What Is Revenue Recognition in SaaS?

Revenue recognition in SaaS is the process of determining when your business has actually earned the revenue it has collected. It’s a strategic decision that impacts your growth metrics, valuation, and tax exposure.

Let’s say a client pays you $120,000 upfront for a 12-month subscription. That’s not $120K in revenue for the month it hit your bank account. It’s $10K per month. Until you deliver the full service, the rest sits on your books as deferred revenue – a liability, not income.

Why does that matter? Because if your books are showing artificially inflated revenue, you’re making decisions off bad data. Your profitability looks better than it really is. And if you’re raising capital or preparing to sell, the buyer will find that gap fast.

This isn’t just about one billing model either. Usage-based pricing, tiered subscriptions, milestone-based contracts all have different implications. And if you’re running hybrid models, the complexity multiplies.

Revenue recognition gives you the financial truth. It’s how you align the timing of value delivery with how you report performance. And when done right, it’s the difference between being surprised by cash flow problems—or seeing them coming six months out.

For a comprehensive breakdown with examples, see KPMG wrote the 764 page “handbook”: Revenue recognition for SaaS and software arrangements. If you don’t have that kind of time, read on to learn what you need to know.

Why Revenue Recognition Actually Matters for SaaS Growth

You can’t build a predictable business on unpredictable numbers. If you’re treating collections as revenue, you’re flying blind. Here’s why this matters:

- Your P&L lies to you: Revenue looks great. Margins look healthy. But your service obligations are just getting started.

- Investors will call it out: In diligence, your books get torn apart. If revenue isn’t tied to performance delivery, expect a haircut on your valuation.

- Team comp becomes misaligned: You might be paying sales bonuses on cash, while the service team eats the delivery burden.

- Tax exposure rises: If you recognize revenue before it’s earned, you may owe tax before you’ve even fulfilled the contract.

- Cash flow suffers: Recognizing too early gives you a false sense of security. Then taxes hit, renewals stall, and cash runs tight.

Misaligned revenue recognition creates a ripple effect. It clouds financial forecasting, misleads hiring decisions, and invites painful surprises.

And this matters most when you’re scaling. The bigger the team, the more critical clarity becomes. The bigger the contracts, the more dangerous the lag between reality and what your books say. Growth hides problems—revenue recognition exposes them.

The Revenue Recognition Principle (Explained for Operators)

The core rule is simple:

Revenue should be recognized when it is earned, not when cash is received.

This shift is more than a timeline adjustment. It forces SaaS founders to think about value delivery, not just deal flow.

Too many early-stage SaaS teams run cash basis books and treat that as reality. But that’s a fantasy. Your burn rate, your runway, your valuation multiple—all of it hinges on what you’ve actually delivered, not what’s been paid.

Think of it this way: cash tells you what’s in the bank. Revenue tells you what you’ve earned. They’re not the same. And if you confuse them, you’re flying into turbulence without an altimeter.

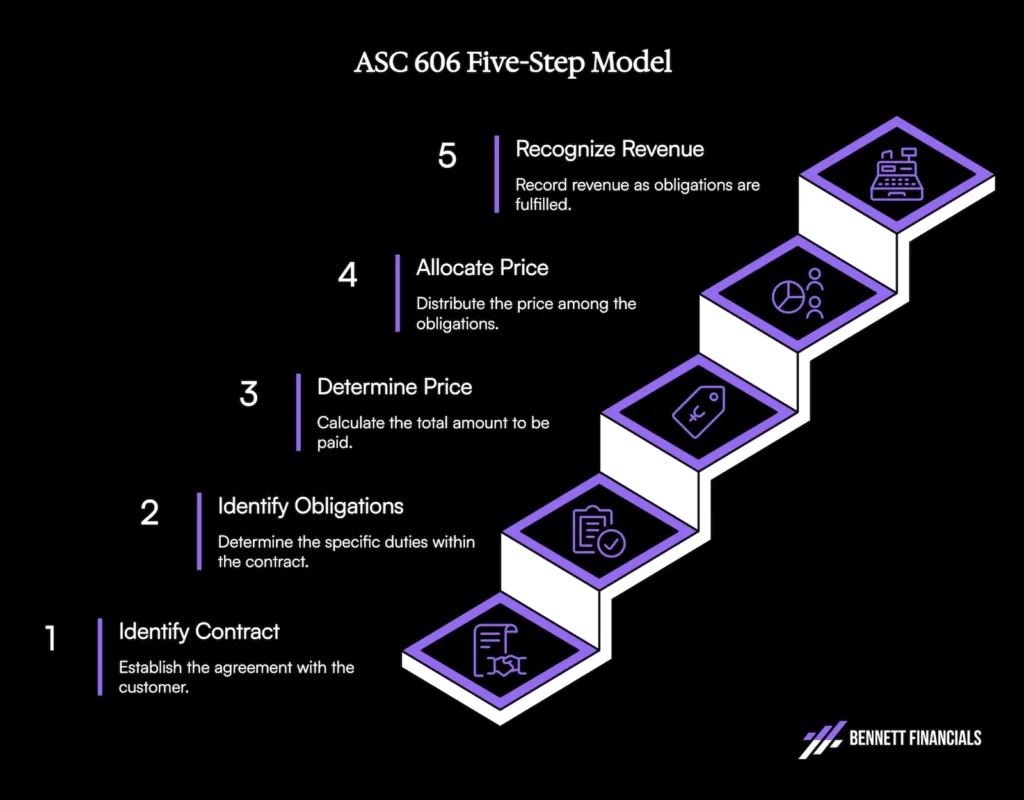

Under ASC 606, there are five steps to follow:

- Identify the contract with the customer

- Identify performance obligations within that contract

- Determine the transaction price

- Allocate the price to performance obligations

- Recognize revenue when each obligation is satisfied

You don’t need to memorize the steps. But you do need to understand what counts as “earned.”

