If you’ve been through more than one tax season as a business owner, you already know the drill.

The forms keep piling up. Deadlines get closer. Your CPA is buried, unresponsive, or only shows up in April—and when they do, it’s just to tell you what you owe.

Meanwhile, you’re still asking: Why is my tax bill this high? Should my business be structured differently? Is there something I’m missing?

Most CPAs don’t answer those questions. They focus on compliance—getting the return filed, keeping the IRS off your back. But that’s only part of the picture. If you’re looking for someone to help you make better decisions, reduce your tax liability before it hits, or plan for growth—compliance isn’t enough.

This article breaks down what a CPA actually does (and doesn’t), how much small businesses typically pay, and what alternatives exist if you need more than just tax prep.

What a CPA Can Do for Your Business (When It’s the Right Fit)

CPAs are licensed to handle the essentials: preparing your tax return, filing it accurately, and representing you if there’s an audit. If you’re getting started or your business is simple, that might be enough. They know the forms. They know the rules. And they know how to keep your paperwork clean.

But most CPAs stay in their lane. They won’t restructure your comp model. They won’t forecast cash flow or walk you through the financial impact of hiring another salesperson. Their role is to report what happened, not help you decide what should happen next. That’s a big distinction, and it’s where most business owners outgrow traditional accounting.

How Much Does a CPA Cost for a Small Business?

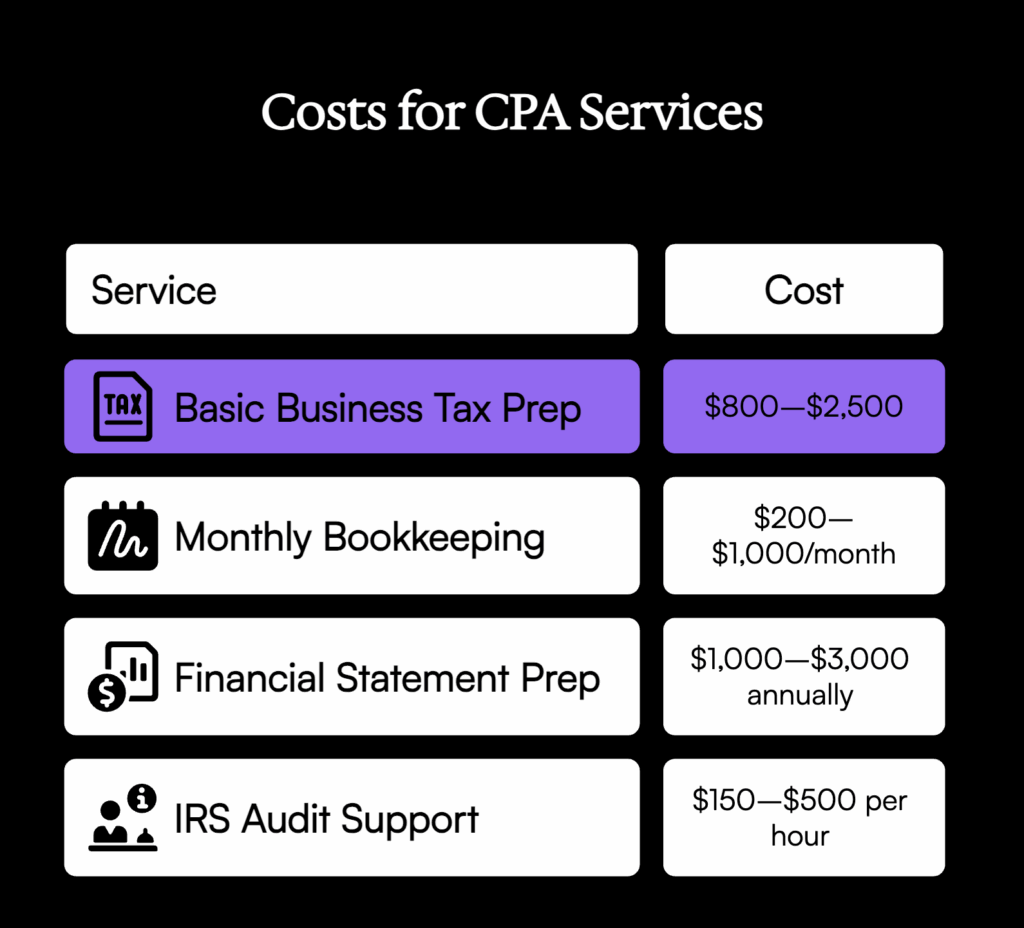

It varies. But here are the general benchmarks:

- Basic business tax prep: $800–$2,500

- Monthly bookkeeping add-on: $200–$1,000/month

- Financial statement prep: $1,000–$3,000 annually

- IRS audit support: $150–$500 per hour

Many CPAs still bill hourly. Some offer flat fees, but usually with tight scopes—“we’ll file your return and answer a few emails.” That price might sound fine until you realize what it doesn’t include. You’re not getting strategic planning. You’re not getting cash flow analysis. You’re definitely not getting a partner to walk through your numbers with you each month.

