If your business touches anything offshore – a foreign entity, a contractor you pay overseas, or even a shell company set up for IP – Form 8858 is not optional. U.S. taxpayers with foreign entities have specific filing obligations, and missing any required tax form can result in significant compliance issues.

It’s a mandatory IRS form and tax form that shows your ownership or control over a foreign disregarded entity or foreign branch. Skip it, file it late, or get it wrong—and the penalties stack up fast. $10,000 per entity, per year, minimum. You don’t want to learn about this form after an IRS notice lands in your inbox. If you’re planning an exit and need to understand how tax and financial strategy fit together, it’s important to know the differences between a financial planner and a CFO advisor for exit planning.

Let’s walk through exactly what Form 8858 does, who has to file it, and how to use it strategically to stay compliant while keeping your global operations smooth.

What Does Form 8858 Actually Do?

Form 8858 reports the activities of a foreign disregarded entity (FDE) or a foreign branch. Think of it as a schedule attached to your regular tax return—similar to Forms 5471 or 8865—but specific to foreign disregarded entities.

It doesn’t calculate tax directly. It’s informational. But “informational” doesn’t mean optional. The IRS uses it to track income, losses, assets, and operations that flow through your foreign entities. Form 8858 collects financial details for tax reporting purposes, ensuring transparency and compliance with international tax requirements.

If you don’t report it? They assume the worst.

Who Must File Form 8858?

Here’s the quick breakdown:

- U.S. persons (including individuals, partnerships, and corporations) that are the tax owner of 100% of a foreign disregarded entity (FDE)

- U.S. persons that operate a foreign branch

- U.S. owners of certain controlled foreign corporations (CFCs) that own an FDE

The ownership test is strict. If you are the direct owner of a foreign disregarded entity, you have the filing obligation for Form 8858. If your U.S. LLC owns 100% of a foreign single-member entity—you’re on the hook. If your U.S. S-corp sets up a foreign branch for contracting or service delivery—same deal.

Even if the entity has no income, no activity, or no bank account, you still have to file.

What Is a Foreign Disregarded Entity (FDE)?

A foreign disregarded entity is any non-U.S. business that’s treated as part of its owner for U.S. tax purposes. While it is considered a separate entity or separate legal entity under foreign law, it is not recognized as such for U.S. tax purposes.

Let’s say your U.S. LLC owns 100% of a Belizean company. Belize treats it as a company. The IRS doesn’t. It disregards it. That means the IRS looks straight through it and treats you—the owner—as directly conducting the activity.

This structure is common in international consulting, remote staffing, offshore holding companies, and digital services.

And it’s exactly why the IRS demands Form 8858. They want to see through your disregarded veil to the underlying business entity or foreign business entity.

How Is Form 8858 Different from Form 5471?

These two often get lumped together, but they report different things.

- Form 5471 is for controlled foreign corporations (CFCs) where U.S. persons own 50%+ of a foreign corporation

- Form 8865 is for foreign partnerships and controlled foreign partnerships, detailing U.S. ownership and reporting requirements for these entities

- Form 8858 is for foreign disregarded entities or branches where a U.S. person owns 100%

Think of it this way:

- 5471 = you’re a shareholder in a controlled foreign corporation

- 8865 = you’re a partner in a foreign partnership or controlled foreign partnership

- 8858 = you’re the owner of something the IRS ignores as separate

One tracks foreign corp compliance, another tracks foreign partnership compliance, and the last ties the activity directly to you.

What Is a Foreign Branch for U.S. Tax Purposes?

The IRS defines a foreign branch as an operation carried on by a U.S. person outside the United States that is either:

- Separate and clearly identifiable, and

- Maintains separate books and records

Form 8858 applies to both an FDE or foreign branch, meaning U.S. taxpayers must report activities for either structure as required by the IRS.

This applies to situations like:

- U.S. consultants working full-time from another country

- U.S. entities hiring and paying local staff abroad directly

- A U.S. service business registering a branch in a foreign country to avoid local withholding or taxes

If the IRS says it’s a branch, you’ll need to file Form 8858—even if you don’t call it that. Compliance is especially important for U.S. taxpayers who operate foreign branches, as accurate reporting is required to meet IRS regulations.

What Form Does a Self-Employed Person File?

