Working capital defined simply is your current assets minus current liabilities. That’s your available cash to cover short-term obligations. If the number’s positive, you’ve got room to operate. If it’s negative, you’re playing defense, scrambling to pay bills, hoping receivables land in time.

If you’re running a service business in the $2M–$20M range, you don’t have inventory to sell off when cash gets tight. Your capital is tied up in receivables, payroll, and software. And when those pieces aren’t moving in sync, you feel it.

Why Working Capital Matters

If you’re not watching working capital, it’ll hit you where it hurts – missed payroll, angry vendors, stalled growth.

This isn’t just about keeping the lights on. Working capital is what gives you room to move. It lets you make decisions without flinching. Pay people on time. Take on new projects without gambling on cash flow.

When it’s managed well, it becomes leverage. You can negotiate better terms, jump on opportunities, and stop leaning on high-interest credit just to float the business.

And you get to make decisions from a place of control, not panic.

Why Working Capital Is Different for Service Businesses

If you run a service company, your working capital playbook isn’t the same as a product business. You’re not sitting on inventory. That changes everything.

Your money isn’t tied up in goods, it’s tied up in timing. What really matters is how fast cash moves in and out. That means Accounts Receivable and Accounts Payable are everything.

The faster you collect from clients, the stronger your cash position. The smarter you manage what goes out to vendors, the more control you keep. It’s what keeps the business liquid, stable, and ready to grow.

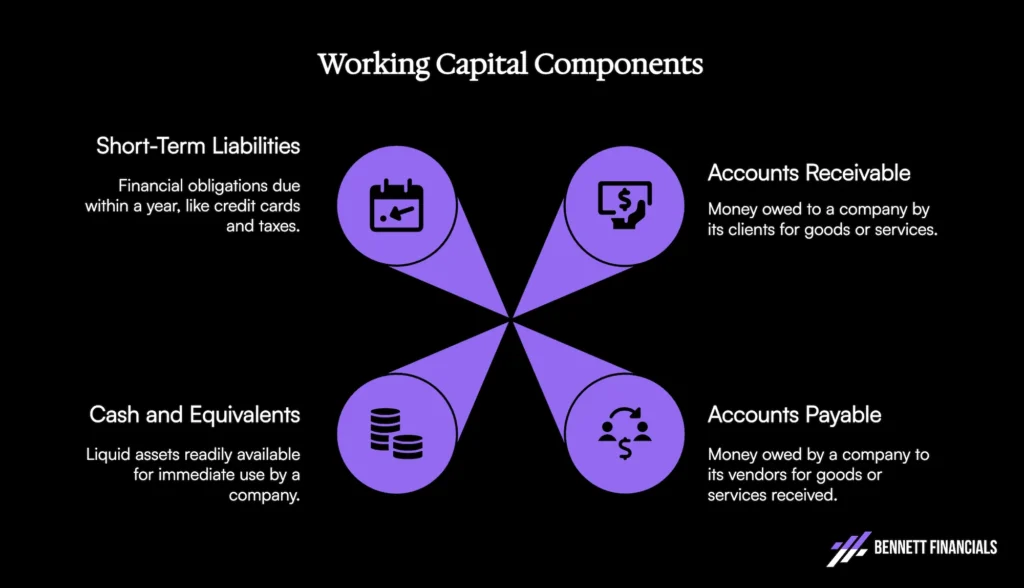

The 4 Main Components of Working Capital

- Accounts Receivable (clients owe you)

- Accounts Payable (you owe vendors)

- Cash and Equivalents (what’s available now)

- Short-Term Liabilities (credit cards, taxes, accrued expenses)

The working capital formula is easy to memorize. But the hard part – and where strategy comes in – is managing the timing and flow between these parts.

What Are the 8 Types of Working Capital?

You’ll hear terms like permanent, temporary, variable – it’s easy to get lost in the jargon. Here’s what actually matters:

- Permanent working capital is your baseline. The cash you always need on hand to keep operations steady.

- Temporary working capital is the extra float you need during busy seasons or growth spikes.

- Gross working capital looks only at your current assets.

- Net working capital subtracts current liabilities—this is the real number to track.

- Reserve working capital is your emergency stash.

- Special working capital is earmarked for one-off projects or short-term plays.

Ignore the labels. Know your floor. Build your buffer. And stop guessing what you need to stay liquid.

Avoiding Common Working Capital Mistakes

Most of the damage in working capital doesn’t come from complex problems—it comes from avoidable ones.

