The most common thing we hear from business owners when we introduce Profit First is this:

“I love the idea. I just haven’t gotten around to setting it up yet.”

The hesitation isn’t because they don’t believe in the system. It’s because they’re afraid of doing it wrong or making their financial life more complicated than it already feels.

This chapter is here to remove that fear. Because once you understand the goal isn’t perfection it’s clarity you’ll realize just how easy this is to get moving.

Don’t Overthink It. Just Get the Buckets in Place.

Profit First works because of separation and visibility. That starts with opening bank accounts that each serve a specific purpose. The Profit First system recommends setting up five primary checking accounts—Income, Profit, Owner’s Pay, Taxes, and Operating Expenses—as separate accounts to manage your business finances.

You’re not building a fortress. You’re building five (or six) buckets—using multiple checking accounts—so money doesn’t all sit in one big puddle where it gets spent without intention. Managing multiple accounts in this way ensures that funds are allocated intentionally for profit, taxes, expenses, and other priorities.

Here’s what to do:

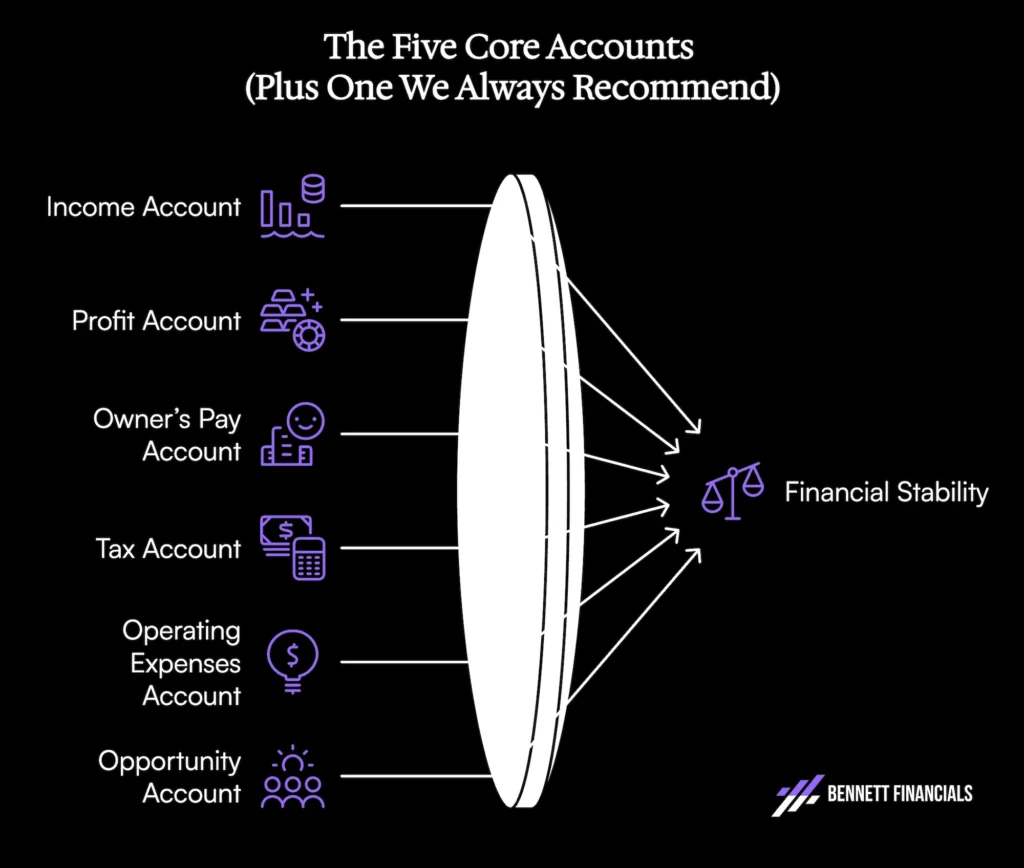

The Five Core Accounts (Plus One We Always Recommend)

The Profit First model is based on intentionally dividing revenue across different bank accounts, using profit first percentages to allocate income for profit, owner’s pay, taxes, and operating expenses. This approach ensures you distribute funds systematically, prioritize profit allocation, and maintain financial discipline.