If you’re a self-employed U.S. person and you operate a foreign disregarded entity or foreign branch, you file:

- Your usual Schedule C or Schedule E on Form 1040, making sure to report any self employment income from the foreign disregarded entity or branch

- Plus Form 8858 attached to your return

This trips up a lot of digital nomads and solo consultants who incorporate offshore but don’t realize the IRS wants a full breakdown of what’s happening overseas. The income and expenses from the foreign entity are ultimately reported on the owner’s personal tax return.

Foreign Entity Reporting: The Broader Compliance Picture

Foreign entity reporting is a cornerstone of tax compliance for US taxpayers with international operations. The IRS requires full transparency when it comes to foreign disregarded entities, foreign branches, and other foreign entities to ensure that all taxable income is properly reported and to prevent tax evasion. Form 8858 plays a pivotal role in this process, providing the IRS with detailed financial information about foreign disregarded entities and foreign branches.

But Form 8858 is just one piece of the international tax forms puzzle. US taxpayers with interests in foreign corporations must also file Form 5471, while those involved in foreign partnerships may need to file Form 8865. Each form targets a specific type of foreign entity, and together they create a comprehensive compliance framework. Failing to file these forms, or submitting incomplete or inaccurate information, can lead to significant penalties—including criminal penalties for willful failure to comply. In today’s regulatory environment, tax compliance is non-negotiable. Staying ahead of these requirements protects your business from costly mistakes and keeps your global strategy on solid ground.

Related Entities and Transactions: What You Need to Disclose

When you file Form 8858, the IRS expects a full accounting of related party transactions between your foreign disregarded entity or foreign branch and any other related entities. This includes dealings with US or foreign corporations, partnerships, or even individuals connected to your business. Whether it’s loans, sales, services, royalties, or capital transfers, every transaction must be disclosed to ensure they’re conducted at arm’s length and not used to shift profits or evade taxes.

Additionally, you’ll need to report any foreign income taxes paid or accrued by the disregarded entity or branch on Schedule J of Form 8858, using the appropriate exchange rate. This is crucial for claiming foreign tax credits, which can directly reduce your US tax liability. Properly documenting these related party transactions and foreign income taxes paid not only keeps you compliant but can also unlock valuable tax benefits. Consulting a tax professional is essential to ensure you’re reporting everything accurately and maximizing your available foreign tax credits.

Your P&L Is Hiding Growth.

We run your business against the 60-15-15 operating standard and show you exactly where the gaps are — plus your enterprise value and a custom tax strategy. Three meetings. One complete picture.

We take 15 per month.

What Happens If You Don’t File Form 8858?

Penalties. And they’re brutal.

- $10,000 per form per year for late or incomplete filings

- Additional $10,000 every 30 days after 90 days of IRS notice (up to $50,000 total)

- Loss of foreign tax credits

- Possible criminal exposure for willful neglect

Failure to file Form 8858 can result in substantial penalties and other potential penalties, and may even impact the statute of limitations on your entire tax return, increasing your risk of audits or further consequences.

This isn’t the kind of form you want to forget.

Even if you think the entity has no activity, file it anyway. Proactively. Correctly. Backed with documentation.

Common Scenarios That Trigger Form 8858 Filing

Let’s make this real. Here are four actual client-level scenarios that required 8858:

- A U.S. SaaS company sets up a single-member entity in Ireland to handle European sales. The Irish entity is wholly owned and has no other partners—classic disregarded entity.

- A U.S. law firm opens a branch office in Canada, but the Canadian entity is not treated as a corporation for U.S. tax purposes. It’s a foreign disregarded entity.

- A U.S.-based cybersecurity business owns a Belizean company that is a foreign subsidiary, but for U.S. tax purposes, it is treated as a disregarded entity. This structure triggers Form 8858 filing requirements.

- An agency acquires a single-member UK entity to manage local contracts. The UK entity is disregarded for U.S. tax purposes.

In all these scenarios, it is essential to report foreign disregarded entities using Form 8858 to ensure compliance with IRS regulations and avoid penalties.

Scenario 1: U.S. LLC owns a foreign single-member entity

A U.S. software agency sets up a 100%-owned Estonian OÜ to run remote payroll. No local clients. No Estonian income tax. But the IRS sees it as a foreign disregarded entity. Form 8858 required.

Scenario 2: U.S. individual owns a foreign branch directly

An independent consultant works from Spain under a Spanish tax ID. No foreign entity, but a stable presence and local clients trigger foreign branch status. Form 8858 required.

Scenario 3: U.S. entity owns a CFC with a disregarded entity under it

A U.S. S-corp owns a Canadian corporation, which owns a Belizean subsidiary treated as a disregarded entity under Canadian law. That bottom-layer entity? Form 8858 required at the U.S. level.