CPA vs Accountants and Other Professionals

You don’t just need a CPA. You need the right financial professional for the job. Here’s how to think about it.

Bookkeepers handle transaction-level details. They keep the books clean.

CPAs handle compliance. They file your returns and keep you legal.

Tax strategists look for savings. They use the tax code to reduce liability.

Fractional CFOs guide decision-making. They forecast, model, and lead financial strategy.

If you’re a $2M service business trying to scale, the person you need isn’t just a tax filer. You need someone who helps you make better financial decisions, structure deals, and spot the downside before it costs you real money.

What You Think You Need a CPA For (But Don’t)

Business owners often hire a CPA expecting strategy. But strategy isn’t built into the job description. Most CPAs won’t help you:

- Create a tax plan that evolves as you grow

- Structure your business across multiple entities

- Plan your exit in a tax-efficient way

- Use financial forecasts to support hiring, pricing, or compensation changes

These are high-leverage moves that impact cash, profit, and equity. If you’re expecting a CPA to lead this, you’ll be disappointed. It’s not that they’re bad—they’re just not positioned to own strategy. That’s a CFO’s job.

The Smarter Alternative: Strategic Finance Instead of Just a CPA

If you’re asking deeper financial questions, you need more than compliance. A fractional CFO steps in as a financial partner. Not just to review your books, but to ask what they mean—and what to do next.

A strategic finance partner helps you:

- Lower taxes by planning before the year ends

- Model pricing, headcount, and margins

- Build a scalable comp structure

- Track real-time cash flow

- Get ahead of financial risks

This isn’t theory. We’ve helped clients cut tax liability in half, clean up margins, and turn five-figure chaos into seven-figure clarity. That’s not magic. It’s financial structure.

Case Studies: Where a CFO Outperforms a CPA

Taylor Hersom was scaling fast, but profits weren’t moving. We built a system around ROI-based decision making. He scaled from $20K to $2M/month, held margins, and walked away from a 25x acquisition offer—because he had clarity, control, and growth on his terms.

Joe Ochal ran a growing service business. He was frustrated with sloppy books and reactive advice. We restructured comp, corrected payroll, and turned his numbers into a tool he could use to lead.

Another client, a real estate investor, wasn’t leveraging depreciation, REPS, or entity layering. We rebuilt his structure and cut his tax bill by 90%. His CPA never flagged the issue.

These stories have a common thread. The CPA filed the return. But it took a CFO to fix the financials behind it.

Why Most CPAs Aren’t What Small Business Owners Actually Need

Most CPAs were trained to file taxes, not think strategically. They’re running nonstop from January through October, turning out thousands of returns. There’s no room for long-term planning. No time for tax strategy. No incentive to spend hours analyzing your forecast.

And when you bring them a high-level question about entity structuring, asset protection, or long-term cash flow planning, they’ll usually say: “That might raise a flag.”

Translation: they don’t have the time or training to think that far ahead.

When a CPA + CFO Combo Works Best

Sometimes both roles matter. If you’re in a tightly regulated industry, preparing for an audit, or pushing toward private equity, your CPA is critical. But so is your CFO.

The CPA keeps the reports clean. The CFO ensures the strategy behind those numbers drives real growth. You can have both—but if you can only have one, ask yourself: do you want numbers reported, or decisions improved?

Already past $1M+ and dealing with tax planning, equity partners, or multiple entities? We wrote about what happens when you outgrow your CPA and don’t fix it in this article.

How to Choose the Right Financial Partner (Not Just a Job Title)

Forget the title. Ask better questions.

Do they show up before decisions are made, or after? Do they bring insight, or just data? Can they explain what the numbers mean and what to do with them? Do they help you tie your financials to your goals?

If the answer is no, keep looking. The right financial partner makes complex decisions easier, not harder.

Your Next Step: What to Do If You’re Still Not Sure

If you’re unsure whether to hire a CPA, a bookkeeper, or a CFO—start here.

Bookkeepers track what happened. CPAs file what happened. CFOs help shape what happens next.

Most businesses start with a bookkeeper. Some add a CPA. The ones that scale bring in a CFO who can turn numbers into decisions.

Do You Actually Need a CPA?

Before you hire a CPA, step back and get clear on what you actually need.

If your only goal is to get taxes filed correctly and stay in compliance, a CPA may be the right fit. But if you’re trying to reduce taxes, increase profit, or build a business you can eventually sell, filing returns isn’t enough.

That’s where most business owners go wrong—they hire based on credentials, not outcomes.

The right move is to talk it through. Map out your goals. Understand what each financial role offers. And figure out whether a CPA, a CFO, or both will actually move the needle for you.

If you’re unsure, don’t guess. Let’s walk through it together and get you the clarity you need to make the right call. Start here.