- Income Account

This is where all revenue lands. It’s a temporary holding tank, not a spending account. Remember, the Income account is purely a pass-through. All expenses, no matter how small, should be paid from the Operating Expenses account. You’ll make allocation transfers from here, usually twice a month, to distribute funds according to your profit first percentages. - Profit Account

This is your reward for owning the business. It’s where you build real margin. Profit allocation and profit distribution are key elements here: the business’s profits are set aside in this account for future distribution. You’ll distribute this quarterly (we’ll cover that in a later chapter). Crucially, this account is for accumulating profit and future distribution—it is not to be used for covering operating expenses. - Owner’s Pay Account

Also known as the owner’s compensation account, this is how you consistently pay yourself. It’s not leftovers—it’s a fixed percentage of revenue that comes first. By allocating income to a dedicated owner’s pay account, you ensure a consistent salary for yourself, regardless of business fluctuations. - Tax Account

This is where you set aside money for the IRS. If you’ve ever been blindsided by a tax bill, this account changes everything. By allocating income to a separate tax account, you ensure you’re always prepared for tax obligations. - Operating Expenses Account (OPEX)

This is what you run the business on. Once the other accounts are funded, this is what’s left. If it’s tight, that’s a signal, not a failure. The system is working.

Typical starting percentages for profit first allocations are 5% for Profit, 50% for Owner’s Pay, 15% for Taxes, and 30% for Operating Expenses. These profit first percentages can be adjusted over time as your business grows and your financial needs evolve.

- Opportunity Account (Optional but critical)

We recommend this to every service-based entrepreneur. It’s your growth reserve. You can use it to self-fund a hire, a marketing push, a slow season, or to pounce on a business opportunity. This account is not part of the core five but can be used for additional profit and tax accounts as your business grows. For specialized strategic guidance, consider a Fractional CFO.

This account turns “maybe later” into “I’m ready now.”

Where to Open the Bank Accounts

The best setup is this:

- Use your existing bank account as the starting point for setting up your multiple bank accounts for Profit First.

- Open the Income, Profit, Owner’s Pay, and Tax accounts at your main bank.

- Open the Profit and Opportunity Accounts at a second bank you don’t check often, ideally with no debit card.

When choosing a bank, consider minimum balance requirements and look for banks (like Relay or Mercury) that allow you to open multiple accounts without fees.

Why? Because you’re building friction. You want it to be a little annoying to dip into your profit. That delay protects your discipline.

This isn’t about hiding from your money it’s about respecting your priorities.

Pro tip: Relay is the official Profit First bank. Digital banks like Relay and Mercury are ideal because they support multiple bank accounts and typically do not impose minimum balance requirements. Relay allows you to create and label all your accounts easily, automate transfers based on your allocation percentages, and set up rules so your business runs on autopilot. It’s designed specifically for this system, and for many of our clients, it makes implementation fast, seamless, and scalable.

Your P&L Is Hiding Growth.

We run your business against the 60-15-15 operating standard and show you exactly where the gaps are — plus your enterprise value and a custom tax strategy. Three meetings. One complete picture.

We take 15 per month.

Naming the Accounts

Use clear, obvious names. Don’t get clever. You want to feel what the money is for the second you see it.

If your bank doesn’t let you rename accounts, use nicknames in your online dashboard or add a one-letter prefix like:

- “P – Profit”

- “T – Tax”

- “O – OPEX”

- “OPP – Opportunity”

The point is to give every dollar a job and every job a label.

Understanding Allocation Percentages

Allocation percentages are the backbone of the Profit First system, guiding exactly how your business revenue is distributed across your different bank accounts. Instead of guessing how much to set aside for profit, taxes, or operating expenses, you’ll use target allocation percentages to create a financial structure that supports consistent profitability and long-term financial stability.

Here’s how it works: Every time you transfer money from your income account, you’ll allocate a set percentage to each account—profit account, owner’s pay account, tax account, and operating expenses account. For example, you might start by putting 5-10% of your revenue into your profit account, 30-50% into your operating expenses account, and the rest into your tax and owner’s pay accounts. These percentages aren’t set in stone; they’re a starting point. As your business grows and your needs change, you can adjust your allocation percentages to better fit your business model and goals.

By intentionally distributing funds to different bank accounts, you’re not just managing cash flow—you’re prioritizing profit, ensuring you can cover expenses, and building a financial buffer for tax obligations. This approach gives business owners the clarity and control needed to make informed decisions, avoid financial surprises, and achieve consistent profitability. Over time, reviewing and tweaking your allocation percentages will help you optimize your cash flow management and set your business up for lasting financial success.

Your Transfer Rhythm

Twice a month is ideal. Most of our clients pick the 10th and 25th. Why?

- It avoids end-of-month chaos.

- It aligns with common billing cycles.

- It builds discipline through rhythm, not reaction.

Regular transfers of funds from the Income account to the other accounts should be automated to ensure you consistently allocate income and distribute funds according to your set percentages.

This regular cadence keeps your financial visibility sharp, prevents cash from piling up unallocated, and turns allocation into a healthy habit that aligns with the natural revenue and expense cycles of your business rather than being a reactive scramble when bills are due.

On those days, you log into your Income account and move money into each of the other accounts based on your set percentages. Automating these transfers helps maintain discipline and ensures that income is allocated and funds are distributed on schedule. Then you run the business out of OPEX.