Scenario 4: Using a foreign company for contractors or IP holding

A U.S. company sets up a Hong Kong limited company to hold IP and pay overseas contractors. No local sales. Still a foreign disregarded entity. Still requires Form 8858.

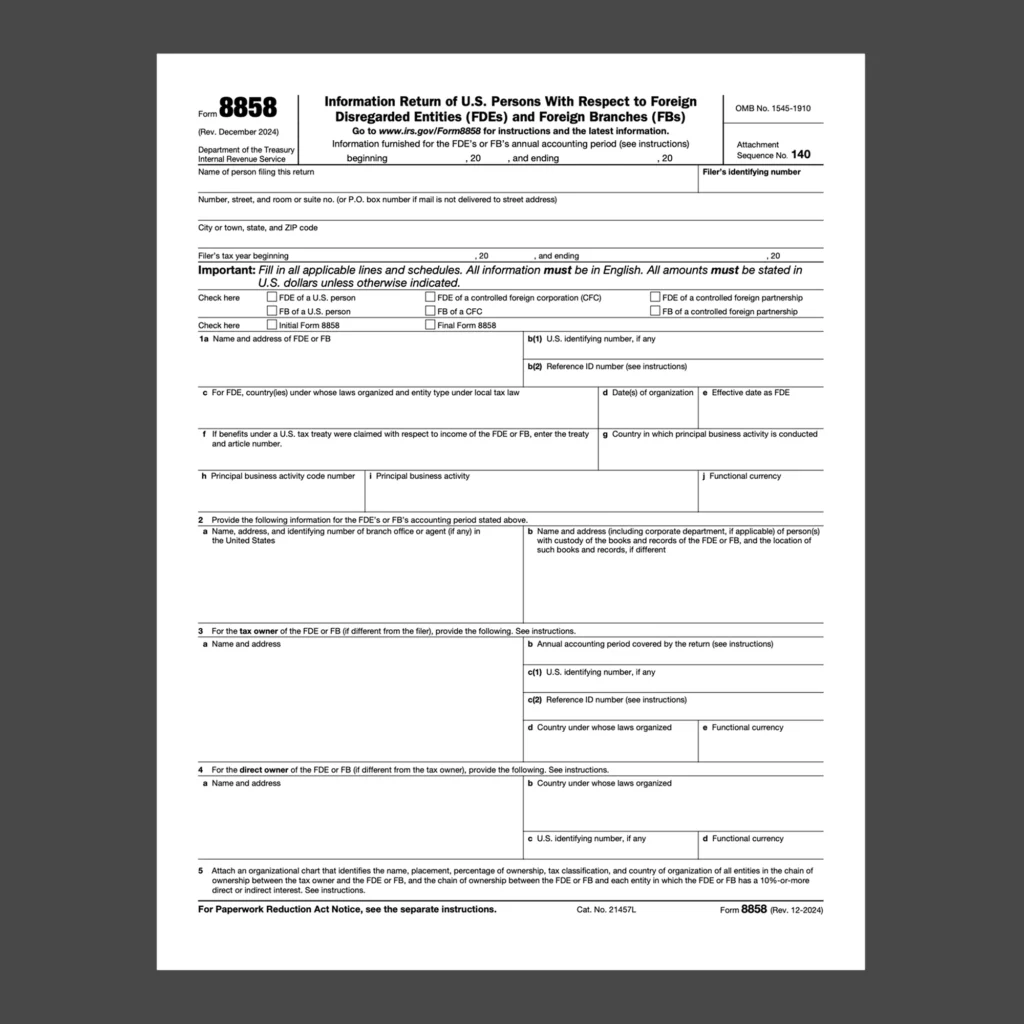

Key Schedules Inside Form 8858 That Actually Matter

Form 8858 looks like overkill—but only a few schedules carry real weight:

- Schedule C – This is a summary income statement that reports the entity’s income in the entity’s functional currency (the functional currency of the foreign entity). The amounts must be converted to US dollars using the appropriate average exchange rate.

- Schedule F – Balance Sheet

- Schedule H – Intercompany transactions

- Schedule M – Transactions between FDE/branch and filer

Schedule I is also important for reporting transferred losses for domestic corporations, detailing calculation and reporting requirements under IRS section 91.

If you’ve got income or expenses running through that entity or branch, you’ll need to fill these out clearly. Don’t skip them. And don’t guess. The IRS has a long memory.