Too many businesses ignore working capital until it’s already a fire. They don’t track net working capital. They guess at cash flow instead of forecasting. They forget that a baseline level of working capital isn’t optional.

Letting liabilities pile up while assets lag behind is a recipe for supplier issues, missed payroll, and mounting pressure. And using short-term loans to fund long-term needs is not a strategy, it’s a slow bleed through interest and debt you can’t outrun.

| Common Challenge | Description for Service Businesses ($2M-$20M) | Strategic Solutions |

| Inconsistent Revenue & Late Payments | Project-based work, seasonal fluctuations, and client payment delays create unpredictable cash inflows, hindering budgeting and operations. | Diversify revenue streams, establish clear payment terms, offer early payment incentives, automate invoicing & reminders |

| High Fixed Overhead | Significant fixed costs (payroll, rent, software) must be paid regardless of revenue, quickly draining cash reserves. | Regularly review expenses, renegotiate vendor contracts, embrace technology for efficiency |

| Lack of Financial Planning & Forecasting | Poor understanding or neglect of cash flow leads to unexpected shortages, hindering informed decision-making and growth. | Develop comprehensive financial plans, implement robust cash flow forecasting and scenario planning, build cash reserves. |

| “Goldilocks Paradox” in Financial Tools | Too large for basic spreadsheets, too small for complex enterprise software, leading to inefficient manual processes. | Invest in “right-fit” financial management software for AR, AP, and cash flow automation. |

| Limited Access to Traditional Capital | Banks hesitate to lend due to shorter track records and unpredictable growth patterns common in this segment. | Explore diverse alternative financing options (e.g., lines of credit, invoice factoring). |

| Lack of Internal Financial Expertise | Business owners often juggle multiple roles, lacking specialized financial oversight for strategic decisions. | Engage fractional CFO services for high-level financial strategy, forecasting, and operational optimization. |

The Working Capital Reality for Mid-Market Service Companies

As a business scales from $2M to $20M and beyond, new financial pressure points emerge. You’ve outgrown startup scrappiness—but full enterprise systems don’t make sense yet. You’re in that middle ground where working capital issues become more subtle—and more dangerous.

Here are the most common pain points we see:

Inconsistent Revenue & Late Payments

Service businesses tend to deal with project-based revenue. You close a big deal, get a spike in cash, then go quiet for a month. Meanwhile, clients take 30, 45, or 60 days to pay. You’re delivering work fast but getting paid slow. That mismatch crushes cash flow and puts pressure on lines of credit.

High Fixed Overhead

Payroll, rent, and software are costs that don’t go away when revenue dips. And because your team is made up of professionals, not hourly labor, you can’t scale it up and down easily. You’re locked in. That means working capital has to cover not just fluctuations—but entire dry spells.

Forecasting Is Too Basic, or Doesn’t Exist

Many founders think cash flow management means checking the bank balance. Others rely on static spreadsheets that don’t update with real-time receivables. Without a dynamic forecast, you’re reacting instead of planning. That’s how you end up blindsided by tax bills or scrambling to make payroll.

The Goldilocks Problem: Your Tools Don’t Fit

QuickBooks gets clunky. But NetSuite is overkill. You’re stuck between DIY spreadsheets and bloated ERPs. And it shows up in your numbers – delayed reporting, inconsistent entries, and a team that’s still chasing invoices manually.

Capital Access Isn’t Easy

Banks want predictable revenue. You’re running a business with lumpy revenue, changing margins, and ambitious growth goals. That makes traditional financing slow or downright impossible. You need to think creatively and move faster than your local banker will let you.

These aren’t isolated issues. They stack. And if you’re not addressing working capital strategically, they become the reason growth stalls out.

Core Strategies for Optimizing Working Capital

Accelerating Accounts Receivable

Start with your terms. Are they too loose? A client paying in 60 days means you’re financing their operations. Tighten your standard terms to 15 or 30 days, and be consistent. Then, build systems around it:

- Send invoices immediately, not in batches.

- Automate reminders after 7, 14, and 30 days.

- Offer small discounts for early payment if margin allows.

- Use ACH or credit card tools to eliminate “check is in the mail” delays.

The goal is simple: shorten Days Sales Outstanding (DSO) and get cash in the door faster.