Here’s the rule of thumb: If the client can’t walk away today having received the value they paid for, you haven’t earned that revenue yet.

Operational Implications of Revenue Recognition Criteria

The biggest gap in most SaaS orgs isn’t technical—it’s operational. Sales reps close the deal. CS teams do the work. But finance is left cleaning up the mess because no one mapped deliverables to revenue policy.

You want to build alignment? Start here:

- Make sure everyone knows the difference between earned revenue and collected cash.

- Include finance in deal structuring and renewals.

- Document what counts as a performance obligation—and what doesn’t.

- Create revenue recognition SOPs for every product line.

This turns revenue recognition from a cleanup task into a strategic driver of clarity.

You also need systems. CRM, billing, and finance tools have to sync. If you can’t tie a contract to revenue entries, you’re exposed. Especially during due diligence or audit. That’s not just a finance problem—it’s a risk to your exit.

How Revenue Recognition Intersects With Software Delivery Models

If you give a client the right to take possession of your software—run it on their own servers, move it to a third-party host—and it’s reasonably feasible for them to do so, then revenue recognition may happen at point of sale.

But that’s rare in modern SaaS. Most SaaS companies host their solution, control deployment, and tie feature delivery to ongoing support.

In those cases, revenue is earned over time—not upfront. The lesson? Structure your delivery model carefully. A change in how you offer access can change when you recognize millions in revenue.

Your contract model, hosting structure, and even user onboarding flow can change the accounting treatment. That’s why revenue recognition isn’t a static rule—it’s a dynamic policy that needs to evolve as your product and go-to-market model evolve.

Revenue Recognition Calculation Methods: What You Need to Know

Here’s where it gets nuanced. There isn’t one formula for revenue recognition. Depending on your business, you may need one—or more—of these methods:

Accrual Method

You book revenue as it’s earned—even if cash hasn’t been collected yet. This is the baseline for most SaaS. It smooths out peaks and valleys, giving a truer picture of recurring performance.

Sales-Basis Method

Revenue is booked only when the sale is finalized and delivery begins. Useful for products or short-term service agreements. It’s also important for projects that deliver value in one specific moment—like a one-time training or consulting session.

Percentage-of-Completion

Ideal for long-term contracts, especially if milestones or development modules are clearly defined. Ties revenue to work completed—not just time elapsed. You’ll need strong project management data to support this.

Completed Contract Method

You recognize revenue only when all obligations are fulfilled. Useful for short-term projects or when performance is binary. It’s conservative—but safe when timing is uncertain.

Proportional Performance

You allocate revenue based on the ratio of work performed. Think multi-phase implementations or large onboarding projects. Especially helpful when each phase has distinct value tied to delivery.

Each method shifts how you show progress. And each has ripple effects on cash flow, investor conversations, and tax exposure. The key is to pick the model that mirrors your delivery reality.

Revenue Recognition Isn’t Just Finance—It’s Cross-Functional Discipline

The SaaS companies that do this best don’t leave it to the CFO. They train everyone—sales, marketing, product, customer success—on what revenue recognition means, and how their actions shape it.

Examples:

- Sales can’t promise “free onboarding” without impacting revenue timing.

- Marketing shouldn’t bundle features without checking performance obligation definitions.

- CS needs to flag partial delivery or scope creep, so finance can adjust schedules accordingly.

This isn’t busywork. It’s how you build a scalable, audit-proof machine.

Cross-functional training on revenue recognition principles is a moat. It makes your team financially literate. It closes the gap between the front lines and the boardroom. And it turns financial discipline into a growth advantage.

Founders Need to Shift From Cash View to Revenue View

Cash in the bank is real. But in SaaS, it lies. It tells you you’re doing better than you are—until churn hits, refunds spike, or obligations drag out.

That’s why we train every founder we work with to lead with recognized revenue—not bookings, not pipeline, and not collections.

If you’re not:

- Mapping revenue to actual performance

- Reviewing your revenue recognition at least monthly

- Stress-testing how revenue shifts impact cash and tax

Then you’re scaling on gut instinct. And that doesn’t cut it when real money is on the table.

Revenue view gives you control. It tells you when to hire. When to reinvest. When to sit on cash. That’s how you stop running the business off vibes—and start running it like a CFO.

Bottom Line

Revenue recognition is about trust. Trust that your metrics are clean. That your forecasts are reliable. That your business can withstand scrutiny from investors, acquirers, and the IRS.

Do it right, and you build a financial foundation that supports growth, protects downside, and keeps your team honest.

Need help applying this to your growing SAAS business? Reach out to our strategic finance team.