If your business is scaling and your financial team still looks like it did two years ago, that’s a problem. Especially if all you have is a CPA and maybe a bookkeeper.

Everyone might be doing their job, but they’re not doing it together. They got you from A to B. Getting to C takes a different skill set. You don’t need a bigger team. You need a connected one.

As you grow, financial decisions start compounding. If your tax planner, CFO, and bookkeeper aren’t working as a unit, things will slip through.

Most CPAs Are Set Up for Compliance, Not Growth

This is where most business owners run into trouble. They think they’re covered because they’ve got a CPA. And maybe that was fine when the business was doing a few hundred grand.

But once you’re at $1M+ in net income, the tax moves start getting more complex. You’re shifting money, opening new entities, taking distributions, launching side ventures. And if your CFO doesn’t know about it, it creates exposure.

Here’s a real example from Bennett Financials founder Arron, speaking to owners of accounting firms and small businesses at ProfitCON:

“You’re going to build an amazing CFO engagement that takes the company to massive amounts of profit.

Then someone like myself doing tax planning comes in, takes $1.5 million out of the bank without you guys knowing it.We’ll save $2.2 million in taxes. Great. But you didn’t plan for the hit. Or they’ve opened two or three other businesses and no one’s looped in.”

— Arron Bennett

That quote sums it up. Strategy gets fragmented. One advisor makes a move, another doesn’t see it coming. You save on taxes, but now you’ve got a cash flow gap. Or your financials are off. Or the next acquisition gets delayed because the numbers don’t line up.

If you’re earlier in your journey and still choosing a CPA, read this first: How to Choose a CPA for Small Business

The Gap Is Structural

This isn’t about bad actors. It’s about roles. CPAs aren’t trained to run your financial strategy. They’re trained to keep you compliant. File returns. Limit exposure.

That’s valuable, but it’s limited. They don’t forecast. They don’t own your budget. They’re not in the loop on operational decisions. And they’re rarely in conversation with your CFO—if you have one.

You need a team. Not more people—just alignment across the ones you already have.

That’s where a fractional CFO steps in.

Here are your updated H2 headings in Title Case:

What a Fractional CFO Actually Does

A real fractional CFO isn’t just reviewing your P&L. They’re quarterbacking your financial picture.

They make sure your CPA isn’t working blind. They time your tax strategies with your cash needs. They model the impact of a new entity before you fund it. And they look at the entire roadmap—so tax moves, distributions, and growth plans all connect.

You’re not just reacting to what happened last quarter. You’re making decisions with full visibility.

Another Example: When Strategy Breaks Down

One of our clients brought on two equity partners in the same year they started expanding into a second business line.

The CPA handled the K-1s, but no one had mapped out how this would affect comp, distributions, or ownership structure across both entities.

We had to unwind months of confusion, restructure both org charts, rebuild their financial model, and correct how cash was flowing between the businesses.

It was fixable, but if a CFO had been in the room earlier, it would’ve been clean from day one.

What Happens if You Don’t Fix It

If you keep growing without upgrading how your financial team operates, the cracks get wider.

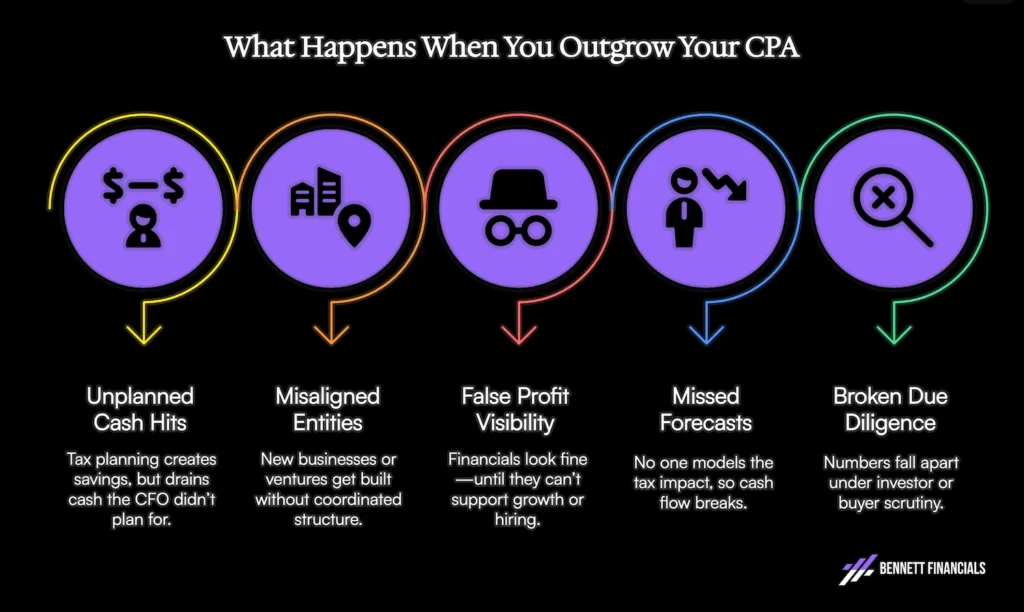

Here’s what we’ve seen happen when companies outgrow their CPA and don’t fix the gap:

- Tax savings show up but cash goes out without warning

- Profit looks good on paper but can’t fund new hires or expansion

- New entities or ventures get built without the right structure

- Cash flow forecasting gets thrown off by tax events no one modeled

- You show up to due diligence with numbers that don’t tell the full story

The team isn’t failing. It’s just that no one’s leading the whole picture.

At this stage, you don’t need more advisors. You need someone who connects the dots. That’s what a fractional CFO does. They bring strategy, structure, and coordination so you’re not flying blind when the numbers start moving fast.

If you’re past $1M in net income and growing, this is the next step. Ignore it, and you’ll keep reacting. Fix it, and you get control.

Book a call and we’ll walk you through what that looks like.