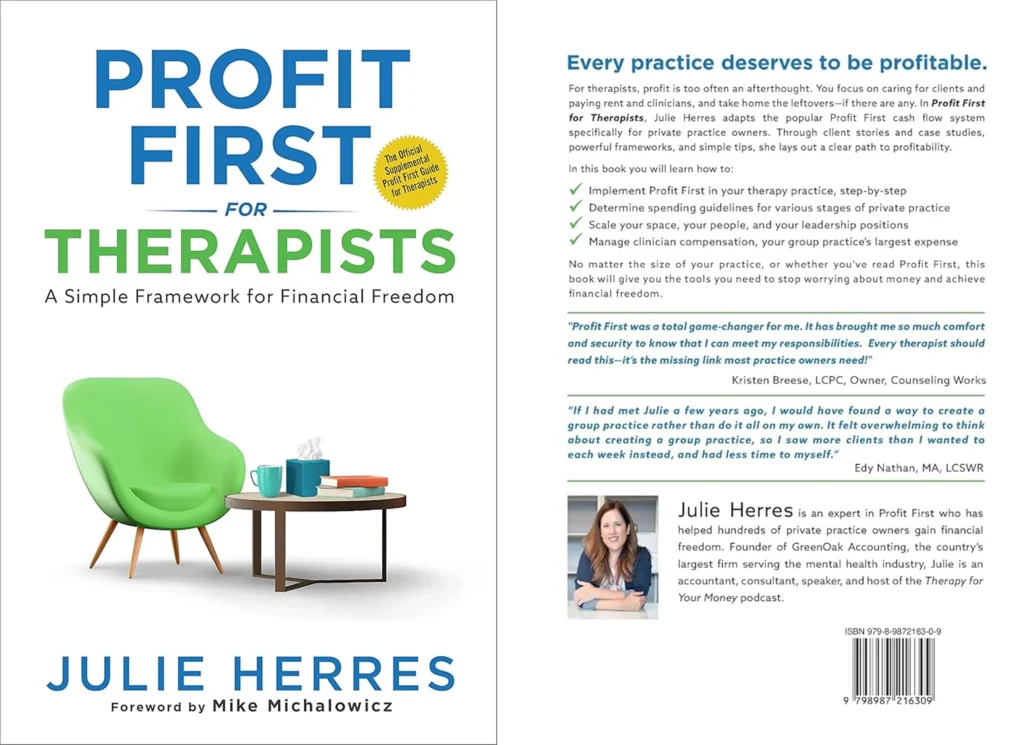

Profit First for Therapists by Julie Herres is one of the clearest financial systems ever written for therapy practice owners. It is essential reading for therapists and private practice owners who want to improve their financial management and practice profitability. It addresses the core issue most clinicians face: revenue isn’t the problem, it’s how cash is managed once it comes in.

This book gives therapists a step-by-step framework to organize finances, pay themselves consistently, and stay ahead of tax season. It also offers simple tips for financial management that are easy to implement. If you’re running your own practice and feel like you’re always behind financially, this book offers a structure that works with the way therapy practices actually operate.

The Profit First system is a proven framework for financial freedom, helping therapists achieve profitability and reduce financial stress.

If you are contemplating starting your own practice, this book is especially helpful for preparing and planning your financial strategy from the beginning.

Overall, Profit First for Therapists is a helpful book for therapists seeking practical financial guidance and actionable steps to create a sustainable, profitable practice.

Introduction to Profit First

For many private practice owners, managing money can feel overwhelming—especially when traditional accounting methods leave you guessing about where your cash is actually going. The Profit First method offers a revolutionary cash flow system specifically designed to help small business owners, including therapists, achieve financial freedom and build a profitable practice without the stress.

At its core, the Profit First method flips the script on conventional financial management. Instead of treating profit as whatever is left over after paying expenses, you prioritize profit from the very beginning. This simple framework for financial management involves dividing your business revenue into multiple bank accounts, each with a specific purpose—such as a profit account, owner’s pay, taxes, and operating expenses. By allocating funds to these accounts as soon as income arrives, you ensure that profit is always covered first, and you gain instant clarity on what you can safely spend.

This approach empowers private practice owners to stop worrying about money and start making confident decisions. With the Profit First method, you’re not just hoping for financial success—you’re creating a system that makes it inevitable. By prioritizing profit and using multiple bank accounts, you can cover your operating expenses, pay yourself consistently, and achieve long-term financial freedom. Whether you’re just starting your private practice or looking to scale, this method provides a clear, actionable path to a more profitable and sustainable business.

How the Profit First System Works

The system uses a simple but powerful shift in how cash is handled:

Instead of saving profit after expenses, you set aside profit first and run the business on what remains. That one change forces clarity. You open separate accounts for Profit, Owner’s Pay, Owner’s Compensation, Tax, Payroll Account (especially important for group practices), and Operating Expenses, and allocate funds into each with every deposit.