It takes 15 minutes. But it gives you financial clarity for the next two weeks.

Managing Cash Flow

Effective cash flow management is at the heart of every successful business, and the Profit First system makes it simple by using separate bank accounts for every major financial need. By dividing your business funds into an income account, profit account, tax account, and operating expenses account, you create instant financial clarity and prevent the common pitfall of commingling personal and business funds.

Your operating expenses account is your go-to for paying business expenses like rent, payroll, and utilities, while your tax account ensures you’re always prepared for tax obligations—no more scrambling at tax time. The profit account and owner’s pay account help you consistently reward yourself and build a financial cushion, rather than letting profit become an afterthought.

Regularly reviewing your account balances and cash flow statements allows you to spot trends, identify areas where you might be overspending, and make timely adjustments to your allocation percentages. This proactive approach to cash flow management helps small business owners consistently pay expenses, avoid financial instability, and maintain a healthy, predictable business cash flow. With the Profit First system, you’re not just reacting to financial challenges—you’re staying ahead of them.

“What If I Don’t Have Enough to Fund Every Account?”

Start small. Even if you’re only putting 1% into Profit, do it. The act of allocating even in tiny amounts rewires how you see money.

If things are tight, keep your allocations small across the board. The goal isn’t to stretch yourself thin it’s to build consistency. We’ll revisit percentages later. For now, just get the system running.

Consistency is what builds clarity. Clarity is what builds control.

What to Expect in the First 30 Days

Most business owners feel a mix of excitement and mild panic when they start. That’s normal.

At first, your OPEX account will feel smaller than you’re used to. That’s the point. That discomfort is where the insights live. It shows you whether your current cost structure is actually sustainable or whether you’ve been covering up problems with volume.

Stick with it. You’ll adjust. And the moment you realize your tax bill is already funded? You’ll never go back.

Reviewing and Adjusting

Setting up your Profit First bank accounts is just the beginning—regular review and adjustment are what keep the system working for you. Every 2-3 months, take time to review your account balances, cash flow statements, and overall financial performance. This routine check-in is your opportunity to assess whether your current allocation percentages are supporting your goals, or if it’s time to make changes.

Look for patterns: Are you consistently running low in your operating expenses account? Is your profit account growing as planned? Are you setting aside enough in your tax account to cover your tax obligations? Use these insights to adjust your allocation percentages, trim unnecessary operating expenses, or set new targets for revenue growth.

Maintaining this financial discipline ensures you can consistently pay yourself a salary, prioritize profit, and build a foundation for long-term financial success. If you ever feel stuck or want to optimize your system further, consider working with a certified Profit First professional. Their expertise can help you fine-tune your approach, so you can focus on growing your business with confidence, knowing your financial structure is rock solid.

Your First Step

Call your bank. Open the five core accounts (Income, Profit, Owner’s Pay, Tax, OPEX). If you can, open a sixth Opportunity Account at a second bank.

Give them clear names. Set calendar reminders for two allocation days per month. And make your first transfer even if it’s just a few dollars.

You’ve just started managing your business based on intention, not anxiety. By implementing Profit First, you are taking control of your business finances and business operations through a proven financial management system. Unlike traditional strategies that focus solely on top-line revenue, Profit First helps you implement profit as a core part of your own business strategy from the start.

Next, we’ll cover how much to actually allocate to each account and how to avoid common mistakes when you set your percentages.

Ready to Put Profit First?

Looking to set up your Profit First bank accounts for consistent profitability and crystal-clear financial understanding? Connect with the Profit First Professionals and we’ll get you set up right. If you have a solo 401(k), make sure you avoid IRS penalties by reviewing Form 5500-EZ Explained: Avoid the $150K IRS Penalty. To better understand your options for exit plans, see the differences between a Financial Planner vs CFO Advisor for Exit Plans.

In the next chapter you’ll learn how to start allocating based on clear target percentages tied to your revenue.

This was a chapter form the upcoming ebook Profit First, Unofficial: A CFO’s Playbook for Owners. For further guidance on scaling SaaS companies with expert financial oversight, see Fractional CFO for SaaS: Growth Clarity for 2026.

Read the previous chapter, How Service Businesses Can Lock In Healthy Cash Flow with the Profit First Method | Continue to the next chapter: The Hidden Cost of Reactive Accounting

Learn more about fractional shares, including their pros and risks before you invest.

Ready to See Your Numbers?

The Scale-Ready Assessment is a full financial diagnostic for service businesses doing $1M–$20M. You’ll get your 60-15-15 scorecard, enterprise value gap, custom tax strategy, and a prioritized roadmap — all in three meetings.

$96.2M in client revenue under active management · 200+ companies analyzed