partner

Here’s a simple framework:

- Bookkeeper: You need one. They handle the transactions.

- Tax Preparer: You need one. But don’t expect them to be strategic.

- Controller or Consultant: If you need better systems or reporting.

- CFO or Strategic Advisor: If you want to grow, exit, or legally reduce taxes.

The right financial partner will:

- Ask questions about your goals, not just your QuickBooks access.

- Understand how your P&L connects to cash and valuation.

- Map out strategies that affect next year, not just last year.

- Integrate tax planning with business planning.

You don’t need a 40-hour/week full-time CFO. But you do need someone who thinks like one.

Final Word: The Real Cost of Staying Reactive

If your tax plan is built in March, it’s already too late.

If your financial strategy is “let’s hope next quarter is better,” you’re gambling—not leading.

Accounting consultants have their place. But if you want to scale, you need more than clean books and generic advice.

You need:

- A system to control cash flow

- A tax strategy that creates room to grow

- A plan that leads to a profitable exit or long-term scalability

Anything less is just maintenance.Want to stay ahead of tax bills, cash flow surprises, and scaling traps before they hit? Start building a real financial strategy. Contact our business finance experts for a consultation.