Rental Income and Tax Liability: Special Considerations

If you own foreign rental property, understanding your tax obligations is critical. US taxpayers must report all rental income from foreign properties on their US tax return, regardless of where the property is located. However, whether you need to file Form 8858 depends on how the property is held. If the rental property is owned directly and not through a foreign disregarded entity or foreign branch, Form 8858 may not be required. But if the property is held via a foreign corporation, partnership, or other disregarded entity, you may be required to file Form 8858 to report the entity’s income and expenses.

It’s also important to consider the impact of foreign income taxes on your overall tax liability. You may be subject to foreign income taxes in the country where the property is located, and these can often be used to offset your US tax liability through foreign tax credits. Navigating these rules can be complex, so working with a tax professional ensures you file Form 8858 when necessary, report all rental income correctly, and take advantage of any available credits or deductions.

Tax Credits and Deductions: Maximizing Your Benefits

US taxpayers with foreign disregarded entities or foreign branches have opportunities to reduce their US tax liability through tax credits and deductions. Foreign tax credits are available for foreign income taxes paid or accrued on income generated by your foreign disregarded entities or foreign branches. These credits can be a powerful tool to avoid double taxation and lower your overall income tax bill.

In addition to credits, you may be able to deduct certain expenses related to your foreign operations—such as interest, taxes, and depreciation—if they are properly documented and reported on Form 8858 and other required international tax forms. Accurate reporting is essential to claim these benefits, and a tax professional can help you identify all eligible credits and deductions. By leveraging these tax planning strategies, you can minimize your tax liability, ensure compliance with federal income tax regulations, and keep your international business operations running efficiently.

When Is Form 8858 Due?

Form 8858 is due with your annual tax return and must cover the annual accounting period or tax year of the foreign entity. It’s due at the same time as your federal return, including extensions.

- Individuals: attach Form 8858 to your federal income tax return (Form 1040)

- S-corps: attach Form 8858 to your federal income tax return (Form 1120-S)

- C-corps: attach Form 8858 to your federal income tax return (Form 1120)

- Partnerships: attach Form 8858 to your federal income tax return (Form 1065)

Miss the extension? The penalties apply—even if you filed everything else on time.

How to File Form 8858 Correctly (Without Guessing)

Most CPAs don’t do this form well. Many don’t do it at all. Here’s what we recommend:

- Determine ownership structure

- Clarify entity classification

- Gather financials

- Ensure you meet all filing obligations and international tax reporting requirements as part of your tax filing

- File the form with your tax return

Attach it to your 1040, 1120, 1065, or 1120-S. Review for accuracy—especially intercompany transactions. Don’t wait until the last minute.

How Form 8858 Ties into Strategic Tax Planning

Here’s the real takeaway: Form 8858 isn’t just about compliance. It’s a window into how your offshore structure affects your entire tax profile. For US tax purposes, the structure of foreign disregarded entities determines how income and activities are reported, and the tax owner is responsible for ensuring proper compliance and filing with the IRS.

Done right, foreign disregarded entities can:

- Support international contractor teams

- Hold IP for transfer pricing advantages

- Serve as global sales arms under a larger tax strategy

But if you don’t disclose it? Or file it wrong? The structure backfires.

Form 8858 is your way of showing the IRS: We know what we’re doing. Here’s the entity. Here’s how it flows, backed by strategic financial leadership. Nothing to hide. For SaaS founders looking for strategic financial oversight, Fractional CFO for SaaS guidance can also ensure cleaner cash flow, better forecasts, and KPI discipline.

Visit the IRS – About Form 8858 for instructions or use this direct link to the PDF form.

Bottom Line: Stay Compliant. Stay Strategic.

Form 8858 isn’t just paperwork – it’s a signal to the IRS that you understand your global footprint and you’re playing by the rules.

If you have foreign disregarded entities or foreign branches and you’re not filing 8858, you’re gambling. And the IRS stacks the odds in their favor.

Get ahead of it. File clean. Document everything. And make sure it supports the larger tax strategy you’re building.

Otherwise, that “foreign entity” could turn into a very expensive mistake.

Need help? Explore essential questions every business owner should ask a CFO advisor Reach out to our tax planning professionals for a free consultation.

Ready to See Your Numbers?

The Scale-Ready Assessment is a full financial diagnostic for service businesses doing $1M–$20M. You’ll get your 60-15-15 scorecard, enterprise value gap, custom tax strategy, and a prioritized roadmap — all in three meetings.

$96.2M in client revenue under active management · 200+ companies analyzed