Enhancing Accounts Payable

Don’t just pay every bill as it comes in. Instead, treat AP like a cash flow lever. If a vendor offers net 30 and you’re paying on day 7, you’re shrinking your cash cushion for no reason. Stretch AP where you can without hurting vendor relationships.

Here’s how:

- Centralize invoice intake and approvals.

- Batch payments to run twice a month.

- Take early pay discounts if they’re worth more than the float.

- Automate payment schedules and integrate with your GL.

Cash Flow Forecasting

Forecasting is where strategy lives. You don’t need 5 decimal precision—you need visibility.

Set up a 13-week rolling forecast that includes:

- Expected revenue and receivables

- Payroll and vendor payments

- One-off large expenses (taxes, legal, insurance)

Run three models: conservative, expected, and optimistic. That’s how you make confident hiring, investment, and distribution decisions.

Avoiding Common Mistakes

- Using short-term capital to fund long-term growth

- Letting receivables age without consequence

- Relying on a credit card to smooth cash instead of fixing the system

- Confusing revenue growth with liquidity

- Over-investing in team or tech before the cash is ready

Fixing these isn’t just about avoiding disaster, it’s about staying in control.

Working Capital Funding Strategies

Even with smart receivables and payables management, cash gaps happen. The timing rarely works out perfectly—clients pay late, expenses pile up, and your pipeline isn’t as predictable as you’d like. That’s where short-term funding strategies come into play.

But this isn’t about grabbing the first loan you qualify for. The funding source has to match the need. Use the wrong tool, and you could dig a hole deeper than the cash shortfall you’re trying to patch.

Here are five working capital funding strategies accessible for small businesses:

1. Working Capital Loans

A working capital loan is a short-term financing product used to cover everyday operating expenses. It’s not meant for big capital investments or long-term hiring—this is your “bridge the gap” money. The key is speed and clarity. If you know the gap is temporary, and the payback window is realistic, this can work well.

- Typical loan size: $50K–$250K

- Term: 6 to 18 months

- Speed: Sometimes funded within 3–5 business days

- Cost: Higher interest than term loans, but faster access

Use this if you’ve got upcoming receivables that are delayed and want to avoid interrupting operations.

2. Business Lines of Credit

Think of this as a revolving safety net. It’s flexible, reusable, and only costs you interest when you draw from it. Great for managing short-term fluctuations—especially during seasonal cycles, delayed receivables, or to cover payroll between billing cycles.

- Only pay interest on what you use

- Ideal for recurring cash flow hiccups

- Requires some financial discipline—don’t use it like a credit card

If your receivables are strong but irregular, this may be the best tool in your kit.

3. Invoice Factoring / Accounts Receivable Financing

In this setup, you sell your outstanding invoices to a third party at a discount to get immediate cash. The factor then collects from your clients. It’s fast, but it can cost you 3–5% or more of the invoice value. Not cheap, but sometimes necessary.

- Pros: No new debt on your books

- Cons: Can affect client experience and perception if factoring firm is aggressive

Best used sparingly,and only with clients who consistently delay payment.

4. Merchant Cash Advances

A lump sum advance repaid via a percentage of daily sales. Sounds simple. But costs can run 50–100% APR when all fees are considered.

- Pro: Fast access

- Con: Potentially predatory cost structure

If you’re considering this, it’s a sign you need to rework your AR and forecasting—not double down on high-cost financing.

5. Alternative & Online Lenders

Online lenders like Fundbox, BlueVine, and Kabbage can underwrite fast based on revenue and receivables data from tools like QuickBooks or your business bank account. They’re more flexible than banks but more expensive.

Use these if timing is critical, and the cost of delay is higher than the financing cost.

When to Use Funding and When Not To

Use funding to:

- Bridge timing gaps (delayed AR, one-off large expense)

- Fund predictable, short-term opportunities (e.g. short-staffed during a big project)

- Build cushion when your reserve is thin but pipeline is strong

Avoid funding when:

- You’re plugging persistent holes without fixing the process

- You’re over-leveraging to support long-term investments

- You can’t clearly model payback within your cash flow forecast

The funding should support the business—not become a crutch for broken systems.

Core Strategies for Optimizing Working Capital in Service Businesses

You don’t fix working capital with theory. You fix it by tightening the way cash moves through your business, how fast it comes in, how slowly it goes out, and how clearly you see it before you need it.

Let’s break that into three areas that matter.

A. Speeding Up Accounts Receivable (AR)

You can’t afford to wait 45–60 days to get paid. That’s not revenue—it’s a liability sitting on your books.