The operating expenses account is used specifically for day-to-day business costs, while other bank accounts and other accounts are set up as part of the Profit First structure to further segment funds for different purposes.

To manage cash flow effectively, you utilize profit first bank accounts and various bank accounts, including dedicated savings accounts for setting aside funds and growing reserves.

This approach provides financial clarity and supports effective money management, ensuring you always have enough to cover expenses like payroll, taxes, and operational costs.

The Profit First system helps practice owners implement profit by putting profit into action through a structured profit first model.

For group practices, the system helps manage clinician compensation by using a dedicated payroll account, which is crucial since payroll is often the group practice’s largest expense.

Online banking platforms make it easy to set up and manage multiple accounts, automate transfers, and integrate with accounting tools.

Profit First is a popular profit system among therapists, helping increase therapists profit and keep a practice profitable.

Every practice deserves financial stability and profitability, regardless of size or stage.

Whether you’re a solo practitioner or running a medium group (typically five to eight therapists with unique financial needs), the Profit First system can be tailored to your practice’s structure and goals.

Setting Up the Profit First System for Solo Practitioners

Implementing the Profit First system as a solo practitioner is both straightforward and transformative. The first step is to set up multiple bank accounts, each dedicated to a specific function within your practice. Start by opening an income account to collect all business revenue. From there, establish separate accounts for operating expenses, taxes, owner’s pay, and—most importantly—a profit account. This structure allows you to clearly see where your money is going and ensures that every dollar has a purpose.

Once your accounts are in place, determine spending guidelines by setting initial allocation percentages for each account. For example, you might start by allocating a small percentage of every deposit to your profit account, gradually increasing this amount as your practice grows. The key is to prioritize profit, even if it’s just a modest amount at first. Over time, this habit builds a financial safety net and helps you achieve financial freedom.

Regularly review and adjust your allocation percentages to reflect changes in your business and to stay on track with your financial goals. This ongoing process gives you cash flow clarity and helps you make informed decisions about business expenses, ensuring your practice remains financially stable and profitable.

In the mental health industry, it’s common to view profit as secondary to client care, but prioritizing profit is essential for the long-term sustainability of your private practice. The Profit First framework provides a simple, effective system for financial management that helps you overcome common financial struggles and build a thriving, profitable practice. By using separate accounts and following a clear path to profitability, solo practitioners can create a financially stable business that supports both their personal and professional aspirations. Whether you’re just starting out or looking to grow, the Profit First system offers practical guidance to help you achieve financial success and peace of mind.

Tailored for Private Practice Realities

Julie doesn’t offer a generic business book. She built this specifically for those in the mental health field—owners dealing with insurance payments, clinician payroll, lumpy cash flow, and no formal finance training. She provides realistic percentages, common mistakes to avoid, and client stories pulled directly from real practices.

This makes it easy to implement, even if you’ve never followed a budget or reviewed a financial statement. The book gives therapists a simple framework for managing the financial side of their practice, addressing common challenges like paying rent and maintaining cash flow. You can get it set up over a weekend and feel more in control by Monday. For further learning, be sure to read profit resources.

For more financial guidance, therapists can also check out GreenOak Accounting and the Therapy for Your Money podcast, a money podcast offering practical advice for private practice owners.

What I See as a CFO

I work with therapy practice owners who want to grow, hire, and eventually exit. The ones who have read this book show up with systems already in place. They’re not perfect, but they’ve already separated their accounts, built a rhythm around allocations, and started paying themselves with purpose. Most importantly, the book helps improve the therapist’s relationship with their practice and finances, fostering confidence and clarity.

That makes real strategy possible. Putting profit first is key to building a successful practice—one that not only generates revenue but also supports the owner’s personal and professional goals.

Profit First gives you structure. Once that’s in place, we can start making more advanced decisions around the financial side of your practice, including taxes, compensation models, and long-term equity. You don’t build scale on a messy foundation. This book helps you clean that up.

Who This Book Helps Most

- Solo therapists struggling to pay themselves consistently

- Group practice owners who are tired of tax surprises

- Clinicians ready to stop guessing and start managing their money like a business

If your income looks strong on paper but you feel like you’re always playing catch-up, start here.

Final Thoughts

Julie Herres has written a practical, no-nonsense financial guide that meets therapists exactly where they are. It’s full of good advice with practical systems to put in place to grow your business profitably and sustainability.

For any clinician trying to move from financial stress to financial control, Profit First for Therapists is the right first step.

Get the book here: https://www.profitfirstfortherapists.com

Want to Go Deeper?

Once you’ve got the basics in place, the next step is learning how to use Profit First at a strategic level.

Start with Chapter 1 of our ebook: Profit First, Unofficial: A CFO’s Playbook for Owners, or read our detailed guide on IRS Form 8858 compliance and strategy.