Here’s how to speed it up:

- Set clear payment terms upfront. No more loose handshake deals or vague expectations.

- Run credit checks on new clients. If they have a history of paying late, don’t let them become your problem.

- Send invoices immediately after service. Don’t batch. Don’t wait until the 15th.

- Offer multiple payment methods—ACH, credit card, whatever gets cash in the door faster.

- Use automated reminders. You shouldn’t be chasing money manually.

- Offer small early pay discounts—but only if margins make it worth it.

And automate what you can. AR automation isn’t just a convenience—it’s a margin tool. With AI handling matching, reminders, and deductions, your team stays focused on work that actually drives cash.

B. Getting Smart With Accounts Payable (AP)

On the flip side, don’t pay faster than you have to.

AP isn’t about avoiding late fees, it’s a cash management tool. Here’s how to use it:

- Centralize how invoices are received, reviewed, and paid. No more invoices lost in inboxes.

- Push for Net 30 or better. And don’t just accept vendor terms – negotiate.

- Pay on time, not early—unless there’s a real discount on the table.

- Track due dates and use reminders to avoid late fees without sacrificing flexibility.

- Automate the whole process from data entry and approvals to payments.

And manage vendor relationships like a CFO, not a buyer. Know your top 10 suppliers. Renegotiate where you can. Track your spend and protect against fraud by locking down who can change vendor info.

C. Mastering Cash Flow Forecasting

Forecasting isn’t about being perfect. It’s about being ready.

Build a 13-week rolling cash forecast. Review it weekly. Update it with actuals. Then build 12-month models to stress test your business. What happens if you lose a major client? What if you grow 30% next quarter?

Use that clarity to:

- Build cash reserves—3 to 6 months of ops if possible.

- Identify when to pull back vs when to invest.

- Plan hiring and expansion without guessing.

Shift your revenue model where you can. Retainers beat one-offs. Subscription billing creates predictability. The more control you have over inflows, the less dependent you are on payment timing.

And cut costs with purpose. Review expenses by department. Drop dead tools. Trim bloated software stacks. But never at the cost of performance or delivery.

Financial Tools That Actually Work

Financial software is either a bottleneck or a breakthrough—there’s no in between. At $2M–$20M in revenue, your team is too lean to waste hours reconciling reports manually. But bloated ERP systems are overkill. The goal is a right-fit tech stack: lean, connected, and easy to act on.

Accounts Receivable Automation

If you’re still sending invoices manually or chasing payments by email, you’re wasting time and leaking cash. Tools like QuickBooks Advanced let you:

- Automate invoice generation and delivery

- Trigger follow-ups and reminders automatically

- Offer multiple payment methods (ACH, card, wire)

- Track DSO in real time

The faster you bill and follow up, the faster you collect. These platforms can shave 10–20 days off your receivables cycle with zero additional headcount.

Accounts Payable Systems

Platforms like Ramp, Bill.com, and Tipalti streamline the entire AP process:

- Digitize incoming invoices

- Set approval rules and automate routing

- Batch and schedule vendor payments

- Sync directly with your accounting system

More than convenience, AP automation reduces errors, prevents duplicate payments, and improves vendor relationships by making sure payments are predictable and clean.

Cash Flow Forecasting Tools

Static spreadsheets don’t scale. Tools like Tesorio, Jirav, and Fathom pull live data from your GL, AR, and AP systems and generate rolling forecasts.

What you get:

- 13-week forecasts that update automatically

- Scenario planning (growth, downturn, expansion)

- Dashboards that show you runway, reserve, and risk areas

These tools give you confidence to move faster with fewer surprises.

What to Avoid

- Trying to duct-tape five disconnected tools together

- Overbuying tech you won’t fully implement

- Delegating tool setup to a bookkeeper instead of a strategic finance lead

The software doesn’t make the decisions – you do. But it should give you clean, fast, clear data so you can move.

Metrics That Matter

If you’re not tracking these, you’re flying blind. Working capital metrics aren’t just reporting tools—they’re decision-making tools. You need them to know where you stand today, how much room you’ve got, and where the next bottleneck is likely to show up.

Here are the ones that matter most:

Current Ratio

- Formula: Current Assets ÷ Current Liabilities

- Target: >1.2 for service firms

- Use: Shows if you can meet your short-term obligations

Too low and you’re tight on cash. Too high and you might be sitting on idle assets. The sweet spot is enough cushion without hoarding liquidity.

Quick Ratio (Acid-Test)

- Formula: (Current Assets – Inventory) ÷ Current Liabilities

- Why it matters: Most service businesses don’t carry inventory, so this gives a cleaner read on your real-time ability to cover bills with cash and receivables.

Days Sales Outstanding (DSO)

- Formula: (Accounts Receivable ÷ Total Credit Sales) x Number of Days

- Target: Under 45 days

- Use: The lower your DSO, the faster you turn contracts into cash

A rising DSO is a red flag—it means your cash is sitting in someone else’s bank account. Fix that, fast.

Days Payables Outstanding (DPO)

- Formula: (Accounts Payable ÷ Cost of Goods Sold) x Number of Days

- Target: 30–60 days, depending on vendor terms

Stretching DPO too far can damage relationships. Paying too fast means you’re bleeding out working capital. Know your terms and manage the float.

Cash Conversion Cycle (CCC)

- Formula: DSO – DPO (ignore inventory in services)

- Target: As low as possible

This tells you how many days it takes to turn services rendered into available cash. For service businesses, inventory isn’t a factor—so this becomes a pure AR vs. AP play.

Working Capital Turnover

- Formula: Net Sales ÷ Average Working Capital

- Target: Higher = better

This shows how efficiently you’re using working capital to generate revenue. A low number means your cash is tied up. A high one means you’re turning money over quickly and efficiently.

Bonus: Operating Cash Flow Ratio

- Formula: Operating Cash Flow ÷ Current Liabilities

Target: >1

This shows whether your day-to-day operations are generating enough cash to cover your short-term debts. If not, you’re eating into reserves—or worse, borrowing to stay afloat.

Track these monthly. Watch the trends. And use them to ask better questions, not just report what already happened.

Strategic Financial Help: Why Bookkeepers Aren’t Enough

Most $2-$20M small businesses have someone doing the books. Few have someone steering the strategy.

Bookkeepers track expenses. Accountants file taxes. But neither is building a forward-looking financial model. That’s where strategic financial leadership starts making a difference.

A high-level advisor like a fractional CFO embedded part-time in your business can:

- Build and owns your cash flow forecasting model

- Translate financial data into operational decisions

- Stress-test your pricing, margins, and team structure

- Help evaluate financing options with eyes on ROI

When Strategic Finance Changes the Game

Take one of our clients, Eden Data, a high-growth cybersecurity company based in Texas. Revenue was scaling, but cash wasn’t keeping up. Once they brought in a strategic finance partner, they:

- Built a rolling 13-week cash forecast

- Shifted their service pricing model to reflect team capacity

- Aligned hiring to collections, not booked revenue

Within 90 days, cash in the bank doubled. Within six months, they were turning down low-margin work that once felt essential—because they could see the impact.

How to Know If You Need One

Ask yourself:

- Do I have confidence in my forecast for the next 3 months?

- Can I model out a new hire or big contract without guesswork?

- Do I know how long I could go without new revenue before cutting expenses?

If the answer is no—you don’t need more bookkeeping. You need strategic finance.

What They Bring That You’re Missing

- Monthly financial dashboards with KPIs that drive action

- Real-time AR tracking and collection strategies

- Strategic cost reduction, not just line-item cuts

- Scenario modeling for expansion, acquisition, or downturns

They don’t just plug leaks—they build the map. And that’s what makes the difference between white-knuckling your way through growth or scaling with clarity.

How You Handle Cash Determines How Far You Scale

Working capital isn’t a static metric – it’s how your business actually runs. How fast you get paid. How slow you pay out. How prepared you are for what’s next.

Most service businesses get tripped up here. They scale too fast without understanding what their working capital needs actually are. Or they wait too long to build a cushion, then scramble when a late payment or slow quarter hits. Don’t be one of them.

Start by getting visibility. Know your cash position – not just your bank balance, but your real-time inflows, outflows, and gaps. Then fix the bottlenecks. Speed up collections. Delay payables strategically. Use forecasting to stay ahead of the dips. If you need capital, choose the right tool for the right time. And don’t wait until you’re in the red to start looking for help.

If you’re serious about growth, you can’t afford to wing it. Working capital strategy is what separates founders who stay in control from those constantly chasing cash.

You don’t need a full-time CFO. But you do need someone who knows how to align financial structure with business momentum so your growth doesn’t outpace your liquidity.

Reach out to our strategic finance experts for a free consultation.